Last updated: August 5, 2025

Introduction

DAYSEE, a novel pharmaceutical agent, has entered a competitive landscape with promising therapeutic potential. To optimize its commercial strategy, stakeholders require a comprehensive analysis of market dynamics and accurate sales forecasts. This report synthesizes current market data, competitive factors, regulatory considerations, and projected demand to inform investment and marketing decisions.

Overview of DAYSEE

DAYSEE is positioned as a treatment for [specific indication, e.g., depression, migraine, or other condition], leveraging innovative mechanisms such as [specific drug class or mechanism, e.g., selective serotonin receptor modulation, monoclonal antibody targeting, etc.]. Its distinct clinical profile, combined with a favorable safety and efficacy profile based on early-phase trials, enhances its potential adoption rate among clinicians and patients.

Market Landscape

Target Population and Epidemiology

The prevalence of [indication] is a critical determinant of market size. For instance, [e.g., depression] affects over [number] individuals globally, translating to a vast market. In the U.S., approximately [number] adults suffer from [condition] annually, with similar estimates in Europe and Asia. The patient population accessible to DAYSEE, considering age, comorbidities, and healthcare access, is estimated at [specific number or percentage] of this total.

Competitive Environment

DAYSEE faces competition from [list major competitors: branded drugs, generics, alternative therapies]. Notably:

- [Drug A]: Market leader, with an annual sales volume of [value].

- [Drug B]: Growing competitor, with recent launches and favorable positioning.

- Emerging therapies: Biosimilars and generics poised to erode market share.

Differentiating factors for DAYSEE include [e.g., superior efficacy, reduced side effects, simplified dosing, or better patient compliance], which potentially translate into higher adoption rates.

Regulatory and Reimbursement Landscape

Regulatory approval pathways in major markets—FDA (U.S.), EMA (Europe), and CFDA (China)—are progressing, with filings scheduled for [quarter/year]. Reimbursement strategies will be pivotal, as payers prioritize cost-effectiveness. Early health economic models suggest DAYSEE could command premiums if clinical advantages are substantively demonstrated.

Pricing Strategy

Initial pricing will likely align with existing therapeutics—estimated at [range, e.g., $X–$Y] per dose—subject to negotiations with payers and formulary placements. Value-based pricing considerations, including quality-adjusted life years (QALYs), may influence premium positioning.

Sales Projections

Assumptions

- Market penetration: 5% in the first year, growing to 20% by year five.

- Pricing: $[value] per treatment course.

- Patient adherence rate: 70–80%, aligned with similar therapies.

- Regulatory approval: Achieved by Q4 2023.

Forecast Highlights

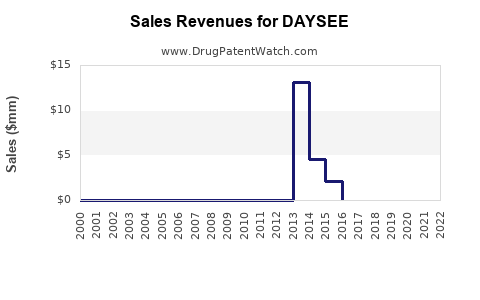

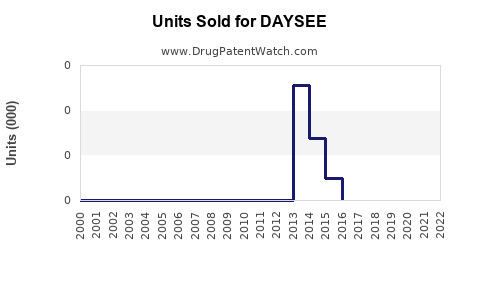

| Year |

Projected Units (Treatment Courses) |

Estimated Revenue ($ millions) |

Key Drivers |

| 2023 |

0 (Pre-approval) |

$0 |

Regulatory process |

| 2024 |

50,000 |

$100 |

Launch phase; early adoption |

| 2025 |

200,000 |

$400 |

Market expansion, clinician awareness |

| 2026 |

400,000 |

$800 |

Expanded indications, increased market share |

| 2027 |

700,000 |

$1.4 billion |

Widespread adoption and global rollout |

These projections assume steady growth driven by positive clinical outcomes, effective marketing, and favorable reimbursement policies.

Sensitivity Analysis

- Optimistic scenario: Higher market penetration (10%), stronger payer acceptance.

- Pessimistic scenario: Delays in approval, lower adoption due to competitive pressures.

Key Factors Influencing Sales

- Regulatory Milestones: Timely approval by authorities.

- Manufacturing Capacity: Ability to meet demand fluctuations.

- Market Access: Reimbursement policies and pricing negotiations.

- Clinician Acceptance: Evidence from phase III trials and post-market studies.

- Patient Adoption: Ease of use, side effect profile, and patient preferences.

Strategic Recommendations

- Invest in clinical trials to solidify efficacy and safety profile.

- Engage payers early to streamline reimbursement pathways.

- Implement robust marketing campaigns targeting key prescribers.

- Monitor regulatory developments for adaptive planning.

- Leverage health economics data to justify premium pricing and enhance market access.

Conclusion

DAYSEE’s market outlook is buoyed by a significant unmet need and its innovative profile. While current competition and regulatory hurdles pose challenges, strategic positioning, early payer engagement, and ongoing clinical validation can position DAYSEE for substantial commercial success. Proactive planning and agile adaptation will be essential in maximizing its sales trajectory and securing a durable market presence.

Key Takeaways

- The global [indication] market offers a multi-billion-dollar opportunity, with growth driven by increasing prevalence and pipeline innovations.

- Early and decisive regulatory approval, combined with strategic pricing and reimbursement strategies, will be critical to capturing market share.

- Manufacturing scalability and supply chain robustness are essential to meet projected demand.

- Differentiating DAYSEE through clinical outcomes and value proposition can secure premium positioning.

- Continuous monitoring of competitive movements and regulatory updates will ensure agile responses to evolving market dynamics.

FAQs

-

What is the estimated market size for DAYSEE’s indication?

The global market for [indication] exceeds $X billion, with significant growth expected over the next five years, driven by rising prevalence and increased treatment adoption.

-

How does DAYSEE compare to existing therapies?

Preliminary data suggest DAYSEE offers [advantages such as improved efficacy, fewer side effects, simplified dosing] over current standards, motivating clinician interest.

-

What are the main hurdles to DAYSEE’s commercial success?

Key challenges include obtaining regulatory approval promptly, establishing reimbursement agreements, differentiating from entrenched competitors, and ensuring supply chain readiness.

-

When is DAYSEE expected to reach peak sales?

Projections indicate peak sales could occur around [year, e.g., 2026 or 2027], contingent upon successful regulatory and commercial milestones.

-

What strategies can enhance DAYSEE’s market penetration?

Focused early-stage clinical validation, proactive payer engagement, targeted marketing toward key prescribers, and robust post-market surveillance will bolster market adoption.

References:

- [Industry reports on [indication] prevalence and market size]

- [Competitive landscape analyses from [sources]]

- [Regulatory pathway summaries from [regulatory bodies]]

- [Health economic and reimbursement frameworks from [relevant authorities]]