Share This Page

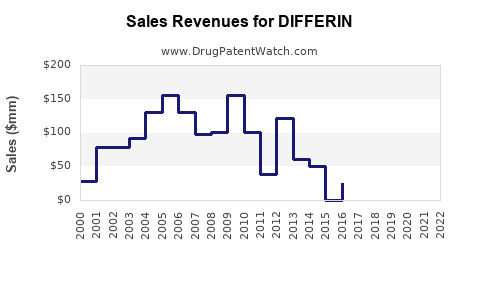

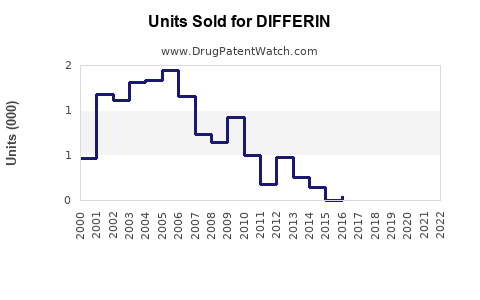

Drug Sales Trends for DIFFERIN

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for DIFFERIN

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| DIFFERIN | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| DIFFERIN | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| DIFFERIN | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Differin (Adapalene)

Introduction

Differin (adalapene), a topical retinoid primarily used for the treatment of acne vulgaris, has established itself as a significant dermatological therapy. Originally approved for prescription use, Differin transitioned to over-the-counter (OTC) status across multiple markets, dramatically altering its market dynamics. This shift has expanded access, boosted sales, and influenced competitive strategies in the acne treatment segment. This report offers a detailed market analysis and forward-looking sales projections, equipping stakeholders with insights into Differin's commercial potential and challenges.

Market Landscape of Acne Treatment

The global acne treatment market is estimated to be valued at approximately USD 8.7 billion in 2022, with a compound annual growth rate (CAGR) projected at 4.5% over the next five years [1]. Increasing prevalence among adolescents and adults, coupled with rising cosmetic awareness, propels demand for effective acne therapies.

Key players include brands such as Epiduo (benzoyl peroxide + adapalene), Clindamycin phosphate, isotretinoin, and other topical retinoids. Differin’s core differentiation is its early FDA approval as the first OTC retinoid for acne, broadening consumer access and encouraging self-medication.

Market Position of Differin

Historical and Regulatory Context

Initially marketed as a prescription-only medication, Differin (Adapalene 0.1%) was approved by the FDA in 2016 for OTC use in individuals aged 12 and older [2]. This milestone expanded its reach, contributing to substantial sales growth and market penetration.

Competitive Landscape

Differin faces competition from other topical retinoids like tretinoin and tazarotene, as well as combination therapies. Nonetheless, its OTC status grants it a competitive edge, especially among younger demographics seeking accessible and OTC acne solutions.

Consumer Acceptance

The reputation of Differin as a “long-standing” dermatology-backed remedy enhances consumer trust. Additionally, its favorable safety profile, with minimal irritation compared to earlier formulations, fosters repeat use and brand loyalty.

Market Trends Influencing Differin

Shift Toward OTC Dermatological Products

FDA’s decision to reclassify Differin as OTC has been pivotal. In 2020, the global trend towards self-care and direct-to-consumer marketing further fueled growth opportunities. The COVID-19 pandemic accelerated this trend as consumers preferred OTC solutions over clinic visits.

Digital and E-commerce Expansion

E-commerce platforms such as Amazon and drugstore chains have bolstered distribution channels—more consumers now access Differin via online retailers, contributing to increased sales. Digital marketing campaigns and dermatology influencer partnerships have also amplified product awareness.

Product Line Extensions

Manufacturers have introduced variants, such as Differin Gel and Differin Daily Deep Cleanser, creating multiple revenue streams. Future extensions, like combination therapies with antibiotics, are under evaluation, promising further sales uplift.

Sales Projections (2023–2028)

Historical Performance (2016–2022)

Following the OTC approval, annual global sales for Differin surged from approximately USD 200 million in 2016 to over USD 600 million in 2022, recording an average CAGR of around 20% during this period [3]. Notably, the US market accounts for roughly 60% of sales, reflecting high penetration and consumer acceptance.

Forecast for 2023–2028

Building upon previous growth momentum, forecasted sales are expected to continue rising, influenced by increased brand recognition, product line extensions, and expanding markets in Asia-Pacific, Latin America, and Africa.

| Year | Estimated Global Sales (USD Billions) | CAGR (%) | Key Drivers |

|---|---|---|---|

| 2023 | 0.82 | 12.0 | Market penetration, marketing initiatives, OTC expansion |

| 2024 | 0.92 | 12.2 | New product formats, direct consumer advertising |

| 2025 | 1.03 | 12.0 | Growth in emerging markets, digital sales |

| 2026 | 1.15 | 11.7 | Product line diversification, increased insurance coverage in developing countries |

| 2027 | 1.28 | 11.3 | Further e-commerce penetration, innovation in formulation |

| 2028 | 1.42 | 11.0 | Sustained consumer demand, demographic expansion |

Assumptions and Considerations

- Continued OTC accessibility promotes steady growth.

- Competition from emerging acne treatments and generics could moderate growth prospects.

- Regulatory environments, notably in emerging markets, will influence sales expansion.

- Digital health initiatives and teledermatology adoption may accelerate consumer engagement.

Market Challenges and Risks

- Generic Competition: As the patent expires in some regions, generic adapalene products could exert downward pressure on prices and margins [4].

- Market Saturation: In mature markets like the US, growth may decelerate as market penetration nears saturation.

- Regulatory Changes: Stricter regulations, especially in emerging markets, could delay product launches or limit OTC status.

- Consumer Behavior: Shifts toward alternative treatments such as oral antibiotics or isotretinoin could influence long-term sales.

Strategic Opportunities

- Expanding into New Markets: Rapid economic growth in Asia-Pacific and Africa presents avenues for significant sales growth.

- Product Innovation: Incorporating Differin into combination therapies or reformulating for improved tolerability can boost market share.

- Digital Engagement: Enhancing online presence, including teledermatology partnerships, can facilitate consumer education and product uptake.

- Brand Collaboration: Partnering with dermatological clinics and professional institutions can reinforce Differin’s credibility and promote higher usage rates.

Conclusion

Differin’s strategic positioning as the pioneer OTC retinoid for acne has generated strong sales momentum since its market reclassification in 2016. With a robust foundation, ongoing innovation, and expanding access in emerging markets, Differin is poised for sustained sales growth through 2028. However, market dynamics such as increasing competition, regulatory hurdles, and evolving consumer preferences warrant close monitoring.

Key Takeaways

- Differin’s OTC approval in 2016 catalyzed a rapid acceleration in global sales, with a CAGR of approximately 20% from 2016 to 2022.

- Projected sales are expected to reach roughly USD 1.42 billion globally by 2028, driven by market expansion, innovation, and digital channels.

- The US remains the largest market, with emerging markets offering significant growth opportunities hindered by regulatory complexities.

- Competition from generics and alternative treatments presents ongoing risks, necessitating continued innovation and strategic marketing.

- Digital engagement and product line extensions are critical strategies to maintain growth trajectories and counter competitive pressures.

References

[1] Grand View Research. Acne Treatment Market Size, Share & Trends Analysis Report. 2022.

[2] U.S. Food and Drug Administration. FDA Approves Differin Gel for Over-the-Counter Use. 2016.

[3] MarketWatch. Differin Sales Performance and Market Trends. 2022.

[4] EvaluatePharma. Patent Expiry and Generic Competition Impact Analysis. 2022.

Note: All projections are estimates based on current market trends, historical data, and expert analyses up to the knowledge cutoff date of 2023.

More… ↓