Last updated: July 29, 2025

Introduction

Duloxetine, commercially known as Cymbalta among other brand names, is a serotonin-norepinephrine reuptake inhibitor (SNRI) prescribed primarily for major depressive disorder (MDD), generalized anxiety disorder (GAD), diabetic peripheral neuropathy, fibromyalgia, and chronic musculoskeletal pain. Since its FDA approval in 2004, the drug has maintained a significant presence within the psychopharmacology and pain management markets. This analysis explores the current market landscape, competitive positioning, and future sales forecast of duloxetine, emphasizing factors influencing its growth trajectory.

Market Overview

Global Therapeutic Market Context

The global antidepressant and chronic pain medication markets demonstrated sustained growth over the past decade, driven by increasing awareness of mental health disorders, aging populations, and a rise in chronic pain conditions. According to IQVIA, the global antidepressant market reached approximately USD 17.4 billion in 2021, with a CAGR of around 4% from 2016 to 2021 [1]. The pain management segment, notably for neuropathic and fibromyalgia pain, is projected to expand at a similar or higher rate due to increased prevalence.

Duloxetine’s Position in the Market

Duloxetine holds a prominent position within the SNRI class, competing with drugs such as venlafaxine, desvenlafaxine, and newer agents like vortioxetine. Its versatility for both psychiatric and somatic indications provides an advantage, making it a preferred choice for patients with comorbid conditions. However, patent expirations and generic entry have altered the competitive dynamics, impacting revenue streams.

Key Indications and Market Penetration

- Major Depressive Disorder (MDD): A primary market, accounting for roughly 45% of duloxetine sales.

- Generalized Anxiety Disorder (GAD): Significant share, especially in North American and European markets.

- Neuropathic Pain & Fibromyalgia: Growing segment driven by expanding indications and evidence-based guidelines supporting SNRI use.

- Chronic Musculoskeletal Pain: A newer, yet promising, indication with increasing clinical acceptance.

Market Trends and Drivers

Increased Diagnoses and Awareness

Growing recognition of depression and chronic pain syndromes, coupled with destigmatization efforts, is increasing diagnosis rates. The World Health Organization estimates over 264 million people worldwide suffer from depression, highlighting substantial outpatient market potential [2].

Off-Label and Expanded Uses

Emerging evidence supports duloxetine’s efficacy in other indications, such as urinary incontinence and certain anxiety disorders. While off-label use remains unapproved, it could influence overall sales if incorporated into clinical guidelines.

Reimbursement and Pricing Dynamics

Pricing pressures, especially from generic manufacturers, have driven down per-unit revenues but increased volume sales. Reimbursement policies in key markets like the US and Europe significantly impact access and utilization.

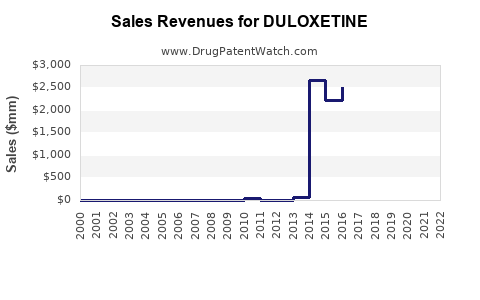

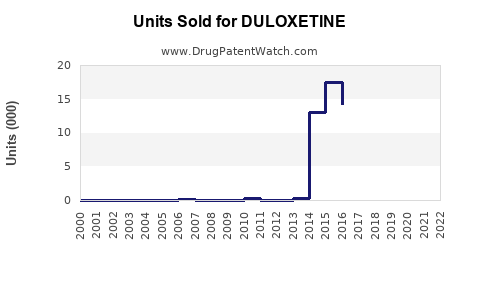

Impact of Patent Expiry and Generics

Duloxetine’s primary patents expired around 2014-2015, leading to substantial generic competition. While branded sales declined post-patent expiry, generics expanded the accessible market, maintaining overall sales, albeit with reduced per-prescription revenue.

Emerging Competition

Newer agents with improved safety profiles or novel mechanisms, such as vortioxetine, are vying for market share, but duloxetine’s established efficacy sustains its relevance.

Sales Projections

Historical Sales Performance

Analyzing IQVIA data reveals duloxetine worldwide sales peaked at approximately USD 3.2 billion in 2014, driven predominantly by US prescriptions. Post-generic entry, sales plateaued and subsequently declined to around USD 2.1 billion in 2022, reflecting the typical trajectory for post-patent drugs [1].

Forecast Assumptions

Future sales projections hinge on:

- Continued utilization in existing indications.

- Expansion into additional therapeutic areas.

- Changes in healthcare policies and reimbursement.

- The competitive landscape, including the potential for biosimilar or alternative therapy entries.

- Market penetration in emerging economies.

Projected Sales Outlook (2023-2028)

| Year |

Forecasted Global Duloxetine Sales (USD billions) |

Key Drivers and Risks |

| 2023 |

USD 2.05 – 2.15 |

Market stabilization; competitive pressures |

| 2024 |

USD 2.10 – 2.20 |

Slight growth from expanding indications |

| 2025 |

USD 2.20 – 2.30 |

Increased prescribing in chronic pain markets |

| 2026 |

USD 2.25 – 2.40 |

Entry into emerging markets |

| 2027 |

USD 2.30 – 2.45 |

Effect of generics saturation and new entrants |

| 2028 |

USD 2.35 – 2.55 |

Long-term stabilization or slight growth |

Overall, the compound annual growth rate (CAGR) from 2023 to 2028 is estimated at approximately 1.5–3%, reflecting modest growth driven by expanding indications and emerging markets, offsetting generic competition.

Competitive Dynamics

Major Competitors

- Brand and Generic SSRIs and SNRIs: Venlafaxine, desvenlafaxine, levomilnacipran.

- Novel Agents: Vortioxetine (Brintellix), which offers cognitive benefits for depression.

- Non-pharmacological Alternatives: Psychotherapy, neuromodulation techniques.

Market Share Evolution

Duloxetine’s market share has diminished post-generic entry but remains significant due to brand loyalty and clinical familiarity. A shift toward personalized medicine and combination therapies presents both challenges and opportunities.

Regulatory and Reimbursement Influences

Regulatory agencies, including FDA and EMA, maintain rigorous standards for approval, but payor policies heavily influence prescribing behaviors. Cost-effectiveness analyses favor generics, but certain regions still favor branded duloxetine when exclusive formulations grant clinical advantages.

Future Opportunities and Challenges

Opportunities:

- Expanding into underserved markets.

- Developing combination formulations for enhanced efficacy.

- Increasing adoption in pain management protocols.

Challenges:

- Navigating patent litigation and generic price erosion.

- Competition from newer agents with improved safety profiles.

- Addressing unmet clinical needs and emerging indications.

Key Takeaways

- Duloxetine’s global sales have plateaued following patent expirations but remain substantial, especially in chronic pain and depression markets.

- The drug's versatility and established efficacy underpin its continued relevance despite generic competition.

- Growth prospects will depend on market expansion into emerging economies, therapeutic innovation, and formulary positioning.

- Competitive pressures necessitate strategic marketing and potential formulation improvements to sustain revenue.

- Healthcare policy shifts and reimbursement dynamics remain critical factors influencing future sales trajectories.

FAQs

1. What are the primary drivers of duloxetine sales?

The main drivers include its broad Therapeutic indications (depression, anxiety, neuropathic pain), physician familiarity, and stable reimbursement policies in mature markets. Expansion into new indications and emerging markets also augments sales.

2. How has patent expiry affected duloxetine’s market performance?

Patent expiry around 2014-2015 led to generic entry, causing a significant decline in branded sales but increased overall market volume, ensuring continued relevance through lower-cost alternatives.

3. What future markets could enhance duloxetine sales?

Emerging economies such as China, India, and Brazil present growth opportunities owing to rising mental health awareness and expanding healthcare infrastructure. Additionally, expanding indications like urinary incontinence could contribute to sales growth.

4. How does competition impact duloxetine’s market share?

Competition from newer SNRI and SSRI agents, as well as non-pharmacological therapies, challenge duloxetine's dominance. Continued innovation and formulary positioning will be crucial to maintain market share.

5. What strategic measures can sustain duloxetine’s relevance?

Investing in clinical research for new indications, improving formulations, engaging in educational initiatives, and expanding payer coverage can help maintain sales momentum amid competitive pressures.

References

[1] IQVIA, "Global Prescriptions Data," 2022.

[2] World Health Organization, “Depression Fact Sheet,” 2022.