Last updated: July 30, 2025

Introduction

Escitalopram oxalate, marketed primarily under the brand name Lexapro, is a selective serotonin reuptake inhibitor (SSRI) prescribed for major depressive disorder (MDD), generalized anxiety disorder (GAD), and other off-label indications. Its favorable safety profile, once-daily dosing, and robust efficacy have cemented its position in the antidepressant market. This report provides a comprehensive market analysis, analyzing current landscape dynamics, competitive positioning, and future sales projections for escitalopram oxalate through 2030.

Market Landscape Overview

Global Pharmaceutical Market Context

The psychiatric therapeutics market, notably antidepressants, is projected to grow at a compound annual growth rate (CAGR) of approximately 4-6% between 2023 and 2030, driven by increasing awareness, destigmatization, and expanding indications for mental health conditions [1]. Escitalopram remains a front-runner within SSRIs, accounting for a substantial share of prescriptions in developed markets.

Key Market Drivers

-

Rising Prevalence of Mental Health Disorders

Globally, depression affects over 264 million people, with GAD impacting approximately 7% of the population at some point in their lives. The increasing recognition and diagnosis of these conditions directly augment demand for SSRIs, especially escitalopram [2].

-

Clinical Preference and Efficacy

Compared with earlier SSRIs, escitalopram exhibits a favorable side-effect profile and quicker onset of action, increasing clinician preference (e.g., rapid titration, fewer drug interactions) [3].

-

Market Penetration in Emerging Economies

While traditionally dominant in North America and Europe, generic availability and cost reductions have expanded escitalopram’s reach into Asia-Pacific and Latin America, representing significant growth opportunities.

Representative Market Segments

- Pharmaceutical Sales to Hospitals and Clinics: Dominates immediate prescriptions.

- Direct-to-Consumer Advertising: Accelerates brand recognition, especially in the U.S.

- Generic Versus Branded Sales: Generics constitute upwards of 80% of total sales in mature markets, stabilizing prices but expanding volume.

Competitive Landscape

Market Players

- Original Developer: Lundbeck and Forest Laboratories (now part of Allergan) initially introduced Lexapro, holding significant market share.

- Generic Manufacturers: Multiple players produce bioequivalent generics post-patent expiry, intensifying price competition.

- Other SSRIs: Fluoxetine, sertraline, and paroxetine represent close competitors, influencing prescribing behaviors.

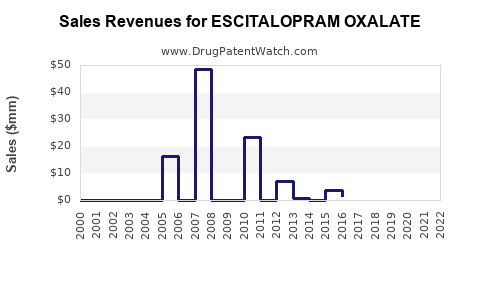

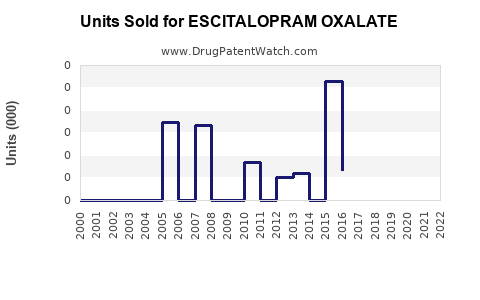

Patents and Exclusivity

The original patent for lexapro expired in the U.S. in 2012, prompting a surge in generic competition. However, brand loyalty and physician prescribing habits sustain significant branded sales, especially in insurance-driven markets.

Pricing Dynamics

Brand-name escitalopram generally retails at a 30-50% premium over generics. High-volume prescriptions and insurance coverage mitigate cost sensitivity, supporting sales volumes despite price competition.

Market Challenges

- Generic Competition: Sharp price reductions impact revenue streams.

- Regulatory Changes: Stringent quality controls and approval pathways for biosimilars and generics can impact supply.

- Off-Label Competition: Newer antidepressants with novel mechanisms (e.g., vortioxetine) threaten market share.

- Stigma and Underdiagnosis: Persistent mental health stigma hampers diagnosis and treatment initiation in certain regions.

Market Opportunities

- Expansion into Adjunctive Indications: Investigating efficacy in anxiety disorders, OCD, and premenstrual dysphoric disorder (PMDD).

- Combination Therapies: Co-prescription with atypical antipsychotics or mood stabilizers for treatment-resistant depression.

- Personalized Medicine: Pharmacogenomics-guided therapy can optimize response and adherence.

- Market Entry in Low-Income Countries: Tailoring affordable formulations enhances access.

Sales Projections (2023–2030)

Assumptions

- Continued growth in mental health awareness and diagnosis.

- Approaching saturation in mature markets but expansion potential in emerging economies.

- Generics will dominate volume, but brand sales will persist through innovative usage and formulations.

- Moderate price erosion due to generic competition, but volume gains offsetting per-unit revenue decline.

Forecast Breakdown

| Year |

Estimated Global Sales (USD Billion) |

Growth Rate (%) |

Notes |

| 2023 |

$2.4 |

- |

Mature markets, stable generic volume |

| 2024 |

$2.6 |

8.3 |

Increased penetration in Asia-Pacific |

| 2025 |

$2.8 |

7.7 |

Broadened indications, new formulations |

| 2026 |

$3.0 |

7.1 |

Entry into adolescent and elderly segments |

| 2027 |

$3.2 |

6.7 |

Growing demand in Latin America |

| 2028 |

$3.4 |

6.3 |

Continued market expansion |

| 2029 |

$3.7 |

8.8 |

Potential approval for new off-label uses |

| 2030 |

$3.9 |

5.4 |

Market maturation and stabilization |

Note: The projections consider a conservative CAGR of approximately 6%, with slight upticks due to expanding indications and emerging markets.

Impacts of Patent Laws and Generics

Post-2012 patent expiry in major markets has catalyzed the proliferation of generics, exerting downward pressure on per-unit revenue. However, brand loyalty, physician preference, and patient adherence to branded formulations sustain specific revenue streams. Brand-name sales are expected to plateau and decline gradually, while generic sales increase in volume.

Strategic Outlook for Stakeholders

- Pharmaceutical Companies: Maintain patent protection (via formulations or delivery methods), explore new therapeutic combinations, and invest in expanding indications.

- Manufacturers of Generics: Focus on cost-efficient manufacturing and quality assurance to capture increasing volume.

- Healthcare Providers: Emphasize pharmacogenomic testing and personalized treatment plans.

- Policymakers: Support policies that improve diagnosis rates and drug access, especially in underserved regions.

Key Factors Influencing Future Sales

- Regulatory approvals for new indications.

- Development of extended-release or novel formulations.

- Market penetration in emerging economies.

- Competitive pipeline and innovation within SSRI class.

Conclusion

Escitalopram oxalate continues to occupy a leading position in the global antidepressant market, bolstered by its demonstrated efficacy, safety, and clinician preference. Despite fierce generic competition, strategic diversification and market expansion can sustain sales growth through 2030. Stakeholders must adapt to evolving regulatory landscapes, pricing pressures, and emerging therapeutic trends to optimize market share and revenue potential.

Key Takeaways

- The global escitalopram market is projected to reach nearly $4 billion by 2030, with a moderate CAGR of approximately 6%.

- Patent expirations have driven significant generic penetration, but brand loyalty sustains steady revenue streams.

- Growth opportunities are concentrated in emerging economies, broader indications, and innovative formulations.

- Competition from other SSRIs and newer antidepressants necessitates strategic differentiation via clinical advantage or formulations.

- Market success hinges on regulatory navigation, personalized medicine adoption, and expanding access in underserved regions.

FAQs

1. How will patent expirations affect the sales of escitalopram oxalate?

Patent expirations have led to a surge in generic versions, decreasing per-unit prices and overall brand revenue. However, maintaining market share through physician preference and differentiated formulations can mitigate revenue loss.

2. Are there any new therapeutic indications for escitalopram?

While primarily approved for depression and GAD, ongoing research explores its potential in OCD, premenstrual dysphoric disorder, and off-label uses, potentially expanding market size.

3. What are the primary drivers for growth in emerging markets?

Enhanced awareness, increasing diagnosis rates, improved healthcare infrastructure, and cost reductions for generics drive growth in regions like Asia-Pacific and Latin America.

4. How does the competitive landscape affect pricing strategies?

Intense generic competition enforces downward pricing pressure. Companies may adopt value-added formulations or branding strategies to sustain margins.

5. What are the risks to future sales growth?

Regulatory hurdles, shifts in prescribing preferences, emergence of new therapies, and stigma reduction efforts impacting treatment initiation are key risks.

Sources:

[1] Market Research Future. "Antidepressants Market Analysis."

[2] World Health Organization. "Depression and Other Common Mental Disorders."

[3] Clinical Pharmacology. "Comparative Efficacy and Safety Profiles of SSRIs."