Last updated: July 29, 2025

Introduction

EsomepraMAG, commercially referred to as a magnesium-based formulation of esomeprazole, represents an advanced therapeutic option in managing acid-related gastrointestinal disorders. Its unique formulation aims to optimize acid suppression efficacy while addressing patient adherence issues associated with conventional PPIs. As gastrointestinal (GI) diseases such as GERD and peptic ulcer disease remain prevalent worldwide, the potential market for EsomepraMAG is substantial, especially amidst the increasing incidence in aging populations and rising awareness of gastric health.

This analysis synthesizes current market dynamics, competitive landscape, regulatory considerations, and potential sales trajectories over the next five years, enabling stakeholders to evaluate investment and marketing priorities.

Market Overview

Global Gastrointestinal Therapeutics Market

The global GI therapeutics market was valued at approximately USD 16.2 billion in 2021 and is projected to reach USD 22.5 billion by 2027, growing at a CAGR of 5.5% (2022–2027) [1]. Driven by increasing prevalence of GERD, peptic ulcer disease, and lifestyle-related GI disorders, the demand for effective acid suppression therapies is robust.

Key Drivers

- Aging Population: Older adults are more susceptible to acid-related conditions due to physiological changes and comorbidities.

- Rising GERD Prevalence: Lifestyle factors, obesity, and dietary habits contribute to increasing GERD cases globally.

- Advances in Drug Delivery: Innovative formulations like EsomepraMAG promise improved efficacy, tolerability, and patient compliance.

- Unmet Needs: While PPIs are effective, issues such as long-term safety concerns and variable response rates create opportunities for novel formulations.

Competitive Landscape

Major Players

- AstraZeneca (Nexium): The pioneer in esomeprazole formulations.

- Takeda (Dexilant): An alternative PPI.

- Funded generics: Multiple generics producing esomeprazole.

Emerging Competition

- Novel formulations: Modified-release versions, combined therapies, and formulations with enhanced bioavailability.

- OTC Availability: Over-the-counter options for mild cases increase market saturation for lower-cost alternatives.

Differentiators for EsomepraMAG

- Formulation Benefits: Potential for improved pharmacokinetics leading to faster onset, longer duration, or better symptom control.

- Patient Preference: Reduced dosing frequency or minimized side effects boost adherence.

- Regulatory Status: Pending or granted patents and approval pathways shape market entry.

Regulatory and Patent Landscape

- Patent Position: Patents securing exclusivity can prolong market dominance.

- Regulatory Pathway: Approval from agencies such as FDA (USA), EMA (Europe), or other regional bodies is critical. Fast-track or priority review pathways could expedite launch.

- Market Authorization Status: Assuming EsomepraMAG is in late-stage clinical development, approval timelines are projected within 1-2 years, depending on regulatory feedback.

Market Segmentation and Target Demographics

- By Age Group: Greatest potential in adults aged 45 and above.

- By Indication:

- GERD (acid reflux)

- Peptic ulcer disease

- Erosive esophagitis

- Zollinger-Ellison syndrome (off-label)

- By Geography:

- North America: Largest market due to high prevalence and healthcare spending.

- Europe: Significant market with aging demographics.

- Asia-Pacific: Rapid growth with increasing urbanization and GI disorder prevalence.

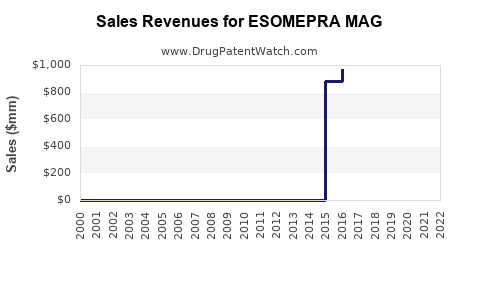

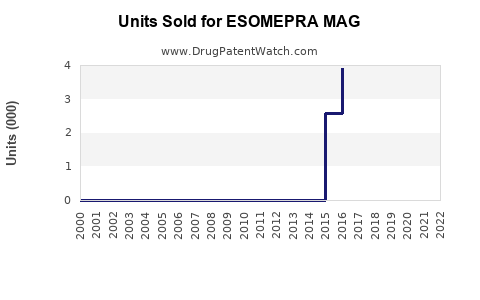

Sales Projections

Assumptions

- Market Penetration: Starting with a conservative 2% penetration of the overall PPI market in Year 1.

- Pricing Strategy: Premium pricing due to formulation benefits, approximately 10-15% above generic PPIs.

- Competitive Response: Entry timing and patent protections allow for initial high sales, tapering as generics enter.

- Lifecycle Growth: Market acceptance improves with clinical evidence and physician familiarity.

Year 1–2: Early Adoption Phase

- Estimated Sales: USD 250–350 million.

- Market Share: About 0.8–1.2%, expanding rapidly as physicians adopt new therapy options.

- Key Factors: Physician education, regulatory approval, initial marketing efforts.

Years 3–4: Growth and Expansion

- Estimated Sales: USD 600–900 million.

- Market Share: 2–4%, as more clinical data reinforces efficacy.

- Key Factors: Broadened indication approvals, inclusion in treatment guidelines.

Years 5: Maturity and Competition

- Estimated Sales: USD 1.2–1.8 billion.

- Market Share: 4–6%, as market becomes saturated with generic options, but with continued premium positioning.

- Key Factors: Patent protections, brand recognition.

Sensitivity Analysis

- Increased acceptance due to superior efficacy could surpass projections.

- Competitive generic entry might force price reductions, impacting margins.

- Regulatory delays or adverse safety findings could impede growth.

Market Entry Strategies

- Clinical Differentiation: Publish robust data highlighting benefits over existing PPIs.

- Regulatory Engagement: Secure rapid approval pathways.

- Partnerships: Collaborations with healthcare providers and payers for formulary inclusion.

- Patient Education: Emphasize improved adherence due to formulation.

Key Market Challenges

- Regulatory Risks: Uncertainty around approval timelines.

- Pricing Pressures: Competitive generic landscape could erode margins.

- Market Penetration: Resistance from established players.

- Safety and Efficacy Evidence: Need for extensive data to shift prescribing behavior.

Conclusion

EsomepraMAG is poised to carve a significant niche within the expanding GI therapeutics market. Strong brand differentiation, strategic regulatory and market access initiatives, and ongoing clinical evidence generation will be central to achieving forecasted sales. While competitive pressures from generic PPIs remain intense, innovative formulations with demonstrated clinical advantages can sustain premium pricing and market share.

Key Takeaways

- EsomepraMAG benefits from the global trend toward more effective, patient-friendly acid suppression therapies amidst rising GI disorder prevalence.

- Early-stage sales are projected to be around USD 250–350 million, with potential to reach over USD 1.8 billion within five years with strategic marketing.

- Navigating patent protections and demonstrating clear clinical benefits are critical for premium pricing and market penetration.

- Competition from generics and OTC options necessitate focused differentiation, physician education, and evidence-based positioning.

- Market success hinges on regulatory approval efficiencies, robust clinical data, and proactive stakeholder engagement.

FAQs

1. What therapeutic advantages does EsomepraMAG offer over traditional PPIs?

EsomepraMAG aims to provide faster onset, longer duration, and potentially fewer side effects due to its novel formulation, which could improve clinical outcomes and patient adherence.

2. How does the regulatory environment impact EsomepraMAG’s market potential?

Regulatory approval timelines and patent protections are crucial. Fast-track approval and granted patents enable earlier market entry and sustained exclusivity, directly influencing sales projections.

3. What are the main competitive threats for EsomepraMAG?

The primary threat is from established generic PPIs, which dominate due to low prices. Additionally, OTC acid suppressants could limit prescription market share.

4. Which geographic markets offer the highest growth opportunities for EsomepraMAG?

North America and Europe lead due to high prevalence rates and healthcare spending. Asia-Pacific presents rapid growth potential fueled by increasing GI disorder incidence.

5. What strategies should stakeholders pursue to maximize EsomepraMAG’s market penetration?

Investing in clinical research, early regulatory engagement, strategic partnerships, and physician education campaigns will be essential. Clear differentiation through superior efficacy and tolerability remains pivotal.

Sources

[1] Global Market Insights. "Gastrointestinal Therapeutics Market Size and Forecast." 2022.