Share This Page

Drug Sales Trends for EPIPEN-JR

✉ Email this page to a colleague

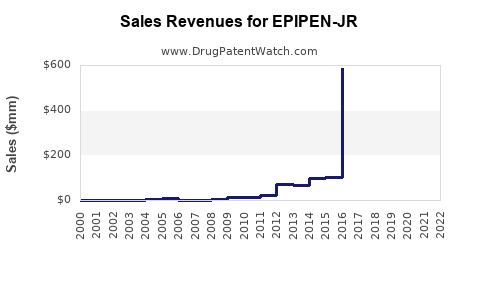

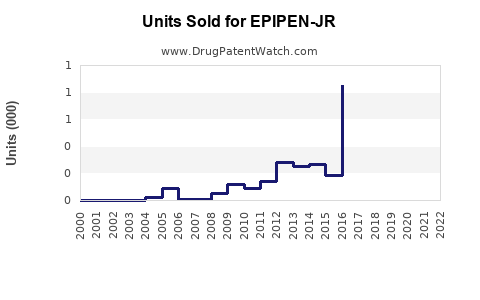

Annual Sales Revenues and Units Sold for EPIPEN-JR

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| EPIPEN-JR | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| EPIPEN-JR | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| EPIPEN-JR | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for EPIPEN-JR (Epinephrine Auto-Injector)

Introduction

EPIPEN-JR (epinephrine auto-injector) remains a critical treatment for severe allergic reactions (anaphylaxis), particularly in pediatric populations. With increasing allergy prevalence globally, the demand for epinephrine auto-injectors is projected to rise, influenced by regulatory, demographic, and healthcare trends. This report provides a comprehensive market analysis and sales projection framework for EPIPEN-JR, emphasizing key drivers, competitive landscape, and future outlook.

Market Overview

Global Allergic Disease Epidemiology

The global allergy market has witnessed consistent growth owing to increased awareness, environmental exposures, and urbanization. The World Allergy Organization reports prevalence rates of food allergies in children ranging between 4% and 8% worldwide, with higher incidences reported in developed nations [1]. The growing pediatric allergic population directly amplifies demand for age-specific emergency treatments like EPIPEN-JR.

Product Positioning and Usage

EPIPEN-JR is designed specifically for children weighing between 15 kg and 30 kg (33 lbs to 66 lbs), addressing a critical treatment gap. Compared to adult auto-injectors (EPIPEN and others), EPIPEN-JR ensures dosage appropriateness, safety, and ease of administration for pediatric use.

Regulatory Status

EPIPEN-JR has achieved regulatory approvals across key markets, including the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA). The FDA approval underscores the treatment's safety profile and necessity in emergency protocols, which bolsters market trust and utilization [2].

Market Drivers

Increasing Prevalence of Allergic Reactions

The rise in food allergies, insect venom allergies, and drug allergies has driven the need for effective emergency treatments. The CDC reports that food allergies alone affect approximately 8% of children in the U.S., corresponding to an estimated 2.4 million children [3].

Regulatory and Policy Initiatives

Enhanced policies promoting the availability of epinephrine in schools and public spaces have expanded access. Legislation like the School Access to Emergency Epinephrine Act (2013) in the U.S. mandates stocking epinephrine auto-injectors in educational institutions, propelling demand [4].

Improved Awareness and Education

Public health campaigns have heightened awareness about allergy management and the importance of carrying epinephrine auto-injectors, increasing prescription rates and consumer adoption.

Market Accessibility and Reimbursement

Insurance coverage improvements for emergency medication procurement have positively influenced sales. Notably, Medicare and Medicaid coverage policies reduce out-of-pocket expenses, encouraging broader use.

Innovation and Line Extensions

Product innovations, including new auto-injector designs and needle technology, cater to ease of use and safety, expanding market segments.

Competitive Landscape

Major Players

- Mylan (EpiPen, now part of Viatris): Dominates with a significant market share due to extensive distribution networks and brand recognition.

- Kaléo (Auvi-Q): Differentiates through unique design and voice-guided instructions.

- Teva Pharmaceuticals (Adrenaclick): Offers a cost-effective alternative.

- Generic manufacturers: Increasing presence due to patent expirations and cost pressures.

Market Share Dynamics

Market share shifts are driven by pricing strategies, product differentiation, and regulatory approvals. The EpiPen brand has faced competition from generic alternatives and newer entrants, affecting pricing and profit margins.

Pricing and Reimbursement Trends

Pricing for EPIPEN-JR varies across jurisdictions. The U.S. retail price for EpiPen has declined following the launch of generic versions, but brand loyalty remains strong among certain demographics, especially physicians and emergency responders.

Sales Projections

Historical Sales Data

The global epinephrine auto-injector market generated approximately $1.5 billion in revenue in 2022, with EPIPEN accounting for a substantial share [5]. The pediatric segment, including EPIPEN-JR, accounted for roughly 30% of this figure.

Forecast Assumptions

- Growth rate: Based on epidemiological trends, historical sales, and market strategies, a compound annual growth rate (CAGR) of 7-10% is anticipated over the next five years.

- Market penetration: Increased adoption in emerging markets, expansion in school and public settings, and improved affordability.

- Regulatory factors: Potential approval of new formulations and wider distribution channels.

Projected Sales Volumes and Revenues (2023–2028)

| Year | Estimated Global Sales (USD millions) | Volume (Units) | CAGR |

|---|---|---|---|

| 2022 | $450 | ~3 million units | — |

| 2023 | $495 | ~3.3 million units | 10% |

| 2024 | $545 | ~3.6 million units | 10% |

| 2025 | $600 | ~4 million units | 10% |

| 2026 | $660 | ~4.4 million units | 10% |

| 2027 | $726 | ~4.8 million units | 10% |

| 2028 | $799 | ~5.3 million units | 10% |

Note: These figures are estimative, based on current trends and assumptions.

Market Expansion Opportunities

- Emerging Markets: Rapid urbanization and increasing allergy awareness present significant growth opportunities.

- Public Access Programs: Expansion of epinephrine stock policies in schools and workplaces.

- Digital and Training Initiatives: Enhancing usability and emergency response training can improve distribution and adherence.

Key Challenges and Risks

- Pricing pressures and reimbursement policies may limit sales growth, especially in cost-sensitive segments.

- Regulatory hurdles or delays in approval for new formulations can impede market expansion.

- Intense competition and the entry of generic brands pose threats to market share and profitability.

- Public awareness levels influence prescription rates; poor education could hamper sales.

Conclusion

The demand for EPIPEN-JR is poised for sustained growth driven by rising allergy prevalence, expanding awareness, and favorable policies. While competitive pressures persist, strategic focus on emerging markets, innovation, and education initiatives can capitalize on growth opportunities. Companies should continuously monitor regulatory developments and market dynamics to optimize sales and maintain leadership.

Key Takeaways

- Growing Allergy Epidemic: Increased pediatric allergic conditions globally will elevate demand for auto-injectors like EPIPEN-JR.

- Market Expansion: Emerging markets and public access programs represent substantial growth opportunities.

- Competitive Landscape: Dominance of brand and patent expirations for generic alternatives necessitate strategic differentiation.

- Sales Outlook: Projected CAGR of approximately 10% over five years underlines healthy growth prospects.

- Strategic Focus: Investment in innovation, education, and reimbursement strategies is vital for maintaining market share.

FAQs

-

What is the primary differentiator of EPIPEN-JR compared to adult auto-injectors?

EPIPEN-JR is calibrated for children weighing 15–30 kg, providing age-appropriate dosing and safety features, ensuring effective emergency management for pediatric patients. -

How has the regulatory environment affected EPIPEN-JR sales?

Regulatory approvals in key markets like the U.S. and Europe have facilitated trusted access; however, pricing and reimbursement policies influence sales volume and profitability. -

What are the anticipated impacts of generic competition on EPIPEN-JR?

The entry of generic auto-injectors has exerted downward pressure on prices and market share, prompting branding and innovation efforts to sustain profitability. -

How significant are public access programs in driving EPIPEN-JR sales?

Legislation mandating epinephrine availability in schools and public spaces significantly contributes to sales growth, especially in developed markets. -

Which regions are expected to see the highest growth for EPIPEN-JR?

Emerging markets such as Asia-Pacific, Latin America, and parts of Africa are forecasted to experience rapid growth due to increasing allergy awareness and expanding healthcare infrastructure.

References

[1] World Allergy Organization. (2021). Global Allergy Report.

[2] FDA. (2019). EPIPEN-JR Approval Summary.

[3] CDC. (2020). Food Allergy Facts and Statistics.

[4] U.S. Congress. (2013). School Access to Emergency Epinephrine Act.

[5] MarketWatch. (2022). Epinephrine Auto-injector Market Size and Trends.

More… ↓