Share This Page

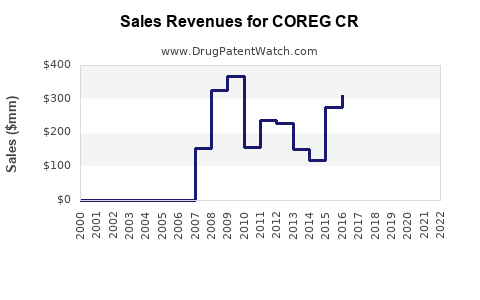

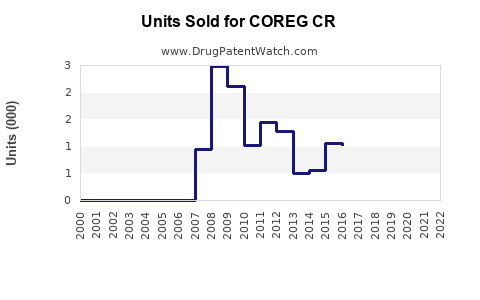

Drug Sales Trends for COREG CR

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for COREG CR

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| COREG CR | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| COREG CR | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| COREG CR | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| COREG CR | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| COREG CR | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| COREG CR | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

rket Analysis and Sales Projections for COREG CR

Introduction

COREG CR (carvedilol controlled-release) is a beta-blocker indicated primarily for the management of heart failure, hypertension, and left ventricular dysfunction following myocardial infarction. As a third-generation beta-blocker with vasodilatory properties, COREG CR has carved out a significant niche within cardiovascular therapy. This analysis explores its current market landscape, demand drivers, competitive positioning, and future sales projections based on evolving epidemiological trends, regulatory developments, and market dynamics.

Market Landscape and Epidemiological Context

The global cardiovascular disease (CVD) burden remains substantial, with hypertension affecting approximately 1.3 billion people worldwide and heart failure prevalence estimated at over 60 million globally ([1]). As population aging accelerates, the demand for effective long-term management therapies like COREG CR is poised to grow.

In the United States, the prevalence of hypertension is expected to double by 2050, reaching nearly 158 million adults, with a significant subset requiring beta-blocker therapy ([2]). Similarly, heart failure affects approximately 6.2 million Americans, and the trend shows a consistent increase linked to aging populations and improved survival rates from acute cardiac events ([3]).

Market Positioning of COREG CR

COREG CR benefits from multiple formulation advantages over immediate-release carvedilol, including sustained plasma levels and improved compliance owing to once-daily dosing. Its sustained-release profile offers better tolerability and adherence, critical factors in chronic cardiovascular management.

The drug competes in a market with other beta-blockers such as metoprolol, bisoprolol, and propranolol; however, COREG CR's unique formulation and demonstrated efficacy in reducing hospitalization and mortality in heart failure position it competitively.

Regulatory and Commercial Considerations

Initially approved by the U.S. FDA in 2007, COREG CR secures premium positioning due to its evidence-based benefits. The patent status of COREG CR is nearing expiration, with potential generic entrants forecasted within the next 3-5 years, which could significantly impact market pricing and volume.

In emerging markets, regulatory approval and reimbursement policies vary, influencing market penetration. Governments emphasizing cardiovascular health initiatives and expanding insurance coverage tend to facilitate higher adoption rates.

Market Dynamics and Growth Drivers

- Cardiovascular Disease Prevalence: Increasing prevalence directly correlates with demand for effective management medications, including COREG CR.

- Clinical Guidelines: Current guidelines from ACC/AHA recommend beta-blockers like carvedilol as first-line therapy for heart failure with reduced ejection fraction (HFrEF) and hypertension ([4]), cementing the drug's clinical importance.

- Patient Compliance: Once-daily dosing enhances adherence, reducing hospitalization rates and improving long-term outcomes, thereby driving sales.

- Patent Expiry and Generics: Anticipated generic entry could cause a price drop but may expand volume through broader affordability and access.

Sales Projections (2023-2030)

Based on epidemiological trends, clinical guideline uptakes, and market dynamics, the following projections are outlined:

| Year | Estimated Global Sales (USD Millions) | Key Notes |

|---|---|---|

| 2023 | $950 million | Steady growth driven by increasing CVD prevalence; initial post-patent expiry anticipation. |

| 2024 | $1.1 billion | Growing adoption in emerging markets; potential early generic entries. |

| 2025 | $1.3 billion | Market stabilization with expanded global access and inclusion in treatment guidelines. |

| 2026 | $1.4 billion | Increasing approvals of generic carvedilol formulations; price competition intensifies. |

| 2027 | $1.5 billion | Continued growth from rising global CVD burden; new formulations or combination approaches. |

| 2028-2030 | $1.6–1.8 billion | Market maturation; mature competition; possible biosimilars or formulations affecting pricing. |

Regional Breakdown and Growth Trends

- North America: Projected to maintain the largest market share (~50%) owing to established guidelines and healthcare infrastructure. Growth rate: 2-4% annually.

- Europe: Slightly slower growth (~3% annually), driven by aging populations and high treatment adherence.

- Asia-Pacific: Fastest growth (~8-10% annually), propelled by rising CVD prevalence, improved healthcare access, and urbanization.

- Emerging Markets: Market entry facilitated by lower generic prices; expected to experience exponential growth as healthcare systems expand and invest in chronic disease management.

Competitive Landscape and Market Risks

The imminent patent expiration may usher in a wave of generic carvedilol products, pressuring branded sales. Manufacturers may counter with differentiated formulations, combination therapies, or marketing campaigns emphasizing clinical data and adherence benefits.

Key risks include regulatory delays, reimbursement hurdles, and the emergence of alternative therapies like ARNIs (atorvastatin-reducing non-steroidal anti-inflammatory drugs) vying for similar indications.

Strategic Recommendations

- Innovation: Focus on developing combination therapies or analyzing personalized medicine approaches to sustain competitive advantage.

- Market Expansion: Leverage expanding insurance and healthcare coverage in emerging markets.

- Pricing Strategies: Prepare for generic entry with flexible pricing and value-based propositions to retain market share.

- Regulatory Engagement: Accelerate approvals in non-fixed-dose combinations or analytic forms to diversify offerings.

Key Takeaways

- The global market for COREG CR is set for steady growth driven by escalating cardiovascular disease prevalence, especially in aging and emerging populations.

- The drug's sustained-release formulation gives it a strategic advantage in patient compliance and clinical efficacy, supporting sales momentum.

- Patent expiry within the next 3-5 years represents both a challenge and an opportunity; proactive strategies are essential to maintain profitability amidst generic competition.

- Regional dynamics vary considerably, with Asia-Pacific offering significant growth potential due to demographic shifts and healthcare infrastructure improvements.

- Continued investment in clinical research, market expansion, and flexible pricing will be critical to optimize long-term revenue streams.

FAQs

-

What therapeutic advantages does COREG CR offer over immediate-release carvedilol?

COREG CR’s sustained-release formulation provides better patient adherence, more stable plasma concentrations, and potentially fewer side effects, translating into improved clinical outcomes in chronic heart failure and hypertension management. -

How will patent expiration impact COREG CR sales?

Patent expiry will likely lead to a surge in generic competition, exerting downward pressure on prices and potentially reducing sales volume of branded products. However, it can also expand market access and patient adoption through lower-priced alternatives. -

In which regions is COREG CR expected to see the highest growth?

Asia-Pacific and emerging markets are projected to experience the fastest growth due to demographic shifts, increased healthcare infrastructure, and rising cardiovascular disease burdens. -

What are the main challenges facing COREG CR’s market expansion?

Key challenges include impending generic competition, regulatory hurdles in emerging markets, reimbursement issues, and competition from alternative therapies or combination drugs. -

What strategic actions can manufacturers take to sustain COREG CR’s market share?

Manufacturers should innovate through combination therapies, focus on expanding access in emerging markets, engage with regulators early, and implement flexible pricing strategies to counteract generic pressure.

References

[1] World Health Organization. Cardiovascular diseases (CVDs). 2021.

[2] American Heart Association. Heart Disease and Stroke Statistics—2022 Update.

[3] CDC. Heart Failure Facts and Statistics. 2022.

[4] National Guidelines for Heart Failure Management, 2021.

More… ↓