Last updated: July 28, 2025

Introduction

Donepezil, a cholinesterase inhibitor, is primarily prescribed for the symptomatic treatment of mild to moderate Alzheimer’s disease. Since its approval by the FDA in 1996, Donepezil has become one of the leading pharmacological options in dementia management. Given the rising global prevalence of Alzheimer’s disease, understanding the market dynamics and projecting sales for Donepezil is vital for stakeholders, including pharmaceutical companies, investors, and healthcare policymakers.

This report offers a comprehensive market analysis and detailed sales projections for Donepezil, underpinning strategic decision-making with current epidemiological trends, competitive landscape insights, regulatory considerations, and emerging market opportunities.

Market Landscape Overview

Epidemiology of Alzheimer’s Disease and Market Drivers

The global Alzheimer’s disease (AD) patient population is projected to reach approximately 130 million by 2050, substantially driven by aging demographics.[1] The World Alzheimer Report 2019 estimates over 50 million affected worldwide, with prevalence expected to triple by 2050.[2] These figures underscore the increasing demand for symptomatic treatments like Donepezil.

Key market drivers include:

- Aging Population: The primary demographic for Donepezil.

- Rising Awareness and Diagnosis: Increased screening leads to higher prescription rates.

- Limited Disease-Modifying Options: Current treatments, including Donepezil, remain foundational with minimal competition due to the absence of approved disease-modifying therapies.

- Healthcare Expenditure: Governments and healthcare providers prioritize dementia care, expanding access to symptomatic drugs.

Competitive Landscape

Donepezil faces competition from other cholinesterase inhibitors such as Rivastigmine and Galantamine, and NMDA receptor antagonists like Memantine. Nonetheless, Donepezil's favorable pharmacokinetic profile and once-daily dosing provide competitive advantages.

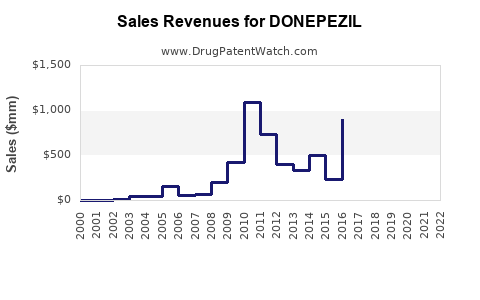

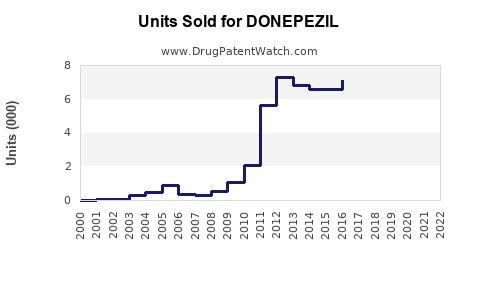

Generic versions of Donepezil entered markets globally post-patent expiry, significantly impacting sales revenues, especially in price-sensitive regions. Notably, the patent expired in major markets by 2018, opening the market for generic manufacturers and influencing the sales landscape.

Regulatory and Patent Considerations

The main patent for Donepezil expired in 2018 in the US and Europe, leading to an influx of generics. Some markets still hold patent protections or exclusivity for approved formulations, impacting sales potential variably across regions.

Emerging formulations, such as extended-release versions or combination therapies, are under clinical development, potentially revitalizing the market.

Current Market Size and Segmentation

Regional Market Distribution

North America remains the largest market, fueled by high diagnosis rates, healthcare expenditure, and established healthcare infrastructure. Europe follows, with significant prescriptive volumes. Asia-Pacific displays rapid growth potential, driven by aging populations and increasing healthcare access.

Market Segments

- Prescription Volume: Driven mainly by neurologists, psychiatrists, and general practitioners.

- Formulations: Primarily tablets; extended-release tablets gaining interest.

- Pricing Dynamics: Generics dominate the market, significantly reducing prices, especially in price-sensitive regions.

Historical Sales Data

A review of recent years indicates:

- 2019: Estimated global sales of approximately $800 million.

- 2020: Slight decline (~5%) attributable to COVID-19 disruptions, with sales around $760 million.

- 2021: Partial recovery, reaching approximately $800 million again as healthcare systems adapted.

This stability hints at sustained demand, albeit with pricing pressures.

Sales Projections (2023-2027)

Methodology

Projections combine epidemiological growth estimates, market penetration trends, generic competition, regulatory landscapes, and innovation pipelines. Using a compound annual growth rate (CAGR) approach, forecast scenarios consider both optimistic and conservative assumptions.

Forecast Assumptions

- Epidemiology Growth: Approximately 3% annually, considering aging demographics.

- Market Penetration Stability: Maintains current levels due to the absence of new disease-modifying drugs.

- Generic Competition: Continues to exert downward pressure on prices but does not significantly reduce demand.

- Innovation: Limited impact expected unless new formulations or combination therapies gain approval.

Base-Case Scenario

- 2023: $820 million – slight recovery post-pandemic.

- 2024: $860 million (+5% CAGR), driven by demographic growth.

- 2025: $900 million (+4.7% CAGR), with increased awareness and diagnosis.

- 2026: $940 million (+4.4% CAGR).

- 2027: $980 million (+4.3% CAGR).

Alternative Scenarios

- Optimistic: Introduction of new formulations or expanded indications could elevate sales beyond $1.1 billion by 2027.

- Pessimistic: Accelerated patent expirations and aggressive generic competition could reduce sales to below $700 million annually.

Market Opportunities and Challenges

Opportunities

- Novel Formulations: Extended-release tablets or patch delivery systems can improve adherence and potentially command premium pricing.

- Combination Therapies: Co-formulations with other symptomatic agents could enhance efficacy and market share.

- Emerging Markets: Rapid growth in Asia-Pacific, Latin America, and Africa, driven by aging populations and healthcare infrastructure expansion.

- Biotech Innovations: Emerging neuroprotective agents and disease-modifying treatments may supplement Donepezil's market, creating synergy rather than competition.

Challenges

- Price Sensitivity: High prevalence of generic versions reduces profit margins.

- Stagnant Therapeutic Landscape: Lack of disease-modifying therapies limits growth beyond symptomatic management.

- Regulatory Variability: Differing drug approval timelines and patent laws across regions.

- Patient and Physician Preferences: Shift towards newer drugs or combination therapies may erode Donepezil’s market share.

Conclusion

Donepezil remains a cornerstone in symptomatic Alzheimer’s disease treatment, with an expected steady market presence driven by demographic trends and healthcare infrastructure. While patent expirations induce pricing pressures, strategic positioning with innovative formulations and targeted markets can sustain sales growth. The global aging demographic and increasing disease prevalence substantiate a resilient market outlook, provided competitive and regulatory challenges are effectively managed.

Key Takeaways

- The global Alzheimer’s population growth underpins sustained demand for Donepezil, with an estimated market size of around $980 million by 2027 under conservative estimates.

- Patent expirations have introduced extensive generic competition, leading to price erosion but maintaining overall demand.

- Opportunities exist in developing improved formulations and entering emerging markets with expanding healthcare infrastructure.

- Market growth will be moderated by competitive pressures and the slow pipeline of disease-modifying therapies.

- Strategic focus on innovation, market expansion, and differentiation will be crucial for stakeholders aiming to capitalize on Donepezil's enduring therapeutic relevance.

FAQs

1. How has patent expiration affected Donepezil sales globally?

Patent expiration in major markets like the US and Europe since 2018 has led to an influx of generics, significantly reducing prices and profit margins but maintaining steady demand due to ongoing need for symptomatic treatment.

2. Are there new formulations of Donepezil in development?

Yes, extended-release versions and combination therapies are under clinical evaluation, aiming to improve adherence and efficacy, which could potentially revitalize market interest.

3. Which regions offer the highest sales growth potential for Donepezil?

The Asia-Pacific region exhibits the highest growth potential due to demographic trends and expanding healthcare access, followed by Latin America and parts of Africa.

4. How does the competitive landscape influence Donepezil sales?

Competition from other cholinesterase inhibitors and NMDA antagonists, along with generic pricing, constrains sales, but Donepezil’s established efficacy and familiar dosing schedule help retain a significant market share.

5. What are the key challenges facing Donepezil's market longevity?

Without disease-modifying therapies, Donepezil’s role remains symptomatic, which limits growth. Price pressures from generics and changing prescriber preferences towards newer therapies pose additional risks.

Sources

[1] World Alzheimer Report 2019. Alzheimer's Disease International.

[2] Prince et al., "The Global Prevalence of Dementia," Alzheimer's & Dementia, 2015.