Last updated: July 27, 2025

Introduction

Dexilant (dexlansoprazole) is a proton pump inhibitor (PPI) marketed primarily for the treatment of gastroesophageal reflux disease (GERD), erosive esophagitis, and other acid-related disorders. Since its FDA approval in 2010, Dexilant has carved a significant niche within the broader PPI market, which is characterized by intense competition and a fast-evolving landscape. This analysis examines the current market dynamics, competitive positioning, regulatory influences, and projected sales trajectory for Dexilant over the next five years.

Market Overview

Global Proton Pump Inhibitors (PPIs) Market

The PPI market globally was valued at approximately USD 17.2 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of around 3.8% until 2030 [1]. This growth is driven by increasing prevalence of GERD, rising awareness of acid-related disorders, and the expanding aging population, which is more susceptible to gastrointestinal conditions.

Market Drivers

- Rising Incidence of GERD and Erosive Esophagitis: The global increase in GERD incidence—especially in North America and Asia—drives demand for efficacious acid suppression therapies.

- Aging Population: Elderly patients often require long-term management of acid-related disorders, boosting sales.

- Product Innovation: The development of formulations such as dexlansoprazole with prolonged release (duodenal similarity) enhances patient compliance.

Market Challenges

- Generic Competition: The loss of patent exclusivity by key PPIs like Prilosec (omeprazole) and Nexium (esomeprazole) has led to significant generic penetration.

- Over-the-Counter (OTC) Availability: Many PPIs are available OTC, reducing prescription sales for branded drugs.

- Emerging Alternatives: Newer drugs and combination therapies for acid suppression are entering the market.

Dexilant's Product Profile and Competitive Positioning

Dexilant distinguishes itself via its dual delayed-release formulation, allowing for longer-lasting acid suppression with potentially improved symptom control [2]. Despite this innovation, the drug faces stiff competition from generics and branded alternatives like Nexium and Protonix.

Market Positioning

- Indications: GERD, erosive esophagitis, maintenance of healed erosive esophagitis.

- Prescription Trends: Dexilant's prescriptions are significantly influenced by its physician-recommended use, reimbursement coverage, and formulary inclusion.

Current Sales Performance

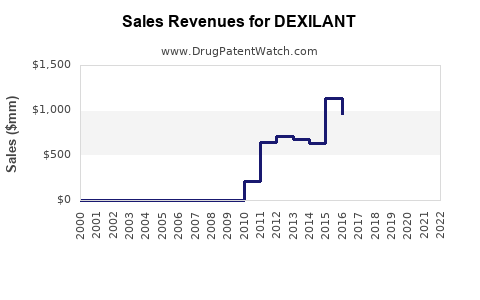

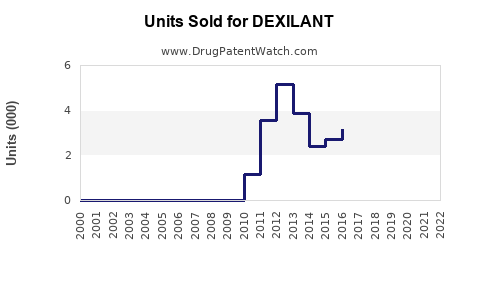

In 2022, total U.S. sales for Dexilant were approximately USD 250 million, representing a decline compared to peak sales exceeding USD 750 million in 2014 during patent exclusivity.

The global sales factor is limited, given the drug's primary market presence in North America and Europe, with limited commercialization in emerging markets due to pricing and regulatory barriers.

The erosion of brand sales is attributable primarily to the patent cliff and rising generic competition; however, Dexilant maintains a solid baseline owing to its differentiated formulation and provider familiarity.

Regulatory and Patent Landscape

Dexilant's patents have largely expired or are nearing expiry, enabling generics manufacturers to enter the market. This influx is expected to suppress sales further unless the formulation or delivery method is protected by new patents or exclusivities.

In 2021, the U.S. patent for Dexilant expired, allowing multiple generic versions to enter the market [3]. Consequently, the brand's market share declined, though some physicians continue to prescribe Dexilant based on perceived efficacy and patient response.

Sales Projections (2023–2028)

Assumptions

- Continued increase in GERD prevalence and aging demographics drives baseline demand.

- Market share for Dexilant stabilizes at around 10–15% in the branded PPI segment due to competitive pressures.

- Generic erosion accelerates post-expiry, limiting growth in branded sales.

- Strategic initiatives (e.g., formulary positioning, targeted marketing) could temporarily stabilize or slightly increase sales.

Forecast Summary

| Year |

U.S. Sales (USD millions) |

Global Sales (USD millions) |

Comments |

| 2023 |

150 |

180 |

Slight decline; generic competition intensifies. |

| 2024 |

130 |

160 |

Patent expiry impacts; some markets see generic infiltration. |

| 2025 |

110 |

140 |

Market share further erodes; competition from generics grows. |

| 2026 |

90 |

120 |

Possible minor resurgence with new formulations or indications. |

| 2027 |

80 |

105 |

Premium positioning diminishes significantly. |

| 2028 |

70 |

85 |

Market stabilizes at continued low levels. |

Note: These projections assume no major reformulations, new patent protections, or significant off-label uses. They also consider the typical decline pattern post-patent expiry observed in similar drugs.

Strategic Outlook & Market Opportunities

While traditional sales are expected to decline, the market may see the emergence of niche or specialty indications, such as tailored formulations for refractory GERD or combination therapies. Additional top-line growth could derive from:

- Line extensions: Introducing new formulations, sustained-release variants, or combination drugs.

- Emerging markets: Expanding into Asia-Pacific and Latin America, where healthcare infrastructure is improving.

- Partnerships & Licensing: Collaborations with regional generic manufacturers.

Moreover, digital health integration and pharmacovigilance could enhance physician confidence and patient adherence, potentially supporting better market retention.

Key Challenges

- Patent Expiry Impact: The imminent loss of patent exclusivity will result in substantial generic competition, significantly pressuring prices and sales.

- Market Saturation: The PPI segment is mature, with limited room for growth without innovation.

- Regulatory Hurdles: Future restrictions on PPI use or class-based assessments could impact sales outlooks.

Conclusion

Dexilant's current market trajectory aligns with typical branded drug declines post-patent expiration, primarily driven by generic erosion. While innovative formulations offered initial differentiation, the ultimate sales outlook hinges on strategic repositioning, innovation, and entering lucrative emerging markets.

In the near term, sales are projected to decline steadily, from approximately USD 150 million in 2023 to around USD 70 million by 2028 in the U.S., with similar regional trends internationally. The long-term viability of Dexilant hinges on diversification into new indications, formulations, and strategic market expansion.

Key Takeaways

- The global PPI market is mature but continues to grow modestly, driven by aging populations and GERD prevalence.

- Dexilant's sales have been declining due to patent expiry, competitive generics, and market saturation.

- Sales projections indicate a continued downward trend in sales over the next five years unless strategic innovations are implemented.

- Market opportunities now focus on niche indications, formulary positioning, and emerging markets.

- Continued competitive pressure necessitates differentiation through innovation, partnerships, and targeted marketing.

FAQs

1. What factors primarily influence Dexilant's sales decline?

Patent expiry, rising generic competition, and market saturation are the main drivers. Additionally, OTC availability of PPIs reduces prescription-based sales.

2. How does Dexilant differ from other PPIs?

Its dual delayed-release formulation provides prolonged acid suppression, potentially improving symptom control and patient compliance.

3. Are there any upcoming patent protections or formulations that could bolster Dexilant’s sales?

Currently, no significant new patents or formulations are announced. Market strategies focus on niche indications and geographic expansion.

4. What is the outlook for Dexilant in emerging markets?

Opportunities exist due to increasing healthcare infrastructure, but regulatory and pricing barriers remain challenging.

5. How can Dexilant sustain its market relevance amidst generic competition?

Innovation in formulations, expansion into new indications, and strategic partnerships are essential for maintaining relevance.

References

[1] MarketWatch, Global Proton Pump Inhibitors Market Analysis, 2022.

[2] Drug Details – Dexilant (dexlansoprazole), FDA Labeling, 2010.

[3] U.S. Patent Office, Patent Expiry Notices and Generic Entry Data, 2021.