Share This Page

Drug Sales Trends for DULERA

✉ Email this page to a colleague

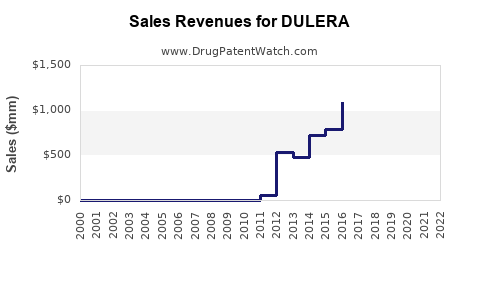

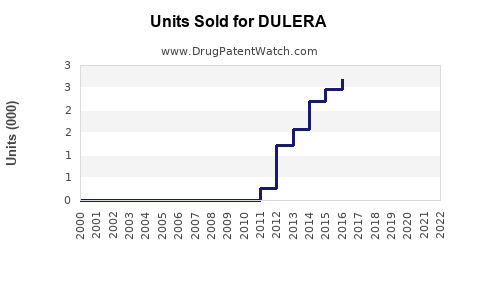

Annual Sales Revenues and Units Sold for DULERA

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| DULERA | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| DULERA | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| DULERA | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| DULERA | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| DULERA | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| DULERA | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for DULERA

Introduction

DULERA, a combination inhaler containing budesonide and formoterol fumarate dihydrate, is prescribed for asthma management, offering both anti-inflammatory and bronchodilator effects. Approved by the FDA in 2014, DULERA initially positioned as a crucial option for patients requiring inhaled corticosteroids with long-acting beta-agonists (LABAs). Its market dynamics are influenced by regulatory, clinical, and competitive factors vital for stakeholders to understand future growth trajectories.

Market Landscape

Global Market Overview

The global inhaled corticosteroid/LABA combination therapy market—including DULERA—has exhibited considerable growth driven by rising asthma prevalence, increasing awareness, and advancements in inhaler technology. According to a report by Grand View Research, the global asthma inhaler market was valued at approximately USD 9.3 billion in 2021, with a compound annual growth rate (CAGR) forecast of around 4.2% through 2028 [1]. DULERA competes within a segment that includes other fixed-dose combination inhalers like Symbicort (budesonide/formoterol), Advair (fluticasone/salmeterol), and Dulera's own brand counterparts.

Regional Dynamics

- North America: Constitutes the largest share, driven by high asthma awareness, healthcare infrastructure, and insurance coverage. The U.S. accounted for over 50% of market revenue in 2021 [1].

- Europe: Growing adoption, facilitated by stringent healthcare policies, with countries like Germany and the UK leading.

- Asia-Pacific: Presents high growth potential fueled by urbanization, environmental pollution, and increasing prevalence of respiratory diseases, although market penetration remains comparatively nascent.

Regulatory & Competitive Environment

In 2020, the FDA approved Teva's generic version of DULERA, intensifying price competition. Meanwhile, newer therapies like biologics and once-daily formulations threaten market share for existing inhalers. Patent expirations, especially for older inhalers, influence portfolio strategies of major pharmaceutical firms.

Key Drivers and Barriers

Drivers

- Increasing Asthma Prevalence: The World Health Organization estimates over 339 million people globally suffer from asthma, fostering sustained demand for effective inhaler therapies [2].

- Enhanced Patient Compliance: Fixed-dose combinations like DULERA improve adherence by simplifying treatment regimens.

- Advancement in Inhaler Technologies: Development of digital inhalers improves monitoring and adherence, appealing to healthcare providers and patients.

- Expanded Indications: Emerging evidence supports off-label use and broader application in COPD management, broadening the target population.

Barriers

- Competitive Market Saturation: Numerous branded and generic fixed-dose inhalers limit growth potential.

- Cost and Reimbursement Issues: High medication costs and insurance limitations impact patient access.

- Patient Preference for Once-Daily Formulations: DULERA’s twice-daily dosing may be less desirable compared to newer, once-daily options.

- Safety Concerns: Risks associated with LABA medications (e.g., asthma-related mortality concerns) can influence prescribing patterns.

Sales Projections

Historical Performance

DULERA has experienced steady initial adoption since its launch, though growth plateaued following the emergence of generics and alternative therapies. In 2021, its global sales approached USD 250 million, indicating moderate market penetration within the asthma inhaler segment [3].

Forecasted Growth

Based on market trends, competitive landscape, and disease prevalence, DULERA’s sales are projected to follow a cautious growth trajectory:

- 2023–2025: CAGR around 3–5%, driven by increased asthma awareness and controlled clinical use.

- 2026–2030: Potential stabilization or marginal decline due to patent expirations and market share erosion by generics and new formulations.

Regional Sales Outlook

- North America: Continues as the largest contributor (approximately 60–65% of sales), with projected growth rates of 2–4%. Market saturation and existing high penetration levels limit rapid expansion.

- Europe: Moderate growth expected, tentatively 3–5% CAGR, contingent upon regulatory approvals and formulary inclusions.

- Asia-Pacific: High growth potential, projected at a 6–8% CAGR, as increased healthcare investments and regulatory approvals promote sales.

Market Share Considerations

DULERA competes traditionally with Symbicort and Advair, which possess broader prescriber recognition and established market presence. However, DULERA’s niche—particularly its approved for certain pediatric indications—may sustain modest growth. The impact of patents, biosimilar entry, and partnerships with healthcare providers significantly influence sales projections.

Strategic Opportunities & Risks

Opportunities

- Expansion into COPD Treatment: Given its bronchodilator component, DULERA could leverage this indication, expanding its market.

- Digital Inhaler Integration: Incorporating digital health solutions can improve adherence, appealing to modern healthcare ecosystems.

- Market Penetration in Emerging Economies: Through partnerships with local distributors and regulatory approvals, DULERA can establish a foothold in high-growth regions.

Risks

- Generic Competition: The entry of generic formulations can drastically reduce revenue.

- Regulatory Changes: New safety warnings or dosing restrictions could limit usage.

- Market Preferences: Transition towards single-inhaler therapies or biologics could undermine DULERA’s relevance.

Conclusion

DULERA operates within a dynamic, mature respiratory drug market characterized by intense competition, technological innovation, and evolving regulatory landscapes. While its moderate sales are projected to grow steadily in the near term, long-term prospects hinge on strategic positioning, expansion into new indications, and navigating competitive pressures. Stakeholders should continuously monitor market trends, patent statuses, and clinical advancements to optimize investment decisions.

Key Takeaways

- DULERA’s global sales are expected to grow modestly at a CAGR of approximately 3–5% through 2025.

- North America remains the primary market driver, though high saturation limits explosive growth.

- Emerging markets and digital inhaler innovations present significant opportunities for expansion.

- Competition from generics and newer therapies poses ongoing risks.

- Strategic focus on indications expansion, technology integration, and regional market penetration can sustain DULERA’s market presence.

FAQs

1. What is the primary therapeutic purpose of DULERA?

DULERA is used to manage asthma symptoms by combining an inhaled corticosteroid (budesonide) and a LABA (formoterol), providing anti-inflammatory and bronchodilator effects.

2. How does DULERA differ from its competitors?

While similar to products like Symbicort, DULERA's unique features include its specific dosing regimen, indications, and formulations. Its clinical profile and safety data also influence prescriber preferences.

3. What factors could impact DULERA’s sales growth?

Patent expirations, emergence of generics, competing therapies (e.g., biologics, once-daily inhalers), and regulatory changes significantly influence sales trajectories.

4. Which regions offer the most growth potential for DULERA?

The Asia-Pacific region presents the highest growth opportunities due to increasing respiratory disease prevalence and expanding healthcare infrastructure.

5. Are there any upcoming regulatory or clinical developments that could affect DULERA?

Ongoing safety evaluations, potential label updates, and expansion into additional indications may influence DULERA’s market stability and growth prospects.

References

[1] Grand View Research. "Asthma Inhaler Market Size & Trends." 2022.

[2] World Health Organization. "Asthma Fact Sheet." 2022.

[3] EvaluatePharma. "2022 Drug Sales Data."

More… ↓