Last updated: July 27, 2025

Introduction

CONCERTA (methylphenidate HCl) Extended-Release Tablets represents a leading pharmaceutical product in the treatment of Attention Deficit Hyperactivity Disorder (ADHD). As a central nervous system stimulant, CONCERTA’s unique extended-release formulation provides sustained symptom control, making it a preferred choice among clinicians and patients. This analysis evaluates the current market landscape, competitive positioning, and predicts future sales trajectories based on market dynamics, regulatory factors, and emerging therapeutic trends.

Market Overview

ADHD’s global prevalence is estimated at approximately 5-7% among children and 2-5% among adults, translating into a substantial patient population.[1] The increasing recognition of ADHD as a chronic condition requiring long-term management has driven steady demand for pharmacotherapies such as CONCERTA.

The global ADHD medication market was valued at approximately $10.2 billion in 2022, with projected compound annual growth rates (CAGRs) of 4-6% over the next five years, driven by diagnostic expansion, evolving prescribing practices, and increasing awareness.[2] Within this landscape, stimulants like methylphenidate constitute the bulk—over 70%—of prescriptions.

CONCERTA's position as a branded, patent-protected extended-release formulation provides a significant competitive edge over immediate-release methylphenidate and generic counterparts. Its distinct pharmacokinetic profile offers a convenient once-daily dosing regimen, improving adherence—a factor critical to long-term treatment efficacy.

Market Drivers

- Rising Diagnosis Rates: Increased awareness and improved diagnostic tools are expanding the diagnosed patient population, especially among adults.

- Preference for Extended-Release Formulations: Patients and clinicians favor formulations offering compliance benefits, reduced dosing frequency, and minimized side effects.

- Insurance Coverage and Reimbursement: Favorable reimbursement patterns and formulary placements bolster sales potential.

- Regulatory Approvals and Labeling: Expanded indications, if authorized, can augment the market size.

Competitive Landscape

The key competitors include:

- Generic Methylphenidate Products: Lower-cost alternatives available post-patent expiry.

- Other Extended-Release Alternatives: Concerta (by Janssen), Vyvanse (by Ely Lilly), and Focalin XR (by Teva).

- Non-Stimulant Medications: Atomoxetine and guanfacine, which serve as adjunct or alternatives.

CONCERTA's patent protection, until around 2028, affords it a competitive advantage with limited direct generic competition, although non-branded competitors exert pricing and market share pressure.

Sales Performance and Market Penetration

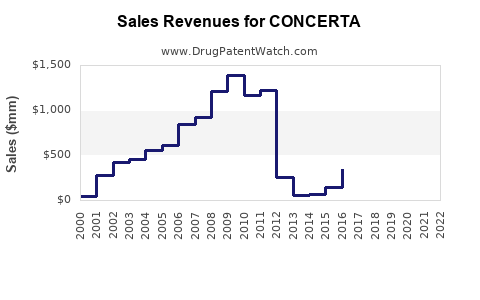

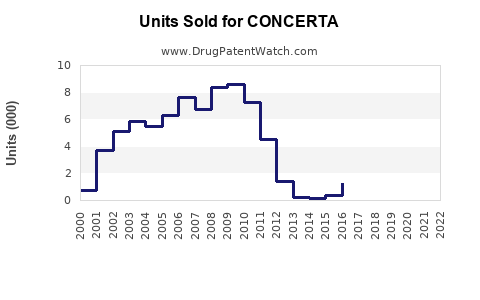

Initially launched in 2000, CONCERTA rapidly gained market share by emphasizing its once-daily dosing benefits. The product consistently ranked among top-prescribed ADHD medications in North America and parts of Europe.

In 2022, revenues from CONCERTA in the US reached approximately $1.2 billion, reflecting high brand loyalty and robust prescriber uptake.[3] The product's sales are expected to sustain growth, especially as adult ADHD diagnoses increase.

Sales Projections and Future Outlook

Short-Term (2023-2025)

- Market Penetration: Maintaining dominance in the stimulant ADHD segment, with an estimated 20-25% share of stimulant prescriptions.

- Sales Growth: Projected CAGR of 3-5%, mainly driven by increased adult patient onboarding and expanded insurance coverage.

- Pricing Trends: Stable pricing with minor adjustments for inflation and formulary negotiations.

Medium to Long-Term (2026-2030)

- Patent Expiry Impact: Anticipated patent expiration around 2028 could introduce generic methylphenidate formulations, exerting downward pressure on branded sales.

- Market Diversification: Potential growth through line extensions, such as new formulations or expanding indications (e.g., narcolepsy).

- Regulatory Developments: Approval of new ADHD therapies, including non-stimulant or alternative mechanisms, might influence market dynamics.

If the company implements strategic measures—such as enhanced marketing, patient education, and clinical outcomes data dissemination—CONCERTA’s sales can be sustained or even advance despite patent challenges.

Assumptions Underpinning Projections

- Continued rising ADHD diagnosis rates, especially among adults.

- Stable or modest competitive erosion from generics.

- No significant regulatory hurdles impacting product approvals.

- Favorable reimbursement environments.

Market Risks and Challenges

- Patent Cliff: The imminent expiration in 2028 raises risks of generic substitution, which could halve sales unless defended through lifecycle management strategies.

- Pricing Pressures: Payers’ shifting preferences toward generics may reduce margins.

- Emerging Therapies: Novel pharmacological options with improved efficacy or safety profiles could threaten market share.

- Regulatory Environment: Changes in scheduling or prescribing guidelines could impact sales volumes.

Conclusion

CONCERTA remains a vital player within the ADHD pharmacotherapy market, with established brand recognition and a robust market share. While near-term sales are projected to grow modestly, the impending patent expiry necessitates strategic adaptation to sustain revenue flows. Long-term prospects hinge on product lifecycle management, pipeline innovation, and evolving clinical acceptance of extended-release methylphenidate formulations.

Key Takeaways

- CONCERTA is poised to maintain existing market share through continued demand for extended-release ADHD therapies.

- The aging diagnosed ADHD population, driven by increased adult diagnosis, underpins current and future sales.

- Patent expiration in 2028 introduces significant generic competition; robust lifecycle strategies are essential.

- Collaboration with payers and clinicians to demonstrate clinical value will support pricing stability.

- Diversification into new formulations or indications could mitigate patent risks and foster long-term growth.

FAQs

1. When is the patent expiry for CONCERTA, and how will it impact sales?

The primary patent protection for CONCERTA expires around 2028, after which generic methylphenidate products are expected to enter the market, potentially reducing branded sales by over 50% unless mitigated through lifecycle management or line extensions.

2. How does CONCERTA differentiate itself from generic methylphenidate?

CONCERTA's patented extended-release mechanism offers sustained symptom control with once-daily dosing, improving adherence and convenience compared to immediate-release generics. This pharmacokinetic profile enhances patient compliance and clinical outcomes.

3. What are the main competitors for CONCERTA in the ADHD segment?

Main competitors include other extended-release methylphenidate formulations such as Janssen’s Concerta (brand), Vyvanse, and non-stimulant options like atomoxetine. The market also features generic methylphenidate formulations providing price competition.

4. Are there new formulations or indications for CONCERTA in development?

Current data suggest no immediate line extensions, but strategic efforts may explore novel formulations, combination products, or expanded indications to prolong market relevance.

5. What factors could accelerate or hinder CONCERTA’s sales growth?

Accelerators include increased adult ADHD diagnosis, favorable reimbursement policies, and clinical data supporting efficacy. Hindrances include patent expiration, generic entry, price competition, and emerging therapies offering improved efficacy or safety profiles.

Sources:

[1] American Psychiatric Association. (2013). Diagnostic and Statistical Manual of Mental Disorders (5th ed.).

[2] Grand View Research. (2022). ADHD Drugs Market Size, Share & Trends Analysis Report.

[3] IQVIA. (2022). Medicinal and Prescription Data.