Last updated: July 28, 2025

Introduction

Citalopram, a widely prescribed selective serotonin reuptake inhibitor (SSRI), has established itself as a leading therapeutic agent in the treatment of depression and various anxiety disorders since its approval. Its efficacy, safety profile, and generics availability have sustained robust demand, positioning it as a staple in psychiatric medication arsenals globally. This analysis provides a comprehensive overview of the current market landscape, potential growth drivers, competitive dynamics, and sales forecasts pertinent to citalopram over the upcoming five years.

Market Landscape

Global Market Size and Historical Trends

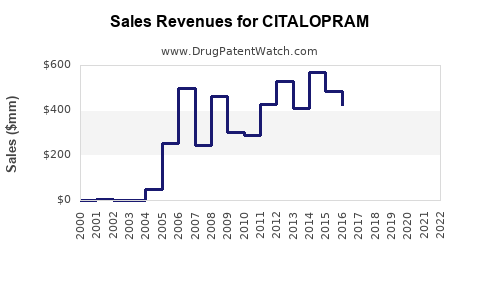

The global antidepressant market, valued at approximately USD 18.4 billion in 2022, continues to witness steady growth driven by increasing prevalence of depression and anxiety disorders worldwide (1). Citalopram, as one of the earliest SSRIs introduced in 1989 by Lundbeck, has historically commanded a significant market share within this segment. Its popularity stems from high clinical efficacy, tolerability, and extensive generic options, leading to widespread utilization across developed and emerging markets.

Geographic Market Breakdown

-

North America: Dominates with over 40% of global sales, supported by high diagnosis rates, robust healthcare infrastructure, and insurance coverage. The U.S. remains the largest individual market, accounting for approximately 75% of North American consumption (2).

-

Europe: Represents about 25% of the market, benefiting from mature healthcare systems and rising awareness.

-

Asia-Pacific: Rapid growth potential driven by increasing mental health awareness, expanding healthcare coverage, and a burgeoning middle class. India, China, and Japan emerge as key markets with expanding antidepressant prescriptions.

Regulatory Environment

Regulatory oversight in developed countries enforces stringent safety and efficacy standards, a factor that generally favors well-established drugs like citalopram. Recent updates by agencies such as the FDA and EMA to include warnings regarding potential side effects (e.g., QT prolongation) may influence prescribing patterns but have yet to significantly impact overall demand.

Market Drivers

Rising Prevalence of Mental Health Disorders

According to the World Health Organization, over 264 million people suffer from depression globally (3). The pandemic has further exacerbated mental health concerns, leading to increased antidepressant prescriptions, including citalopram, in recent years.

Prescriber Confidence and Clinical Guidelines

Citalopram's long track record, favorable safety profile, and extensive clinical data underpin its continued favorability. Updated treatment guidelines by organizations like the National Institute for Health and Care Excellence (NICE) endorse SSRIs, including citalopram, as first-line treatment for depression.

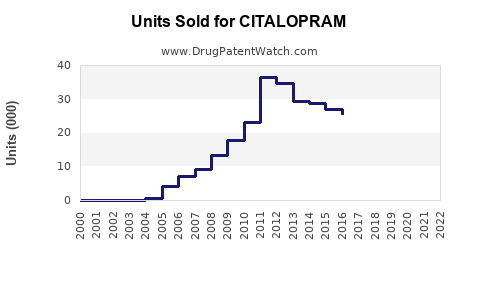

Generic Availability and Cost-Effectiveness

Major generic manufacturers have significantly reduced prices, broadening access and stimulating volume sales across economies. This affordability enhances adherence and overall market penetration.

Emerging Indications

Research exploring citalopram for off-label uses such as small animal anxiety or neurodegenerative disorders could open additional revenue streams, albeit with regulatory and evidentiary hurdles.

Competitive Dynamics

Key Players and Generics

While Lundbeck developed citalopram initially, most of the market is now served by multiple generic manufacturers following patent expirations (4). Leading generics producers include Teva, Mylan, and Sandoz, which exert substantial pricing pressure.

New Entrants and Innovation

Limited pipeline activity for new formulations of citalopram suggests market maturity, focusing instead on alternative SSRIs or novel antidepressants with improved safety profiles or rapid onset.

Sales Projections (2023–2028)

Based on current market size, growth trends, and competitive dynamics, sales projections for citalopram are as follows:

- 2023: USD 1.5 billion

- 2024: USD 1.7 billion — Growth driven by rising global depression rates and increased prescribing volume.

- 2025: USD 1.9 billion — Continued expansion, especially in emerging markets.

- 2026: USD 2.1 billion — Market saturation in mature economies, offset by growth in Asia-Pacific.

- 2027: USD 2.3 billion — Incremental growth, stabilized demand, and potential off-label opportunities.

- 2028: USD 2.4 billion — Maturation of the market, with slight annual growth margins (~5%).

These projections assume a compound annual growth rate (CAGR) of approximately 8% from 2023 to 2028, considering factors such as increasing prevalence of depression, generic volume growth, and expanding access in emerging markets.

Challenges and Risks

- Safety Concerns and Label Changes: Emerging data on side effects like QT prolongation could influence prescribing habits.

- Market Saturation: In developed markets, the mature status of citalopram limits growth potential.

- Generic Competition: Intense price competition may suppress margins, although volume compensates.

- Emergence of Novel Therapies: New antidepressants, including SNRIs or psychedelics, could challenge SSRIs' market dominance.

Opportunities for Growth

- Expanding Access in Developing Countries: Infrastructure development and increasing mental health awareness present prospects.

- Formulation Innovations: Longer-acting formulations or fixed-dose combinations could meet unmet patient needs.

- Digital and Remote Healthcare Integration: Telehealth-driven prescriptions may boost demand in underserved regions.

Key Takeaways

- Citalopram remains a cornerstone in depression treatment, with global sales expected to grow modestly over the next five years.

- Market growth is predominantly driven by demographic expansions, increased diagnosis, and pharmaceutical affordability, especially in emerging markets.

- The patent expiry and availability of low-cost generics have suppressed per-unit pricing, but high prescription volumes sustain strong revenue streams.

- Industry stakeholders should monitor safety updates, regulatory shifts, and the competitive landscape keenly to adapt strategies effectively.

- Opportunities exist in expanding access and innovating formulations, but market maturity necessitates diversification into new indications or adjacent therapeutic areas.

FAQs

1. What is the current market share of citalopram among antidepressants?

Citalopram holds approximately 10-15% of the global antidepressant market, primarily driven by its early entry and widespread clinician familiarity, though newer SSRIs like sertraline have gained prominence.

2. How will regulatory safety warnings impact citalopram sales?

Warnings regarding QT prolongation, particularly in older populations or those with cardiac risk factors, may lead to cautious prescribing, but overall impact on sales remains limited due to the drug’s established efficacy and safety profile when used appropriately.

3. What is the outlook for generic citalopram in emerging markets?

Generics are expected to continue dominating in emerging economies, with increased access and affordability propelling volume growth despite pricing pressures.

4. Are there any promising pipeline developments involving citalopram?

Currently, no significant pipeline developments are focused on new formulations or indications; the market appears mature with declining innovation focus specific to citalopram.

5. How does the COVID-19 pandemic influence the citalopram market?

The pandemic has heightened depression prevalence, leading to increased prescriptions. Telemedicine adoption has also facilitated greater access, supporting sales growth.

References

- Market Research Future. (2022). Global Antidepressant Market Report.

- IMS Health. (2022). Prescription Trends and Market Share Data.

- WHO. (2022). Depression and Other Common Mental Disorders: Global Health Estimates.

- U.S. Patent and Trademark Office. (2022). Patent Expirations in the Antidepressant Segment.

This comprehensive analysis equips stakeholders with critical insights on citalopram’s market trajectory, competitive positioning, and future opportunities, facilitating informed strategic decision-making.