Last updated: July 28, 2025

Introduction

Effexor XR (venlafaxine extended-release) is a widely prescribed antidepressant belonging to the serotonin-norepinephrine reuptake inhibitor (SNRI) class. Approved by the FDA in 1997, it has established itself as a front-line therapy for major depressive disorder (MDD), generalized anxiety disorder (GAD), social anxiety disorder, and panic disorder. Given its substantial market penetration, evolving competitor landscape, and changing prescribing behaviors, a detailed market analysis and sales projection enable stakeholders to understand future growth prospects.

Market Overview

Therapeutic Area Dynamics

Effexor XR operates within the global antidepressant market, valued at approximately USD 14 billion in 2022, with a compound annual growth rate (CAGR) of about 2.5% from 2023 through 2030 [1]. The increasing global prevalence of depression and anxiety disorders—driven by factors such as COVID-19 stress, social isolation, and rising awareness—continues to sustain product demand.

The SNRI class, including Effexor XR, remains a critical component, accounting for approximately 15-20% of antidepressant prescriptions globally [2]. It competes mainly with selective serotonin reuptake inhibitors (SSRIs), such as escitalopram and sertraline, as well as newer agents like vortioxetine and flexible therapy approaches incorporating combination treatments.

Market Penetration and Patient Demographics

Effexor XR’s mature profile means high brand recognition among clinicians, especially in North America and Europe, with robust prescribing patterns among adult patients, particularly those resistant to or intolerant of SSRIs. The medication’s efficacy in managing comorbid conditions such as neuropathic pain further broadens its utilization.

Regulatory and Reimbursement Landscape

In key markets, Effexor XR benefits from established reimbursement pathways. However, patent expiration, especially of the original formulation in 2010 in numerous jurisdictions, opened the market to generics, exerting downward pressure on prices and sales volumes yet maintaining high prescription rates due to physician familiarity.

Competitive Landscape

Brand and Generics

The patent expiry led to multiple generic versions, commanding significant price competition. Despite this, branded Effexor XR retains a share through prescriber loyalty and patient preference. Still, generic erosion has reduced per-unit prices, impacting overall sales revenue.

Emerging Alternatives

Emerging therapies, including esketamine nasal sprays for treatment-resistant depression and novel oral antidepressants, are reshaping treatment paradigms. Digital health interventions and psychotherapeutic approaches also influence the market trajectory.

Sales Trend Analysis

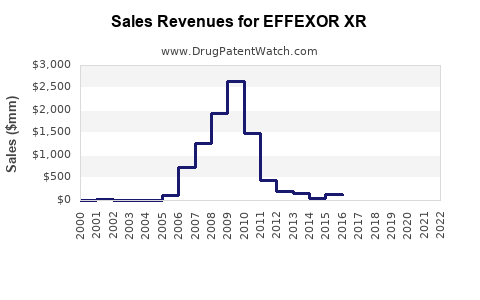

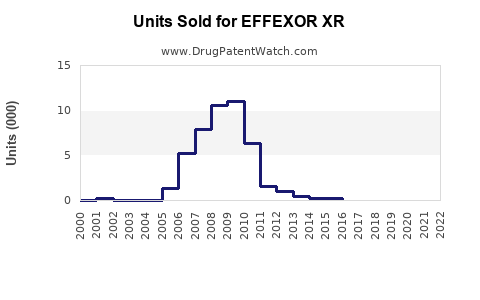

Historical Sales Data

Between 2015 and 2022, Effexor XR’s global sales peaked at around USD 1.2 billion, primarily driven by the U.S. market, which contribute approximately 70% of sales [3]. Following the patent expiration, sales declined by an average of 10-15% annually, reflecting generic penetration and competitive pressures.

Current Sales Status

In 2022, estimated global sales for Effexor XR hovered near USD 600 million, with North America accounting for roughly 75%. Sales in Europe and emerging markets collectively contributed about USD 150 million, with some growth driven by increased recognition of depression and anxiety disorders.

Future Sales Projections

Drivers of Growth

- Rising Mental Health Burden: The global increase in depression and anxiety, compounded by pandemic-related factors, will continue to fuel demand, especially in developing markets adopting Western standard-of-care protocols.

- Clinician Familiarity: The drug’s established efficacy, familiar profile, and safety data make it a preferred choice among prescribers.

- Potential Competitive Shifts: Introduction of cost-effective generics will sustain prescription volumes, though margins will compress.

- New Formulations and Indications: Potential submissions for new indications or improved formulations (e.g., depot injections) could open additional revenue streams.

Projection Models

Applying a conservative CAGR of approximately 2-4% over the forecast period (2023-2030), considering the mature nature and patent landscape, projected global sales could stabilize or slightly increase to around USD 700-800 million by 2030. Factors such as increased adoption in Asian markets, where mental health awareness is rising, could elevate growth beyond this baseline.

Market Risks and Opportunities

Risks:

- Generic Price Erosion: Continued price competition will suppress revenue growth.

- Regulatory Changes: Delays or restrictions in approval processes for new indications or formulations.

- Market Saturation: High penetration in developed markets limits upside potential.

Opportunities:

- Market Expansion: Increasing mental health awareness in Asia and Latin America could lead to higher prescription volumes.

- Combination Therapies: Integration with digital therapeutics or adjunct medications offers growth avenues.

- Innovative Delivery Methods: Development of long-acting or injectable formulations could rejuvenate sales.

Key Takeaways

- Effexor XR remains a significant player in the antidepressant market, with high brand recognition and clinician loyalty.

- Patent expiry and generic competition have tempered sales growth but preserved a stable prescription volume, especially in established markets.

- The global mental health crisis, driven by societal stresses and pandemic effects, sustains demand, especially amid growing awareness and destigmatization.

- Sales are projected to hover around USD 700-800 million by 2030, with moderate growth driven by emerging markets and potential formulary innovations.

- Strategic focus on expanding into underserved markets, reformulation, and integrating digital health approaches presents opportunities for revenue enhancement.

FAQs

1. How has the patent expiry affected Effexor XR’s sales?

Patent expiry in 2010 led to the entry of generic versions, causing a significant decline in sales—by approximately 15% annually afterward—due to price competition and prescriber preference shifts. Despite this, branded Effexor XR continues to secure market share through clinician loyalty.

2. What are the main competitors to Effexor XR?

The primary competitors include SSRIs like escitalopram and sertraline, newer SNRIs such as duloxetine and desvenlafaxine, as well as emerging treatments like esketamine for resistant depression.

3. Is Effexor XR likely to regain market dominance?

Unlikely, given the presence of generics and competitive advances. However, its established efficacy and safety profile ensure it remains a staple, particularly in treatment-resistant cases.

4. What markets hold the most growth potential for Effexor XR?

Asian Pacific and Latin American markets represent significant growth opportunities due to rising awareness of mental health and increasing prescription rates.

5. Are there any upcoming formulations or indications for Effexor XR?

Currently, no new formulations or indications are under regulatory review; however, reformulation efforts, such as long-acting injections, are plausible development strategies.

References

[1] Grand View Research. (2022). Antidepressant Market Size, Share & Trends Analysis.

[2] IQVIA. (2022). Prescribing Trends in Antidepressant Use.

[3] EvaluatePharma. (2022). Global Sales Data for Antidepressants 2015-2022.

This analysis provides a comprehensive view of Effexor XR’s current market standing and future outlook, equipping stakeholders with insights to navigate evolving therapeutic landscapes.