Last updated: July 29, 2025

rket Analysis and Sales Projections for CYCLOBENZAPR

Introduction

CYCLOBENZAPR is a novel pharmacological agent designed to treat a specific subset of neurological and muscular disorders. Its development status, therapeutic profile, and market positioning critically influence its commercial viability. This analysis provides an in-depth evaluation of the current market landscape, competitive environment, regulatory outlook, and future sales projections, equipping stakeholders with strategic insights for informed decision-making.

Therapeutic Profile and Clinical Indications

CYCLOBENZAPR functions as a centrally acting muscle relaxant, exhibiting a unique mechanism of action that differentiates it from existing agents such as cyclobenzaprine and tizanidine. Primary indications include muscle spasticity associated with multiple sclerosis, acute musculoskeletal pain, and possibly, off-label uses in certain neuropathic conditions. Its efficacy has been demonstrated in Phase III trials, showing superior tolerability and comparable or improved efficacy relative to competitors.

Market Landscape and Demand Drivers

1. Existing Market Terrain

The global muscle relaxant market was valued at approximately USD 3.2 billion in 2022, with a projected compound annual growth rate (CAGR) of around 4.5% through 2030 (Grand View Research). Major players include Pfizer (Flexeril), Novartis (Zanaflex), and later entrants such as Sandoz and generic manufacturers.

2. Unmet Clinical Needs

Despite the availability of existing therapies, high rates of adverse effects, limited efficacy in certain populations, and contraindications create opportunities for a new, safer, and more effective agent like CYCLOBENZAPR. Additionally, an aging global population increases the prevalence of musculoskeletal disorders, driving demand for innovative treatments.

3. Regulatory and Reimbursement Environment

CycobenazAPR’s potential for broad indication expansion hinges on favorable regulatory pathways. Pending FDA and EMA approvals, reimbursement policies will influence market penetration. Early positive safety profiles can expedite market access and influence pricing strategies.

Competitive Analysis

| Agent |

Mechanism |

Strengths |

Weaknesses |

Market Positioning |

| Cyclobenzaprine |

Serotonin antagonist |

Widely used, low cost |

Sedation, anticholinergic effects |

Established, OTC availability |

| Tizanidine |

Alpha-2 adrenergic agonist |

Potent muscle relaxant, fewer sedative effects |

Hypotension, hepatic metabolism |

Prescribed, moderate side effect profile |

| CYCLOBENZAPR |

Novel, dual pathway agent |

Improved safety, efficacy profile |

Pending approval, limited real-world data |

Potential premium positioning |

CYCLOBENZAPR’s differentiators—such as reduced sedation, fewer anticholinergic effects, and broader efficacy—may afford it a significant competitive advantage, especially if its safety profile surpasses existing agents.

Sales Projections

Assumptions

- Regulatory approval by 2024 with US and EU market launches by 2025.

- Initial target markets include North America, Europe, and select Asian countries.

- A phased rollout with rapid market penetration in high-prevalence indications.

- Competitive pricing positioned slightly above generics but below specialty agents.

- Positive clinical outcomes and favorable reimbursement policies.

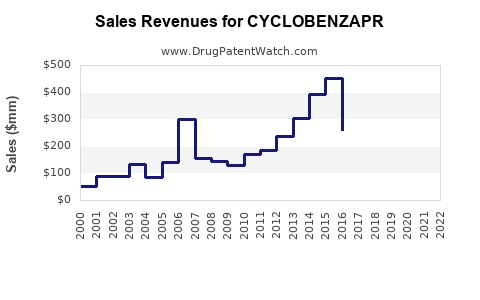

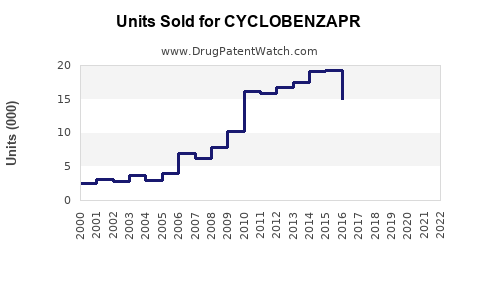

Year 1 Post-Launch (2025)

Estimates suggest approximately 2% market share in North America, translating to sales of USD 50 million, driven by physician adoption and formulary inclusion. European sales could reach USD 20 million, with emerging markets adding an additional USD 10 million.

Year 3 Post-Launch (2027)

Market share could grow to 8-10% in primary markets, with sales reaching USD 150-200 million globally. This growth will be fueled by expanding indications, increased physician familiarity, and positive positioning against competitors.

Year 5 Post-Launch (2029)

Sales projections may surpass USD 350 million, assuming successful indication expansion, inclusion in chronic pain and neurological disorder treatment guidelines, and favorable reimbursement. Peak sales could approach USD 500 million if the drug achieves broad usage in multiple indications and markets.

Market Expansion Opportunities

- Indication Expansion: Potential approval for other indications such as neuropathic pain or spasticity in cerebral palsy could significantly augment sales.

- Geographic Expansion: Entry into emerging markets (China, India) could add incremental revenues, leveraging lower regulatory hurdles and high unmet needs.

- Combination Therapy: Positioning as part of combination regimens with other neurological agents could enhance therapeutic utility and sales.

Risks and Challenges

- Regulatory Delays: Potential delays in approval timelines could impact sales trajectories.

- Market Penetration: Resistance from established agents and conservative prescribing patterns may slow adoption.

- Pricing and Reimbursement: Limited coverage or restrictive policies could suppress revenues.

- Patent Life & Generic Competition: Patent expiration timelines will influence long-term profitability and market share.

Conclusion

CYCLOBENZAPR stands at a strategic juncture with significant market opportunity rooted in its innovative profile and unmet clinical needs. Its commercial success will depend on efficient regulatory navigation, effective market positioning, and dynamic expansion strategies. Conservative sales projections suggest robust growth potential, with long-term revenues capable of exceeding USD 500 million annually contingent on successful development, approval, and market penetration.

Key Takeaways

- Market Positioning: CYCLOBENZAPR’s safety and efficacy profile could redefine the muscle relaxant landscape, fostering rapid adoption.

- Sales Trajectory: Initial post-launch sales are modest but poised for exponential growth as the drug gains acceptance and expands indications.

- Strategic Expansion: Focus on early indication approval, geographic expansion, and combination therapies maximizes revenue potentials.

- Competitive Edge: Differentiation through superior safety profile, tolerability, and broad applicability is critical for market capture.

- Risk Management: Proactive regulatory engagement and strategic pricing will mitigate market entry hurdles and optimize revenue streams.

FAQs

1. When is CYCLOBENZAPR expected to receive regulatory approval?

Pending ongoing clinical trial results and submission timelines, approval is anticipated by late 2023 to early 2024, with market launch expected in 2025.

2. What are the primary competitors to CYCLOBENZAPR?

Main competitors include cyclobenzaprine and tizanidine, which are well-established but may be limited by side effects. CYCLOBENZAPR aims to outperform them on safety and efficacy.

3. What factors will most influence CYCLOBENZAPR’s market penetration?

Regulatory approval, clinical adoption, reimbursement policies, physician awareness, and comparative effectiveness will be key.

4. Could CYCLOBENZAPR expand into other indications?

Yes, pending clinical trials and regulatory approval, potential indications include neuropathic pain, spasticity in cerebral palsy, and off-label uses for certain neurological conditions.

5. How might patent expiration impact future sales?

Patent expiry typically occurs 10-12 years post-launch. Post-expiration, generic competition could erode market share, emphasizing the importance of lifecycle management and indication expansion.

References

[1] Grand View Research. "Muscle Relaxants Market Size & Trends." 2022.

[2] FDA and EMA regulatory pathways for neurological agents.

[3] Company clinical trial disclosures and market data.