Share This Page

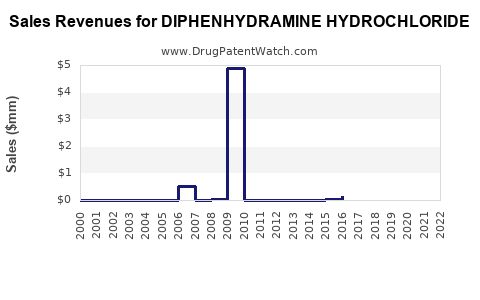

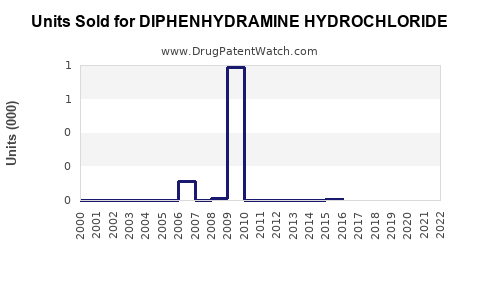

Drug Sales Trends for DIPHENHYDRAMINE HYDROCHLORIDE

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for DIPHENHYDRAMINE HYDROCHLORIDE

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| DIPHENHYDRAMINE HYDROCHLORIDE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| DIPHENHYDRAMINE HYDROCHLORIDE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| DIPHENHYDRAMINE HYDROCHLORIDE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| DIPHENHYDRAMINE HYDROCHLORIDE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Diphenhydramine Hydrochloride

Introduction

Diphenhydramine hydrochloride, a first-generation antihistamine, remains a cornerstone in the treatment of allergy symptoms, motion sickness, and common cold symptoms. Its over-the-counter (OTC) availability and well-established safety profile sustain its broad utilization globally. This analysis explores the current market landscape, key drivers, competitive environment, regulatory factors, and future sales projections for diphenhydramine hydrochloride.

Market Overview

Global Drug Market Context

The antihistamine segment forms a significant portion of the global OTC medication industry, valued at approximately USD 8 billion in 2022, with a compound annual growth rate (CAGR) of around 4% (1). Diphenhydramine constitutes roughly 35–40% of this category, driven by its wide usage in allergy relief and sleep aid formulations.

Key Markets and Demographics

- The North American market dominates, accounting for nearly 45% of global sales, attributable to high OTC consumption and mature healthcare infrastructure (2).

- Europe contributes approximately 25%, with Latin America and Asia-Pacific rapidly expanding segments due to increased healthcare awareness and urbanization (3).

Prescription vs. OTC Status

While primarily available OTC, diphenhydramine is sometimes prescription-listed in certain jurisdictions for specific indications, such as pediatric sleep disorders. The OTC status ensures high accessibility, fueling consistent demand.

Market Drivers

1. Ubiquity in Consumer Healthcare

Diphenhydramine’s proven efficacy in allergy relief, sleep management, and cold symptom treatment guarantees steady demand. Its dual role as an antihistamine and sleep aid uniquely positions it in consumer preferences.

2. Aging Population and Allergic Conditions

Growing prevalence of allergic diseases, especially among the elderly, broadens the user base. The CDC reports that approximately 20% of Americans suffer from allergic rhinitis, stimulating consistent OTC sales (4).

3. Expanded Formulations and Combinations

Product innovation, including combination drugs for multi-symptom relief and formulation adaptations (e.g., fast-dissolving tablets), enhances consumer appeal and increases sales volume.

4. Regulatory Environment

Supportive regulations for OTC availability, particularly in North America and Europe, sustain steady market access and growth prospects.

Market Challenges

- Safety Concerns: Potential anticholinergic side effects, especially in older adults, have prompted regulatory scrutiny. Some jurisdictions impose age restrictions or warnings, possibly constraining sales growth (5).

- Market Saturation: High penetration in mature markets limits aggressive growth; innovation and expanding indications are thus vital for future expansion.

- Generic Competition: The entry of numerous generic manufacturers depresses prices and profit margins, impacting overall revenue.

Competitive Landscape

Major Players

- Johnson & Johnson (Benadryl)

- McNeil Consumer Healthcare (Equate, Tylenol formulations)

- GlaxoSmithKline (Allergy medications)

- Local generic manufacturers across Asia-Pacific and Latin America

Market Dynamics

Price competition among generics is intense, leading to standardized pricing. Brand dominance persists primarily due to consumer loyalty and marketing, though generics capture significant market share due to affordability.

Regulatory Factors

United States

The FDA approves diphenhydramine OTC formulations, with ongoing evaluations focusing on vulnerable populations. The recent attention to anticholinergic burden has led to risk communication but has not significantly restricted access (6).

Europe

Managed under the European Medicines Agency (EMA), with select restrictions based on age and medical conditions, ensuring ongoing market stability.

Emerging Markets

In Asia and Latin America, regulatory frameworks are evolving, often with less restrictive OTC policies, providing growth opportunities but also necessitating compliance navigation.

Sales Projections (2023–2030)

Baseline Scenario

Assuming consistent demand in mature markets, moderate growth in emerging regions, and sustained form of OTC availability:

| Year | Projected Global Sales (USD billion) | CAGR | Remarks |

|---|---|---|---|

| 2023 | 3.5 | — | Current estimate |

| 2024 | 3.64 | 4% | Continued demand, minor market expansion |

| 2025 | 3.78 | 4% | Increased formulations and awareness |

| 2026 | 3.93 | 4% | Entry into new markets, regulatory adaptation |

| 2027 | 4.09 | 4% | Growing awareness, aging populations |

| 2028 | 4.25 | 4% | Expansion in Asia-Pacific |

| 2029 | 4.41 | 4% | New combination products, formulations |

| 2030 | 4.58 | 4% | Mature markets plateau, emerging markets grow |

Factors Influencing Projections

- Introduction of new formulations or delivery methods (e.g., transdermal patches, nasal sprays) potentially increasing demand.

- Regulatory restrictions may temper growth, particularly in elderly populations or where safety concerns dominate.

- Competitive pressure from newer antihistamines with fewer sedative effects could impact sales (~loratadine, cetirizine).

Conclusion

Diphenhydramine hydrochloride maintains a vital position in the global OTC therapeutic landscape. While facing competitive and regulatory challenges, its entrenched consumer recognition and adaptation through innovative formulations underpin steady long-term sales. Significant growth potential exists in emerging markets driven by expanding healthcare infrastructure and increasing allergy prevalence, provided regulatory environments evolve favorably.

Key Takeaways

- The global diphenhydramine hydrochloride market is projected to grow at approximately 4% annually through 2030, reaching nearly USD 4.58 billion.

- North America remains the dominant market owing to high OTC use and consumer familiarity, though emerging markets offer substantial growth avenues.

- Innovation in formulations and expanding indications are critical to maintaining competitive advantage.

- Regulatory scrutiny related to safety in vulnerable populations may impact sales trajectories, necessitating careful compliance.

- Price competition among generics requires strategic focus on branding and differentiated formulations to sustain profitability.

FAQs

1. What factors most significantly influence diphenhydramine hydrochloride sales?

Demand driven by allergy prevalence, consumer preferences for OTC products, regulatory environment, and formulation innovations primarily influence sales. Market saturation and competition from newer antihistamines also play critical roles.

2. How do regulatory restrictions affect its market potential?

Restrictions aimed at vulnerable populations, such as the elderly, can reduce accessible user base and impose label requirements, potentially slowing market growth. However, widespread OTC availability remains a key enabler.

3. What growth opportunities exist in emerging markets?

Rising healthcare awareness, increasing allergy diagnoses, urbanization, and expanding OTC distribution channels make Asia-Pacific and Latin America promising regions for growth.

4. How does competition from newer antihistamines impact diphenhydramine sales?

Newer antihistamines (loratadine, cetirizine) offer non-sedating profiles, appealing to consumers seeking fewer side effects. This competition pressures diphenhydramine to innovate and differentiate through formulations and indications.

5. Are there any recent regulatory or safety developments affecting its market?

Yes. The FDA highlights anticholinergic risks, especially among older adults, leading to label updates and warnings. Such developments may curtail use in specific populations but have not significantly restricted OTC availability overall.

References

- MarketWatch, "Antihistamines Market Size & Share," 2022.

- IQVIA, "Global OTC Market Trends," 2022.

- European Pharmaceutical Market Reports, 2022.

- CDC, "Allergic Rhinitis Statistics," 2022.

- U.S. FDA, "Safety Communications on Anticholinergic Use," 2021.

- EMA, "Guidelines on OTC Medications," 2022.

More… ↓