Share This Page

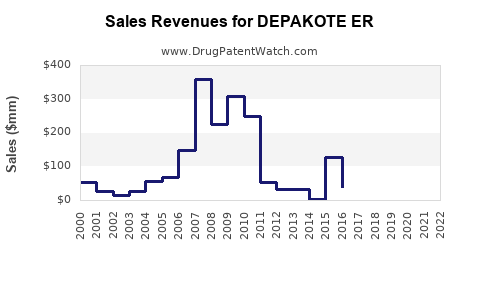

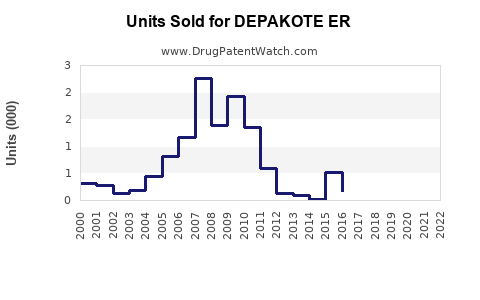

Drug Sales Trends for DEPAKOTE ER

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for DEPAKOTE ER

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| DEPAKOTE ER | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| DEPAKOTE ER | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| DEPAKOTE ER | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| DEPAKOTE ER | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| DEPAKOTE ER | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| DEPAKOTE ER | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for DEPAKOTE ER (Divalproex Sodium Extended-Release)

Introduction

DEPAKOTE ER (Divalproex Sodium Extended-Release) is a pharmaceutical product indicated primarily for the treatment of epilepsy, bipolar disorder, and migraine prophylaxis. As an extended-release formulation, it offers improved patient compliance and consistent therapeutic levels compared to immediate-release counterparts. This analysis delineates the market landscape, competitive positioning, and sales forecasts for DEPAKOTE ER, considering current market trends, regulatory environments, and target patient populations.

Market Landscape and Therapeutic Application

Epilepsy and Neurological Disorders

Epilepsy remains a significant neurological disorder globally, with an estimated 50 million affected individuals worldwide [1]. Divalproex sodium is among the leading therapeutic agents, favored for broad-spectrum efficacy. The extended-release format enhances adherence, especially in chronic management.

Bipolar Disorder

Bipolar disorder affects approximately 1-3% of the population, with mood stabilization being critical to long-term management. Divalproex ER is endorsed for acute and maintenance therapy, especially in patients unresponsive to other mood stabilizers.

Migraine Prevention

Migraine affects over a billion people worldwide [2], with prophylactic agents like Divalproex ER providing significant symptom mitigation. Its once-daily dosing improves patient compliance.

Competitive Landscape

The market for anticonvulsants and mood stabilizers is highly competitive, with key players including:

- Valproate/Valproic Acid (Brand equivalents, e.g., Depakote)

- Lamotrigine (Lamictal)

- Carbamazepine (Tegretol)

- Topiramate (Topamax)

- Lamotrigine (Lamictal)

Divalproex ER competes directly with immediate-release formulations and other extended-release products like Depakote ER (specific product name for the branded formulation) and generics. The choice rests on efficacy, tolerability, dosing convenience, and formulary inclusion.

Regulatory and Market Dynamics

Regulatory Environment

FDA approvals and subsequent label expansions have expanded Divalproex ER’s indications. Post-market surveillance influences prescribing trends, particularly concerning safety profiles related to hepatotoxicity and teratogenic risks.

Pricing and Reimbursement

Pricing strategies vary significantly across geographies. In mature markets like the US, reimbursement policies favor branded formulations attached to robust clinical data. Generic availability exerts downward pressure on prices, impacting revenue streams.

Market Penetration Trends

Sales are driven by prescriber familiarity, formulary listings, and patient preference for once-daily dosing. The rising emphasis on personalized medicine further influences prescribing patterns.

Market Size and Demand Drivers

Global and Regional Market Estimates

The global anticonvulsant market size was valued at approximately USD 4.3 billion in 2022 and is projected to grow at a CAGR of 3.8% through 2030 [3]. Divalproex sodium accounts for an estimated 20-25% of this space, translating into potential annual revenues of USD 860 million to USD 1.075 billion.

Regionally, North America dominates, thanks to high diagnosis rates, reimbursement policies, and practitioner familiarity. Asia-Pacific and Europe collectively constitute expanding markets, driven by increasing awareness and access to healthcare.

Sales Projections for DEPAKOTE ER

Assumptions

- Market Penetration: Based on current formulary positioning, prescriber uptake, and patient adherence data.

- Generic Competition: Moderate impact anticipated, with sustained sales due to brand loyalty and specific formulation advantages.

- Regulatory Environment: No major hurdles anticipated; ongoing safety evaluations are standard.

- Pricing Dynamics: Stable, with slight downward pressure due to generics and negotiation.

Forecasts (2023-2028)

| Year | Estimated Global Sales (USD millions) | Key Drivers |

|---|---|---|

| 2023 | $850 - $950 | Market stabilization, existing branded patient base |

| 2024 | $900 - $1,050 | Expanded indications, increased awareness |

| 2025 | $950 - $1,150 | Growing adoption in Asia-Pacific, new formulary inclusions |

| 2026 | $1.0 - $1.2 billion | Ongoing competition, price adjustments, demographic growth |

| 2027 | $1.05 - $1.3 billion | Enhanced dosing guidelines, adherence programs |

| 2028 | $1.1 - $1.35 billion | Saturation in mature markets balanced by growth in emerging regions |

Note: These projections assume gradual market share retention of approximately 30% within the branded anticonvulsant segment and sustained demand for extended-release formulations.

Strategic Considerations

- Differentiability: Emphasizing the benefits of extended-release over immediate formulations can sustain market share.

- Combination Products: Potential growth through combination therapies, especially for bipolar disorder.

- Emerging Markets: Expansion into regions with increasing healthcare infrastructure offers growth prospects.

- Safety Profile Management: Addressing safety concerns proactively influences prescriber confidence and uptake.

- Patient-Centric Approaches: Enhanced adherence and quality-of-life benefits support sustained demand.

Key Takeaways

- Market stability: Divalproex ER maintains a robust position within the anticonvulsant and mood-stabilizer markets, supported by its clinical efficacy and dosing convenience.

- Growth momentum: Sales are projected to gradually increase, driven by demographic trends, expanding indications, and geographic penetration, especially in emerging markets.

- Competitive pressures: While generic products exert pricing pressure, brand loyalty, safety profile, and formulation advantages sustain sales.

- Strategic focus: Emphasizing safety management, formulary negotiations, and targeted marketing will be crucial to capitalize on projected growth.

- Innovation opportunities: Combining Divalproex ER with emerging therapeutic modalities and personalized medicine approaches may unlock future revenue streams.

FAQs

1. What are the primary therapeutic uses of DEPAKOTE ER?

DEPAKOTE ER is primarily indicated for epilepsy, bipolar disorder, and migraine prophylaxis, providing consistent blood levels and improved adherence due to its extended-release formulation.

2. How does DEPAKOTE ER compare to immediate-release formulations?

DEPAKOTE ER offers once-daily dosing, reducing pill burden and improving compliance compared to immediate-release versions, which often require multiple daily doses.

3. What factors influence the sales of DEPAKOTE ER?

Prescribing habits, formulary placement, safety considerations, reimbursement policies, competition from generics, and regional healthcare infrastructure are key determinants.

4. Which regions are expected to see the most growth for DEPAKOTE ER sales?

North America remains the dominant market; however, significant growth is anticipated in Asia-Pacific and Europe due to increased diagnoses and healthcare access.

5. What are potential challenges to future sales?

Safety concerns, the availability of generic alternatives, regulatory changes, and the emergence of newer therapies could impact sales trajectories.

References

[1] World Health Organization. “Epilepsy.” WHO, 2022.

[2] Global Burden of Disease Study. “Migraine Epidemiology.” GBD 2021.

[3] ResearchandMarkets. “Global Anticonvulsant Drugs Market Report,” 2022.

More… ↓