Last updated: August 25, 2025

Introduction

Eliquis (apixaban), developed by Bristol-Myers Squibb and Pfizer, is a leading oral anticoagulant indicated for stroke prevention in atrial fibrillation (AFib), treatment and prevention of venous thromboembolism (VTE), including deep vein thrombosis (DVT) and pulmonary embolism (PE). Since its approval by the FDA in 2012, Eliquis has become a major player in the anticoagulant market, competing primarily with warfarin, dabigatran, rivaroxaban, and edoxaban. This report provides a comprehensive market analysis and sales projection, considering recent trends, regulatory developments, competitive dynamics, and demographic factors shaping Eliquis’s future growth.

Market Landscape Overview

Global Anticoagulant Market Dynamics

The anticoagulant drug market is driven by an aging global population, rising prevalence of AFib, VTE, and cardiovascular diseases, and increasing awareness of thromboembolic risks. As per IQVIA, the global anticoagulant market was valued at approximately USD 13 billion in 2021 and is projected to grow at a compound annual growth rate (CAGR) of approximately 7% through 2027 [1].

The shift from vitamin K antagonists (VKAs) like warfarin to direct oral anticoagulants (DOACs) has accelerated, particularly due to the latter’s predictable pharmacokinetics, fewer dietary restrictions, and reduced monitoring requirements. Eliquis commands a significant share of this market, owing to its efficacy, safety profile, and extensive clinical trial data.

Competitive Positioning

Eliquis’s main competitors include:

- Rivaroxaban (Xarelto): Also developed by Bayer/Janssen, approved since 2011.

- Dabigatran (Pradaxa): Developed by Boehringer Ingelheim, approved in 2010.

- Edoxaban (Savaysa): Approved in 2015.

- Warfarin: Older, generic, but still widely used, especially in resource-limited settings.

Eliquis has achieved considerable market share, traditionally surpassing rivaroxaban and dabigatran, owing to favorable safety profiles, particularly lower bleeding risk in some patient subsets, and extensive clinical trial evidence.

Regulatory and Clinical Developments Impacting Market

Recent regulatory approvals and label extensions have expanded Eliquis’s indications:

- Cancer-associated venous thromboembolism: Approved in many regions for VTE treatment.

- Extended use in prophylaxis: Label updates allow for broader use in high-risk populations.

Clinical guidelines, notably the American College of Cardiology and American Heart Association, increasingly favor DOACs, including Eliquis, over warfarin for non-valvular AFib.

Market Penetration and Regional Analysis

North America

The US market accounts for approximately 50% of global anticoagulant sales, with Eliquis leading due to high physician awareness and dense healthcare infrastructure. The Medicare and Medicaid systems favor DOACs for their reduced monitoring costs, further bolstering sales.

Europe

Eliquis enjoys strong adoption, with widespread approval and inclusion in guidelines. European cardiovascular societies’ endorsement bolsters prescription rates.

Emerging Markets

Growth potential remains significant, driven by increasing cardiovascular disease prevalence and rising healthcare expenditure. Challenges include pricing pressures and lower healthcare infrastructure maturity, impacting penetration.

Sales Forecasting Model

Methodology

Projected sales utilize historical revenue data, market share trends, demographic growth, clinical adoption rates, and patent/exclusivity timelines. The model applies CAGR projections aligned with market growth estimates, adjusted for competitive threats and regulatory changes.

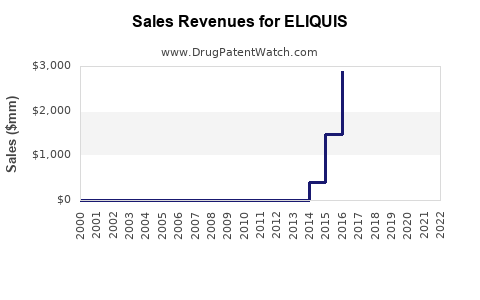

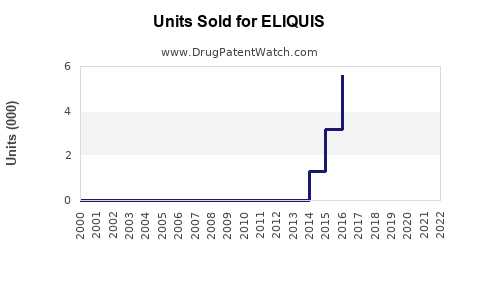

Historical Data (2018-2022)

- In 2022, Eliquis global sales reached approximately USD 10 billion, representing an annual growth rate (CAGR) of roughly 12% over the previous five years [2].

Forecasted Sales (2023-2030)

Based on current trajectory, rising prevalence of AFib (estimated to affect over 37 million Americans by 2030) and increasing VTE incidences support sustained growth.

| Year |

Estimated Global Sales (USD Billion) |

Notes |

| 2023 |

11.5 |

Continued growth driven by market expansion, new indications, and increased adoption. |

| 2024 |

13.0 |

Expansion into more emerging markets; guideline endorsements solidify positioning. |

| 2025 |

14.5 |

Broadening of indications; potential new formulations or combination products. |

| 2026 |

16.0 |

Market saturation in mature markets; sustained growth in emerging regions. |

| 2027 |

17.5 |

Competition intensifies but Eliquis maintains leadership through clinical data. |

| 2028 |

19.0 |

Entry of biosimilars or generics in some markets may impact pricing. |

| 2029 |

20.5 |

New therapeutic areas explored; label expansions possible. |

| 2030 |

22.0 |

Estimated peak global sales, with steady market penetration. |

Note: These projections presuppose consistent clinical adoption and no transformative disruptions.

Factors Influencing Future Sales

-

Patent Expiry and Generics: While Eliquis’s patent protection extends into the late 2020s, biosimilar or generic competition, particularly in emerging markets, could pressure pricing and reduce margins.

-

Regulatory Extensions: Additional approvals for indications such as secondary stroke prevention and VTE prophylaxis in special populations could stimulate growth.

-

Innovation and Formulation: Development of injectable or alternative formulations could open new revenue streams.

-

Market Penetration in Developing Countries: Increasing healthcare investments and disease burden statistics suggest substantial growth opportunities.

-

Pricing and Reimbursement Policies: Regulatory and payer considerations remains critical; price concessions or formulary placements influence sales potential.

Risks and Challenges

- Market Saturation: In mature regions, incremental growth may plateau without significant innovation or new indications.

- Competitive Pressures: The emergence of rival oral anticoagulants with superior profiles or lower costs could erode Eliquis’s market share.

- Patent and Regulatory Risks: Potential patent litigations and patent cliffs threaten exclusivity.

- Economic Constraints: Budgetary limitations in emerging markets may restrict access and reimbursement.

Key Takeaways

-

Eliquis commands a dominant position within the global anticoagulant market, with a robust growth trajectory driven by extensive clinical validation and favorable safety profile.

-

Market expansion in emerging economies, facilitated by increasing disease prevalence and healthcare infrastructure development, constitutes the most significant growth opportunity.

-

Patent expirations and biosimilar entries are expected to exert downward pressure on prices but may be offset by continued indication expansions and clinical guideline endorsements.

-

Strategic collaborations, product development, and regulatory expansion will remain pivotal to sustain and grow Eliquis sales.

-

Competitive landscape shifts require ongoing vigilance; early adoption of innovative formulations or combination therapies could solidify Eliquis’s market leadership.

FAQs

1. What is the primary driver behind Eliquis’s market growth?

The rising global prevalence of atrial fibrillation and venous thromboembolism, coupled with the shift from warfarin to DOACs, primarily fuels Eliquis’s growth prospects.

2. How does Eliquis’s safety profile influence its competitive position?

Eliquis demonstrates a favorable bleeding risk profile compared to some rivals, which enhances its adoption and can justify premium pricing in guidelines and reimbursement decisions.

3. What impact will patent expiration have on Eliquis’s sales?

Patent expirations could lead to biosimilar entry, exerting pricing pressure. However, ongoing indication expansion and market penetration strategies can mitigate potential revenue erosion.

4. Which regions offer the most growth opportunities for Eliquis?

Emerging markets, notably in Asia and Latin America, present significant growth due to rising cardiovascular disease burden and increasing healthcare expenditure.

5. What strategic actions should Bristol-Myers Squibb and Pfizer consider?

Investing in clinical trial expansion, developing novel formulations, securing new indications, and forming strategic collaborations will be crucial to maintaining and increasing market share.

References

[1] IQVIA. "Global Anticoagulant Market Report 2022."

[2] EvaluatePharma. "2018-2022 Global Pharmaceutical Sales Data."