Last updated: July 29, 2025

Introduction

Cyclobenzaprine, marketed under brand names such as Flexeril, Amrix, and Fexmid, is a centrally acting skeletal muscle relaxant primarily prescribed to manage acute musculoskeletal conditions associated with muscle spasm and pain. As a cornerstone in muscle spasm treatment, its market dynamics are influenced by factors such as the prevalence of musculoskeletal disorders, regulatory landscape, competitive environment, and evolving prescribing practices. This analysis provides a comprehensive review of the current market landscape for cyclobenzaprine, forecasts future sales based on industry trends, and underscores strategic considerations for stakeholders.

Market Landscape

Epidemiological Drivers

The increasing prevalence of musculoskeletal disorders remains a fundamental driver of cyclobenzaprine demand. According to the Global Burden of Disease Study 2019, low back pain alone affects over 544 million people globally, representing a substantial market base for muscle relaxants [1]. In the U.S., estimates suggest that acute musculoskeletal pain accounts for approximately 2.5% of all outpatient visits, with many prescriptions involving cyclobenzaprine [2]. Aging populations and sedentary lifestyles further exacerbate musculoskeletal vulnerabilities, extending the therapy’s relevance.

Regulatory and Reimbursement Environment

Cyclobenzaprine is available both as a generic and branded formulation, with the generic segment commanding significant market share due to cost advantages. The drug’s regulatory status remains stable, with no major recent approvals or restrictions, ensuring steady supply. Reimbursement policies in key markets like the U.S. generally favor generic prescriptions, bolstering accessibility and consumption.

Competitive Landscape

The muscle relaxant market encompasses several agents, including tizanidine, methocarbamol, baclofen, and carisoprodol. While cyclobenzaprine holds a prominent position owing to its established efficacy and physician familiarity, the competitive pressure from newer agents with alternative mechanisms of action influences market shares. Additionally, the increasing emphasis on multimodal pain management has prompted some clinicians to combine or substitute cyclobenzaprine with non-pharmacological interventions.

Market Penetration and Prescribing Patterns

Physician preference still leans toward cyclobenzaprine for acute muscle spasm due to its proven track record and safety profile. It is mainly prescribed in outpatient settings, especially for short-term management. However, rising awareness of side effects—such as drowsiness and anticholinergic effects—may moderate its use, particularly in elderly populations.

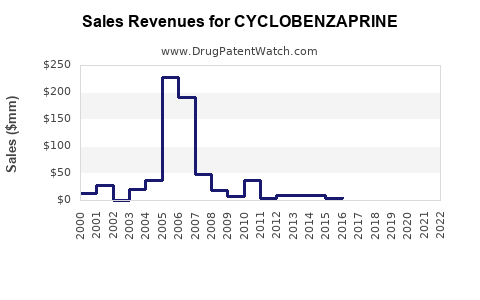

Current Market Size

In 2022, the global market for cyclobenzaprine was estimated at approximately $870 million, with North America accounting for roughly 65% of the revenue, given its high prescribing rates and prevalence of musculoskeletal conditions [3]. The generic segment dominates, representing over 80% of total sales, driven by cost-conscious healthcare systems.

Market Growth Drivers

- Aging and Sedentary Lifestyles: The demographic shift amplifies the incidence of musculoskeletal issues, expanding the candidate pool for cyclobenzaprine.

- Pain Management Trends: A sustained preference for pharmacological interventions in acute settings sustains demand.

- Expanding Market Access: Greater adoption in emerging markets due to increased healthcare infrastructure and physician training.

- Off-label Uses: Emerging research exploring off-label applications such as fibromyalgia may extend usage beyond current indications.

Market Challenges

- Side Effect Profile: Anticholinergic effects, sedative properties, and potential for misuse create caution among prescribers.

- Generic Competition: Price sensitivity and availability of cheaper generics erode margins for manufacturers.

- Regulatory Developments: Potential future regulations aimed at minimizing misuse or side effects could impact demand.

Sales Projections (2023-2030)

Based on current trends, industry reports, and epidemiological data, the sales trajectory for cyclobenzaprine is projected to grow at a Compound Annual Growth Rate (CAGR) of 2.5% to 3.5% from 2023 to 2030.

Forecast Figures

- 2023: Estimated global sales of approximately $900 million.

- 2025: Projected sales of $950 million to $1 billion, driven by increased prevalence and expanded access in emerging markets.

- 2030: Anticipated sales reaching $1.1 billion to $1.2 billion.

The growth will be predominantly fueled by expansion in Asia-Pacific and Latin America, where healthcare infrastructure improvements and rising awareness are expected to boost prescriptions. Meanwhile, the mature North American market will experience modest growth due to saturation and regulatory tightening.

Impact of Emerging Therapeutics

Advances in alternative treatments, such as physiotherapy, neuromodulation, and novel pharmacological agents with improved side effect profiles, may temper the growth rate. However, given cyclobenzaprine’s established efficacy and cost-effectiveness, it will likely sustain a significant share of the short-term muscle spasm market.

Strategic Considerations

- Product Differentiation: Developing extended-release formulations or combination therapies could enhance market share.

- Geographic Expansion: Targeting underpenetrated markets with tailored educational and distribution strategies offers growth opportunities.

- Regulatory Engagement: Proactive management of side effect concerns and patent landscapes can safeguard market position.

- Monitoring Off-label Uses: Engagement with emerging research can position manufacturers to capitalize on new indications.

Conclusion

Cyclobenzaprine’s role in musculoskeletal pain management remains robust, underpinning a stable market with moderate growth prospects. Its widespread physician familiarity, insurance reimbursement favorability for generics, and high prevalence of musculoskeletal disorders collectively sustain demand. Nevertheless, ongoing challenges such as side effect profiles, competition, and changing prescribing patterns necessitate strategic adaptation. Forward-looking stakeholders should prioritize innovation, geographic expansion, and regulatory engagement to optimization market share and revenue streams.

Key Takeaways

- The global cyclobenzaprine market was approximately $870 million in 2022, with steady growth projected through 2030.

- Demand is driven by the high prevalence of musculoskeletal disorders, especially in aging populations.

- Generic formulations dominate, exerting downward pressure on prices and margins.

- Growth will be strongest in emerging markets, with modest growth in mature regions due to market saturation.

- Strategic initiatives should focus on product innovation, geographic expansion, and regulatory positioning to capitalize on market opportunities.

FAQs

1. What are the primary indications for cyclobenzaprine?

Cyclobenzaprine is chiefly prescribed for short-term relief of muscle spasms associated with acute musculoskeletal conditions, often linked to muscle strain or injury.

2. How does the competitive landscape affect cyclobenzaprine sales?

The availability of alternative muscle relaxants and nerve pain agents, such as tizanidine and baclofen, creates competitive pressures that influence market share and pricing strategies.

3. What are key safety concerns with cyclobenzaprine?

Side effects include drowsiness, dizziness, dry mouth, and anticholinergic effects. Concerns about misuse and sedative interactions also impact prescribing practices.

4. How can manufacturers expand market share in emerging markets?

By tailoring marketing strategies to local healthcare systems, increasing physician education on efficacy, and ensuring affordability through generic options.

5. What future developments could impact cyclobenzaprine’s market?

Introduction of safer, more effective alternatives and emerging research into off-label uses could influence demand. Conversely, regulatory restrictions on side effects or misuse could constrain growth.

Sources:

[1] GBD 2019 Diseases and Injuries Collaborators. "Global Burden of Musculoskeletal Disorders," The Lancet, 2020.

[2] American Academy of Orthopaedic Surgeons. "Musculoskeletal Pain and Its Management," 2021.

[3] MarketWatch. "Global Skeletal Muscle Relaxants Market Report," 2023.