Share This Page

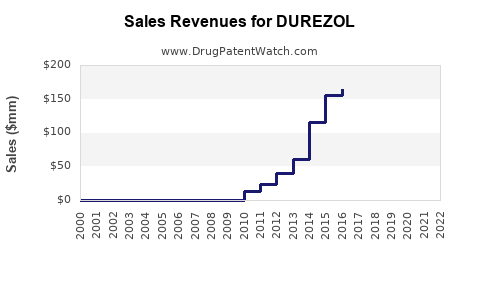

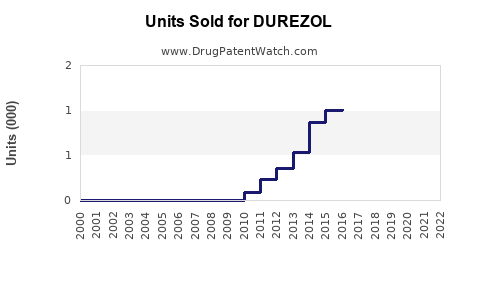

Drug Sales Trends for DUREZOL

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for DUREZOL

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| DUREZOL | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| DUREZOL | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| DUREZOL | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| DUREZOL | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| DUREZOL | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for DUREZOL

Introduction

DUREZOL (difluprednate ophthalmic emulsion) is a potent corticosteroid prescribed for the management of ocular inflammation and pain. Since its FDA approval in 2007, DUREZOL has established itself within the niche market of ophthalmic corticosteroids. This analysis examines global market dynamics, competitive positioning, and future sales trajectories over the next five years to facilitate strategic decision-making for pharmaceutical stakeholders.

Market Overview

Current Market Landscape

The global ophthalmic corticosteroids market was valued at approximately USD 1.8 billion in 2022 and is projected to grow at a CAGR of 4.2% through 2028, driven by increasing prevalence of ocular diseases, evolving treatment guidelines, and rising awareness among patients and healthcare providers [1].

DUREZOL, as a branded formulation, primarily targets post-surgical inflammation, allergic conjunctivitis, and other inflammatory ocular conditions. Its high potency and favorable safety profile differentiate it from generic corticosteroids, positioning it as a preferred choice for ophthalmologists dealing with severe or persistent inflammation.

Key Market Segments

- Therapeutic Indications: Postoperative inflammation, allergic conjunctivitis, uveitis, keratitis.

- Patient Demographics: Adults aged 18-65, elderly populations with age-related ocular conditions, pediatric patients with ocular allergies.

- Distribution Channels: Hospital ophthalmology departments, specialized clinics, retail pharmacies, and online pharmacies.

Competitive Landscape

Major Competitors

- Pred forte (prednisolone acetate): Widely used, cost-effective, broad market penetration.

- Vexol (fluorometholone): Known for safety profile, less potent.

- Maxitrol (neomycin, polymyxin B, dexamethasone): Combines antibiotics with corticosteroids.

- Generic Difluprednate: Increasingly available, impacting brand sales.

Differentiators for DUREZOL

- Potency: Higher efficacy in controlling inflammation.

- Safety Profile: Lower incidence of raising intraocular pressure compared to older corticosteroids.

- Formulation: Emulsion formulation enhances bioavailability and compliance.

Market Entry and Barriers

While DUREZOL faces competition from generics and other corticosteroids, patent protection and clinical preference for its efficacy sustain its market position. However, patent expirations and rising costs of branded formulations threaten future sales.

Market Drivers and Restraints

Drivers

- Rising prevalence of ocular inflammatory diseases.

- Increasing aging population with age-related eye conditions.

- Growing adoption of minimally invasive ocular surgeries requiring anti-inflammatory management.

- Patient demand for safe, effective topical corticosteroids.

Restraints

- Expiry of patents leading to generic proliferation.

- Cost sensitivity among patients, favoring cheaper alternatives.

- Regulatory pressures to minimize corticosteroid-related side effects.

- Competition from emerging non-steroidal anti-inflammatory drugs (NSAIDs).

Sales Projections: 2023-2028

Based on current market dynamics, global sales of DUREZOL are projected to grow steadily, with variations across regions.

Regional Forecasts

- North America: Dominates over 45% of market due to high ophthalmic disease prevalence and advanced healthcare infrastructure. Sales are expected to reach approximately USD 210 million in 2023, growing at a CAGR of 4% due to patent protections and brand loyalty.

- Europe: Accounts for 25% of sales, with growth driven by increasing surgical procedures and allergy cases. Anticipated market size of USD 125 million in 2023.

- Asia-Pacific: Rapid growth, projected at a CAGR of 6%, reaching USD 90 million by 2028, fueled by expanding healthcare access, rising awareness, and demographic shifts.

- Rest of the World: Developing markets expected to see modest growth due to regulatory and economic hurdles.

Overall Market Outlook

By 2028, global DUREZOL sales could surpass USD 430 million, given current trends, patent expiration timelines, and increasing demand for effective corticosteroids. The trail of patent cliffs and rising generics may suppress growth in some regions but could be offset by increased volume driven by expanding indications and improved awareness.

Impact of Patent Expiry and Generics

Patent expiration in key markets, notably the U.S. expected around 2025, will likely lead to increased generic competition, pressuring DUREZOL's price and market share. Nevertheless, brand loyalty and clinical positioning may sustain a significant share for DUREZOL until ultimate market saturation.

Strategic Opportunities

- Lifecycle Management: Developing new formulations or combination products to extend market exclusivity.

- Geographic Expansion: Penetrating emerging markets with tailored pricing strategies.

- Clinical Positioning: Conducting comparative effectiveness studies favoring DUREZOL to reinforce clinician preference.

- Partnerships: Collaborating with healthcare providers and insurers to enhance accessibility and acceptance.

Risks and Uncertainties

- Price erosion from generics post-patent expiry.

- Regulatory hurdles for new formulations or indications.

- Competition integrating newer, non-steroidal anti-inflammatory agents.

- Changes in prescribing trends favoring alternative therapies.

Key Takeaways

- DUREZOL's current market is robust, supported by its efficacy, safety, and clinical reputation.

- The global market is expected to grow at a moderate pace (~4-6%), with high-growth potential in Asia-Pacific.

- Patent expirations will necessitate strategic adaptations, including lifecycle management and geographic expansion.

- Competitive dynamics favor differentiation through clinical evidence and formulation innovation.

- Cost sensitivity and regulatory landscapes will influence long-term sales trajectories.

Conclusion

DUREZOL remains a valuable asset within the ophthalmic corticosteroids segment. Its future sales depend on successfully navigating patent cliffs, expanding into emerging markets, and maintaining clinical differentiation. Strategic investments in innovation, evidence generation, and market access are essential for sustaining growth amid intensifying competition.

FAQs

1. What are the primary indications for DUREZOL?

DUREZOL is primarily indicated for managing ocular inflammation and pain associated with postoperative surgical procedures, allergic conjunctivitis, uveitis, and keratitis.

2. How does DUREZOL compare to other corticosteroids in terms of efficacy?

DUREZOL offers higher potency and effective inflammation control with a favorable safety profile, including a lower risk of intraocular pressure elevation compared to some older corticosteroids.

3. What impact will patent expiration have on DUREZOL sales?

Patent expiration, expected around 2025 in major markets like the U.S., will lead to increased generic competition, reducing prices and market share unless proactive lifecycle management strategies are implemented.

4. Which regions are expected to drive future sales growth for DUREZOL?

Asia-Pacific is expected to see the fastest growth, driven by demographic shifts, rising awareness, and expanding healthcare infrastructure. North America and Europe will continue to be significant but face competitive pressures.

5. What strategic options exist for maintaining DUREZOL's market share?

Strategies include developing new formulations or combination drugs, expanding into emerging markets with tailored pricing, conducting comparative effectiveness research, and establishing strong clinical and payer relationships.

Sources:

[1] MarketResearch.com, “Ophthalmic corticosteroids market forecast 2022-2028,” 2022.

More… ↓