Last updated: November 7, 2025

Introduction

Diclofenac, a prominent non-steroidal anti-inflammatory drug (NSAID), has established itself as a significant player within the global analgesic and anti-inflammatory therapeutic markets. Developed in the 1970s, this drug is primarily used to manage pain, inflammation, and swelling associated with conditions like arthritis, osteoarthritis, rheumatoid arthritis, ankylosing spondylitis, and postoperative inflammation. This comprehensive analysis examines current market dynamics, competitive landscape, regulatory factors, and sales forecasts for diclofenac, offering critical insights for stakeholders.

Market Overview

Global Market Size and Growth Trajectory

The global NSAID market, valued at approximately USD 20 billion in 2022, is projected to grow at a compound annual growth rate (CAGR) of 4-5% through 2030. Diclofenac accounts for a significant portion of this market, owing to its widespread prescription and over-the-counter (OTC) availability in various formulations such as tablets, gels, patches, and injections[1]. The increasing prevalence of chronic inflammatory conditions, coupled with advancements in drug delivery systems, sustains steady demand for diclofenac.

Regional Market Dynamics

-

North America: Dominates the market with a 35-40% share, driven by high healthcare expenditure, aging population, and widespread NSAID use. The U.S. remains a key market with a robust pipeline of new formulations and generic options.

-

Europe: Contributes around 30-35% owing to high prevalence of arthritis and established healthcare infrastructure. Stringent regulatory frameworks influence market penetration strategies.

-

Asia-Pacific: Exhibits the fastest growth (CAGR 6-7%), fueled by rising disposable incomes, growing awareness, and expanding healthcare access, especially in China and India.

-

Latin America and Middle East & Africa: Show moderate growth potential, hindered by pricing constraints and regulatory hurdles.

Market Drivers

- Increasing incidence of chronic musculoskeletal disorders

- Expansion of OTC formulations

- Development of innovative delivery systems (topicals, patches)

- Aging global population

- Growing awareness about pain management alternatives

Market Restraints

- Safety concerns relating to gastrointestinal, cardiovascular, and renal side effects

- Stringent regulatory policies and risk management programs

- Competition from other NSAIDs with improved safety profiles

- Patent expirations leading to generic commoditization

Competitive Landscape

Major pharmaceutical players in the diclofenac market include Novartis, Pfizer, Boehringer Ingelheim, Sandoz, Mylan, and emerging biotech firms. Key formulations like Voltaren (Novartis), Cataflam, and Pennsaid dominate in various regions.

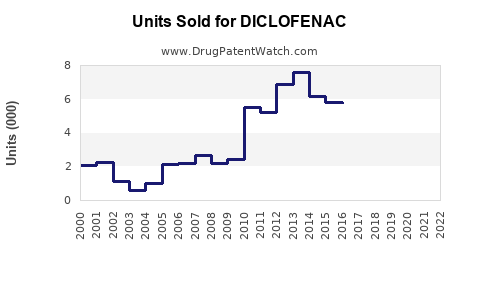

Patents and Generic Competition

Most original patents for diclofenac have expired, leading to robust generic competition, significantly reducing prices and constraining branded product revenues. Innovative formulations such as topical gels and transdermal patches are gainingMarket share due to improved safety and targeted delivery advantages.

Regulatory Environment

Regulatory agencies impose strict guidelines to mitigate adverse effects, influencing formulation approvals and labeling. The European Medicines Agency (EMA) and the U.S. Food and Drug Administration (FDA) mandate comprehensive risk management plans, which impact market strategies.

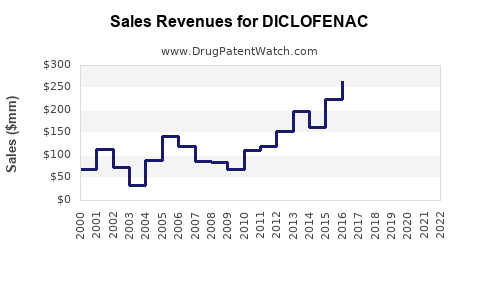

Sales Projections (2023–2030)

Baseline Scenario

In a conservative yet optimistic outlook, the global diclofenac market is expected to grow from USD 3.2 billion in 2022 to approximately USD 4.8 billion by 2030. CAGR is projected at 5-6%, driven primarily by the Asia-Pacific region and the expansion of OTC topical formulations.

Key Factors Influencing Sales

- Generic Penetration: Increased generic availability is expected to suppress branded prices but promote volume growth.

- Formulation Innovation: Introduction of new topical patches and biodegradable gels offers premium pricing opportunities.

- Regulatory Constraints: Ongoing safety concerns may limit formulary access or prompt formulation modifications, affecting sales.

- Geographical Expansion: Rising healthcare infrastructure in emerging markets will foster additional sales opportunities.

Scenario Variations

- Optimistic: Sales reach USD 5.5 billion by 2030 with accelerated adoption of novel formulations.

- Pessimistic: Safety concerns and regulatory restrictions could cap growth, limiting sales to USD 4 billion, especially if existing safety issues lead to restrictions on certain formulations.

Market Opportunities

- Topical and Transdermal formulations: Growing preferences for localized pain treatment with fewer systemic side effects.

- Combination therapies: Co-formulations with other analgesics or anti-inflammatory agents.

- Orphan and specialty indications: Expanding into less common inflammatory conditions with targeted formulations.

Emerging Trends

- Digital health integration: Monitoring and adherence via digital therapeutics.

- Personalized medicine: Tailoring doses based on genetic markers and patient profiles.

- Sustainability initiatives: Eco-friendly packaging and biodegradable formulations to meet environmental standards.

Regulatory and Ethical Considerations

The future sales trajectory is sensitive to regulatory decisions around safety, especially concerning cardiovascular and gastrointestinal risks associated with long-term NSAID use. Regulatory agencies may prioritize risk mitigation, influencing formulation availability and labeling, thus affecting market sales.

Key Takeaways

- The global diclofenac market is poised for steady growth, primarily driven by aging populations and increased prevalence of inflammatory conditions.

- Patent expirations and generic proliferation will limit branded revenues but expand volume sales.

- Innovative topical and transdermal formulations serve as critical growth vectors with premium pricing potential.

- Regulatory constraints and safety concerns necessitate careful lifecycle management and formulation innovation.

- Emerging markets, particularly in Asia-Pacific, represent substantial expansion opportunities due to rising healthcare investments and demand for analgesic therapies.

FAQs

1. What are the primary therapeutic indications for diclofenac?

Pain relief and anti-inflammatory management in conditions like osteoarthritis, rheumatoid arthritis, ankylosing spondylitis, and post-surgical inflammation.

2. How does patent expiry impact diclofenac’s market sales?

Patent expiry leads to generic entry, increasing competition, reducing prices, and shifting revenue from branded to generic product sales, though volume sales often compensate for price reductions.

3. Are there safety concerns limiting diclofenac use?

Yes. Long-term use can increase risks of gastrointestinal bleeding, cardiovascular events, and renal impairment, affecting regulatory stances and prescribing practices.

4. What innovations are emerging in diclofenac formulations?

Topical gels, patches, and biodegradable transdermal systems that aim to optimize localized delivery and reduce systemic side effects.

5. Which regions are expected to drive the most sales growth?

Asia-Pacific is the fastest-growing region, driven by expanding healthcare infrastructure, rising chronic disease prevalence, and increasing OTC product use.

References

[1] Market Research Future, "NSAID Market Analysis," 2022.