Share This Page

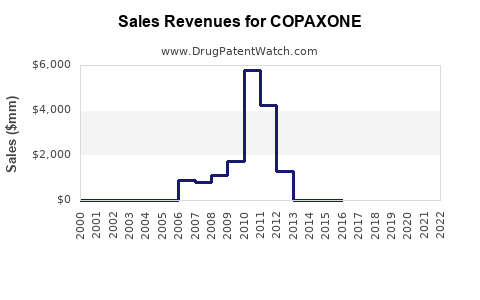

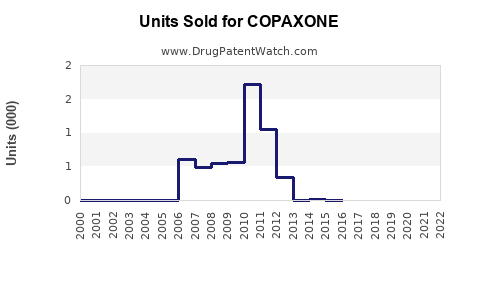

Drug Sales Trends for COPAXONE

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for COPAXONE

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| COPAXONE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| COPAXONE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| COPAXONE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for COPAXONE (Glatiramer Acetate)

Introduction

COPAXONE, the brand name for glatiramer acetate, is a disease-modifying therapy primarily used in the management of multiple sclerosis (MS). Since its initial approval by the FDA in 1996, COPAXONE has established itself as a leading treatment in the MS therapeutics market. This analysis evaluates the current market landscape, competitive positioning, and future sales projections, considering regulatory, clinical, and competitive dynamics.

Market Overview

Global Multiple Sclerosis Market Dynamics

Multiple sclerosis affects approximately 2.8 million individuals worldwide, with varying prevalence across regions. The global MS therapeutics market was valued at approximately USD 20 billion in 2022 and is projected to grow at a compounded annual growth rate (CAGR) of roughly 6% through 2030 [1]. This growth underscores increasing diagnosis rates, improved awareness, and expanding treatment options.

COPAXONE’s Market Position

COPAXONE remains a cornerstone for relapsing-remitting MS (RRMS). As of 2022, it held a significant market share, approximately 10-15%, overshadowed by newer therapies like injectable agents (e.g., Avonex, Betaseron), oral drugs (e.g., Tecfidera, Aubagio), and monoclonal antibodies (e.g., Ocrevus, Mavenclad). Its long-standing safety profile and proven efficacy enhance its continued relevance.

Regulatory Landscape and Patent Status

Glatiramer acetate's patent expiry has spawned biosimilar competitors, reducing pricing and affecting revenues. The launch of biosimilars, notably in Europe and emerging markets, intensifies pricing pressure. Regulatory agencies in the U.S. and EU have approved biosimilars like Glatopa and other generics, which threaten COPAXONE's market share [2].

Market Drivers & Challenges

Drivers

- Increased Prevalence: Rising MS prevalence, especially in women, propels demand.

- Long-Term Safety Profile: COPAXONE's well-established safety profile favors patient adherence.

- Patent Expiration & Biosimilars: Despite significant competition, robust familiarity and efficacy sustain demand in certain segments.

- Physician & Patient Preference: Preference for injectable therapies with proven long-term safety benefits.

Challenges

- Enhanced Competition: Oral and infusion alternatives with superior convenience challenge COPAXONE's position.

- Pricing Pressure: Biosimilars reduce pricing margins.

- Patient Convenience: Injection-based administration is less preferred compared to oral options.

- Regulatory Hurdles: Potential delays or restrictions for biosimilar approvals could impact market share.

Sales Projections (2023-2030)

Baseline Scenario (Status Quo)

Given the rising MS prevalence and steady physician and patient preference for established therapies, COPAXONE's sales are expected to experience a gradual decline, primarily due to biosimilar competition.

- 2023 Revenue Estimate: USD 1.5 billion

- Growth Rate: Approximately -5% annually, influenced by biosimilar penetration and pricing pressures.

Optimistic Scenario

In the event that COPAXONE maintains a larger than anticipated market share due to brand loyalty, clinical familiarity, and pricing strategies, sales could stabilize or modestly grow.

- 2023-2025: Stabilization at USD 1.2-$1.5 billion

- 2030 Projection: Around USD 1 billion, assuming some market share retention despite competition.

Pessimistic Scenario

If biosimilars rapidly capture market share and new oral therapies gain consumer preference, COPAXONE could see significant revenue erosion.

- 2023-2025: Decline to below USD 1 billion

- 2030 Projection: Approximately USD 500-$700 million

Factors Influencing Sales Trajectory

- Biosimilar Market Penetration: Faster adoption will accelerate revenue decline.

- Pipeline & Label Expansion: Additional indications or formulation improvements could temper decline.

- Market Access & Pricing Strategies: Strategic negotiations and value demonstration could preserve revenues.

Competitive Landscape

Key Competitors

- Biogen’s Avonex and Betaseron: Established injectables with similar efficacy.

- Sanofi’s Aubagio and Tecfidera: Oral therapies with higher convenience.

- Ocrevus (Roche): Monoclonal antibody with efficacy in both RRMS and secondary-progressive MS.

- Biosimilars: Glatopa and other generics in the pipeline.

Strategic Positioning

COPAXONE's proven safety and long-term effectiveness sustain its relevance among certain patient demographics, especially those preferring injections or with contraindications to newer agents. However, market share erosion remains an inevitable consequence of patent expirations and competition from oral therapies.

Regulatory & Market Access Outlook

Regulatory agencies are increasingly scrutinizing the approval process for biosimilars, influencing market dynamics. Payers are also demanding more cost-effective therapies, favoring biosimilars, which could further diminish COPAXONE’s revenues.

Key Trends and Future Opportunities

- Development of Next-Generation Formulations: Longer-acting formulations or combination therapies might mitigate declining sales.

- Expansion into Emerging Markets: Growing MS diagnosis rates and demand in Asia-Pacific, Latin America, and Africa present growth opportunities.

- Patient Support and Differentiation Strategies: Emphasizing safety profiles and patient adherence could sustain brand loyalty.

Conclusion

COPAXONE’s revenue trajectory from 2023 to 2030 will be predominantly shaped by biosimilar competition, innovation in formulation, regional expansion, and evolving prescribing trends. While it retains a significant role in MS management, sustained growth appears unlikely given current competitive pressures. Strategic market positioning and pipeline enhancements are critical to maintaining a meaningful share in the expanding MS therapeutics landscape.

Key Takeaways

- Market Decline Anticipated: Due to patent expirations and biosimilar proliferation, COPAXONE’s revenues are projected to decline 5-10% annually over the next decade.

- Competitive Dynamics Favor Oral Agents: Oral therapies are increasingly preferred for their convenience, challenging injectable agents like COPAXONE.

- Emerging Market Potential: Growth opportunities exist in regions with rising MS prevalence and limited treatment options.

- Strategic Differentiation Needed: Emphasizing safety profiles, long-term efficacy, and patient adherence may help preserve market share.

- Pipeline and Formulation Innovation Critical: New formulations and combination therapies could offset some decline, especially if they offer improved efficacy or dosing convenience.

FAQs

Q1: How will biosimilars impact COPAXONE sales over the next decade?

A: Biosimilars are expected to significantly reduce COPAXONE’s market share and pricing margins, leading to an anticipated decline in revenues of approximately 5-10% annually, particularly in regions where biosimilar adoption is expedited.

Q2: Are there any pipeline developments that could influence COPAXONE’s market standing?

A: Yes, next-generation formulations, longer-acting injections, or combination therapies in development could enhance patient adherence and extend COPAXONE’s relevance, potentially stabilizing sales.

Q3: What regions offer promising opportunities for COPAXONE’s growth?

A: Emerging markets in Asia-Pacific, Latin America, and the Middle East present growth potential due to increasing diagnosis rates, healthcare infrastructure improvements, and limited current treatment options.

Q4: Can COPAXONE remain competitive against oral therapies?

A: While challenging, COPAXONE’s established safety profile and efficacy can maintain its niche, especially among patients contraindicated for oral agents or those preferring injectable treatments.

Q5: What strategies can Pfizer employ to prolong COPAXONE’s market relevance?

A: Pfizer could focus on differentiated branding emphasizing safety and long-term benefits, negotiate favorable pricing with payers, explore expanded indications, and invest in pipeline innovations.

References

[1] Market Research Future. (2022). Global Multiple Sclerosis Market Analysis.

[2] U.S. Food and Drug Administration. (2018). Biosimilar Approval and Policy Updates.

More… ↓