Share This Page

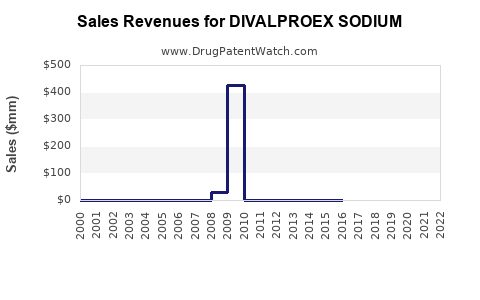

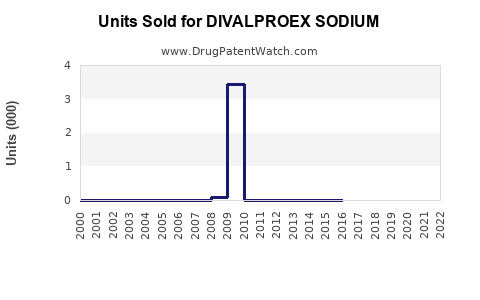

Drug Sales Trends for DIVALPROEX SODIUM

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for DIVALPROEX SODIUM

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| DIVALPROEX SODIUM | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| DIVALPROEX SODIUM | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| DIVALPROEX SODIUM | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| DIVALPROEX SODIUM | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| DIVALPROEX SODIUM | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| DIVALPROEX SODIUM | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Divalproex Sodium

Introduction

Divalproex sodium, a widely prescribed antiepileptic and mood stabilizer, plays a critical role in the management of epilepsy, bipolar disorder, and migraine prophylaxis. Its pharmacological efficacy, combined with its established safety profile, positions it as a staple in neurological and psychiatric treatment regimens globally. With increasing clinical indications, evolving healthcare policies, and expanding geographic reach, the market for divalproex sodium is poised for significant growth. This report provides a comprehensive market analysis, including current dynamics, competitive landscape, emerging trends, and sales projections through 2030.

Market Overview

Market Definition and Therapeutic Indications

Divalproex sodium is marketed under brand names like Depakote, Depakote ER, and others. It functions as a prodrug that converts into valproic acid, controlling seizure activities and stabilizing mood swings. Its primary indications include:

- Epilepsy

- Bipolar disorder

- Migraine prophylaxis

The drug is also being explored for off-label uses, including neurodegenerative diseases and psychiatric conditions, broadening its potential market share.

Market Drivers

- Rising Prevalence of Epilepsy and Bipolar Disorder: The global burden of epilepsy affects approximately 50 million people, with bipolar disorder impacting over 45 million worldwide ([1]). These figures underpin the consistent demand for effective pharmacotherapy.

- Expanding Treatment in Developing Countries: Growing awareness and improved healthcare infrastructure are increasing drug accessibility.

- Off-label Uses and Innovation: Ongoing research into new therapeutic applications enhances market potential.

- Patent Expiry and Generic Adoption: The landscape is shifting towards generic formulations, which provide cost-effective options and boost market penetration.

Market Constraints

- Safety Concerns: Risks such as hepatotoxicity, teratogenicity, and pancreatitis impact prescription practices. Regulatory warnings influence clinician prescribing behavior.

- Competition: Other antiepileptic drugs (e.g., lamotrigine, levetiracetam) and mood stabilizers (e.g., lithium) compete within the same therapeutic niches.

- Regulatory Environment: Stringent approval processes and post-marketing surveillance influence market dynamics.

Current Market Dynamics

Regional Market Insights

- North America: Dominates the market due to high prevalence, advanced healthcare infrastructure, and widespread drug approval. The U.S. accounts for over 50% of global sales, driven by insured populations and continuous clinical use ([2]).

- Europe: Significant shares attributable to well-established healthcare systems, with increasing adoption amidst aging populations and mental health awareness.

- Asia-Pacific: Emerging market potential, driven by expanding healthcare access, rising incidence of neurological disorders, and growing recognition of mental health issues.

- Rest of World: Notable growth potential, although constrained by access and affordability challenges.

Competitive Landscape

Major players include AbbVie (Depakote), Teva Pharmaceuticals, Mylan, and Sun Pharmaceutical Industries, among others. Market share shifts favor generic manufacturers, leading to price reductions and increased accessibility. Patented formulations with extended-release profiles continue to capture niche segments, offering improved compliance.

Regulatory and Reimbursement Trends

Regulatory agencies like the FDA and EMA maintain rigorous standards, ensuring safety but also posing entry barriers. Reimbursement policies increasingly favor generic substitution, decreasing treatment costs for payers and patients.

Sales Projections (2023–2030)

Methodology

Projections incorporate epidemiological data, drug adoption rates, patent expiry timelines, regulatory trends, and competitive dynamics. Scenario analyses consider optimistic, moderate, and conservative cases based on potential market developments.

Projected Market Growth

- Compound Annual Growth Rate (CAGR): Estimated at 4.2% from 2023 to 2030.

- Market Size 2023: Valued at approximately USD 3.2 billion globally.

- Projected Market Size 2030: Approaching USD 4.9 billion.

Key Drivers of Growth

- Increasing incidence of neurological and psychiatric conditions.

- Greater acceptance of divalproex sodium in off-label and combination therapies.

- Price erosion favoring generic formulations.

- Emerging markets' expansion.

Major Market Drivers by Region

- North America: Steady growth driven by high disease prevalence, innovation, and regulatory stability.

- Europe: Moderate growth facilitated by increased diagnosis rates and healthcare reforms.

- Asia-Pacific: Highest growth potential, projected at approximately 6% CAGR, due to rising disease burden and healthcare expansion.

Impact of Patent Expiry and Generics

Patent expirations (notably for Depakote ER) by 2019-2022 have significantly accelerated generic penetration, reducing pricing and promoting volume growth. However, brand-specific preferences and physician loyalty continue to sustain branded sales in certain segments.

Competitive Strategies and Market Opportunities

- Product Differentiation: Extended-release formulations and combination products offer improved patient compliance.

- Regulatory Approvals: Exploring new indications and formulations to expand indications.

- Partnerships: Strategic collaborations with healthcare providers, payers, and generic manufacturers enhance market reach.

- Geographical Expansion: Focused penetration into emerging markets through affordable pricing strategies.

Challenges and Risks

- Safety concerns necessitate vigilant monitoring and may limit prescription volumes.

- Market saturation in mature regions could dampen growth.

- Price competition among generics may pressure profit margins.

- Regulatory changes and patent litigations pose ongoing risks.

Key Takeaways

- The global divalproex sodium market is poised for steady expansion, with an expected CAGR of over 4% till 2030.

- Generic formulations dominate sales post-patent expiration, fostering increased accessibility.

- Growing prevalence of targeted disorders and emerging markets underpin future growth.

- Safety profile concerns remain pivotal in shaping prescriber behavior.

- Strategic differentiation and geographic expansion are critical to maintaining competitive advantage.

FAQs

1. What is the primary therapeutic use of divalproex sodium?

Divalproex sodium is primarily used for epilepsy management, bipolar disorder stabilization, and migraine prophylaxis.

2. How has patent expiry affected the divalproex sodium market?

Patent expiry has led to increased generic competition, significantly reducing prices and expanding market penetration globally.

3. What are the safety concerns associated with divalproex sodium?

Risks include hepatotoxicity, teratogenic effects, pancreatitis, and weight gain, which influence prescribing patterns and regulatory warnings.

4. Which regions are expected to showcase the highest growth in the coming years?

Asia-Pacific is anticipated to exhibit the highest CAGR driven by increasing disease burden and rising healthcare infrastructure.

5. What strategic moves can pharmaceutical companies adopt to capitalize on market growth?

Developing extended-release formulations, obtaining approvals for new indications, expanding into emerging markets, and forming strategic partnerships are key strategies.

References

[1] World Health Organization. (2022). Epilepsy fact sheet.

[2] IQVIA. (2022). Global Epilepsy Treatment Market Report.

More… ↓