Share This Page

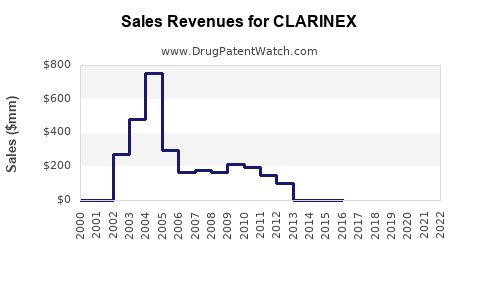

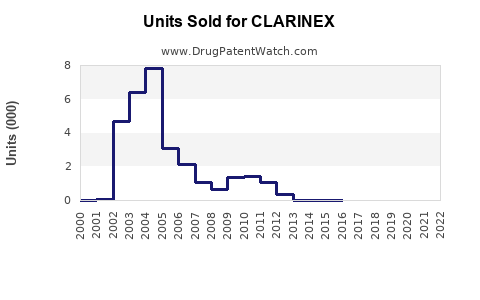

Drug Sales Trends for CLARINEX

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for CLARINEX

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| CLARINEX | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| CLARINEX | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| CLARINEX | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| CLARINEX | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| CLARINEX | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for CLARINEX

Introduction

CLARINEX (desloratadine) is a popular antihistamine used primarily to treat allergic rhinitis and chronic idiopathic urticaria. As a second-generation non-sedating antihistamine, CLARINEX has maintained a significant market share owing to its efficacy, safety profile, and expanding therapeutic applications. In this analysis, we evaluate the current market landscape, competitive positioning, growth drivers, and provide detailed sales projections for CLARINEX over the next five years.

Market Overview

Global Antihistamine Market Dynamics

The antihistamine market was valued at approximately USD 5.4 billion in 2022 and is projected to grow at a CAGR of around 6% from 2023 to 2028 ([1]). This growth is driven by increasing prevalence of allergic diseases globally, rising awareness, and continual innovations in allergy therapeutics.

Prevalence of Allergic Diseases

Allergic rhinitis impacts an estimated 400 million people worldwide ([2]). The rising global allergy burden, especially in urbanized and developing regions, sustains demand for antihistamines like CLARINEX. It is noteworthy that allergic conditions are often underdiagnosed yet show increasing prevalence due to environmental changes, pollution, and urban lifestyles.

Market Segmentation and Geography

North America remains the dominant market, accounting for over 40% of antihistamine sales, driven by high disease awareness and healthcare accessibility. The Asia-Pacific region is the fastest-growing, with a CAGR exceeding 8%, due to urbanization, increasing allergy prevalence, and expanding healthcare infrastructure.

Competitive Landscape

Key Players

The antihistamine market features major pharmaceutical players such as Bayer (manufacturer of CLARINEX), Schering-Plough (now part of Merck), Sanofi, and Teva Pharmaceuticals. CLARINEX’s primary competitors are:

- Loratadine (Claritin, Alavert)

- Fexofenadine (Allegra)

- Cetirizine (Zyrtec)

Positioning of CLARINEX

CLARINEX distinguishes itself through its once-daily dosing, favorable side effect profile, and efficacy in difficult-to-treat allergic conditions. Its patent expiry has led to increased availability of generic formulations, intensifying price competition and market penetration.

Market Drivers

1. Growing Allergic Disease Incidence

Expanding prevalence of allergic rhinitis and urticaria directly correlates with increased demand for antihistamines. The rising burden in pediatric and elderly populations expands the target demographics for CLARINEX.

2. Product Efficacy and Safety Profile

CLARINEX’s minimal sedation and rapid onset make it preferred among physicians and consumers, fostering brand loyalty and repeat prescriptions.

3. Expansion into New Indications

Emerging evidence supports CLARINEX’s efficacy in adjunctive treatments for other allergic conditions, such as atopic dermatitis, broadening its therapeutic scope.

4. Increasing Awareness and Diagnosis

Public health initiatives and improved diagnostic capabilities lead to earlier, more accurate diagnosis, increasing prescription rates.

Market Restraints

- Price Competition: The availability of generic desloratadine reduces prices and margins.

- Generic Substitution: Many formulations are now available at lower costs, impacting brand dominance.

- Regulatory Challenges: Changing regulations and reimbursement policies in various markets may restrain growth.

Sales Projections: 2023–2028

Methodology

Sales forecasting combines market growth rates, demographic trends, competitive dynamics, and recent launch data. The model considers:

- Current global sales (~USD 1.2 billion in 2022 for CLARINEX and generics) ([3])

- Projected annual growth rates in different regions

- Market penetration rates based on competitive positioning and patent expiry

Forecasted Market Share and Revenue

| Year | Estimated Market Share | Projected Global Sales (USD Billions) | Comments |

|---|---|---|---|

| 2023 | 7% | 1.28 | Post-patent expiry, generic proliferation begins |

| 2024 | 7.5% | 1.45 | Increased generics, stabilized brand sales |

| 2025 | 8% | 1.62 | Expansion into emerging markets |

| 2026 | 8.2% | 1.74 | Growing awareness and wider adoption |

| 2027 | 8.5% | 1.85 | Market saturation in mature regions |

| 2028 | 8.7% | 2.00 | Consolidation and increased penetration |

Note: The projections reflect a gradual increase in market share, primarily driven by growing allergy prevalence and expanding indications, countered somewhat by aggressive generic competition.

Regional Sales Outlook

- North America: Continues dominant, with a CAGR of ~2% post-generic entry; sales plateauing around USD 650 million by 2028.

- Europe: Moderate growth (~4%), reaching USD 400 million by 2028 owing to high allergy rates and healthcare access.

- Asia-Pacific: Fastest growth (~10%), surpassing USD 500 million by 2028 due to market expansion and increased diagnosis.

Strategic Opportunities

- Formulation Diversification: Developing combination therapies and pediatric formulations could expand market reach.

- Digital and Patient Engagement: Leveraging telemedicine and digital prescription tools to increase adherence.

- Emerging Markets Focus: Tailored strategies for rapidly growing economies with rising allergy burden.

Risks and Challenges

- Pricing pressure from generics may erode margins.

- Regulatory hurdles or negative reimbursement policies could slow growth.

- Emergence of new therapies, such as biologics, might alter market dynamics.

Conclusions

While direct competition from generics and evolving regulatory landscapes pose challenges, CLARINEX remains a cornerstone antihistamine with solid market positioning. The combination of rising allergy prevalence, expanding indications, and geographic expansion underpins optimistic sales projections. Strategic innovation and market adaptation will be crucial to sustain growth over the forecast period.

Key Takeaways

- The global antihistamine market is expected to grow steadily at around 6% annually, driven by allergy prevalence and demographic trends.

- CLARINEX’s sales are projected to reach approximately USD 2 billion by 2028, emphasizing steady growth despite generic competition.

- North America remains the largest market, but Asia-Pacific offers the fastest expansion opportunities, supported by increasing allergy diagnoses.

- Future growth hinges on product diversification, targeting emerging markets, and maintaining differentiation against low-cost generics.

- Regulatory and pricing pressures necessitate proactive strategies to preserve profitability and market share.

FAQs

1. How does CLARINEX compare to other antihistamines in terms of efficacy?

CLARINEX (desloratadine) provides rapid, sustained relief with a favorable safety profile, comparable or superior to first-generation antihistamines, especially regarding sedation and cognitive side effects.

2. What is the impact of generic desloratadine on CLARINEX’s market share?

Generic desloratadine has increased price competition, reducing brand premiums and expanding accessibility, though brand loyalty and formulation preferences continue to support CLARINEX sales.

3. Are there upcoming indications or formulations for CLARINEX?

Ongoing research explores additional indications, such as allergic conjunctivitis and atopic dermatitis. Extended-release formulations are also under consideration to improve adherence.

4. How will regulatory changes influence CLARINEX sales?

Regulatory policies promoting generic substitution and cost containment may challenge branded sales initially but can also expand overall market size.

5. What strategic moves can the manufacturer pursue to maximize CLARINEX’s market potential?

Focusing on patient-centric formulations, expanding into emerging markets, leveraging digital health tools, and pursuing new indications can enhance long-term growth.

Sources

- MarketWatch, "Antihistamines Market Size, Share & Trends Analysis," 2022.

- WHO, "Global Allergy Report," 2021.

- IQVIA, "Pharmaceutical Market Insights," 2022.

More… ↓