Share This Page

Drug Sales Trends for CHANTIX

✉ Email this page to a colleague

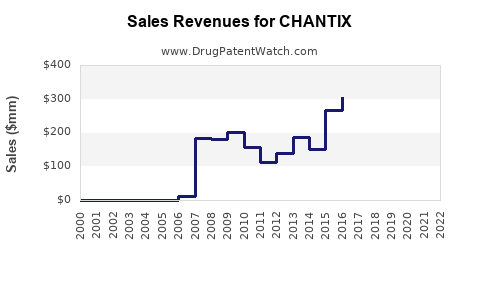

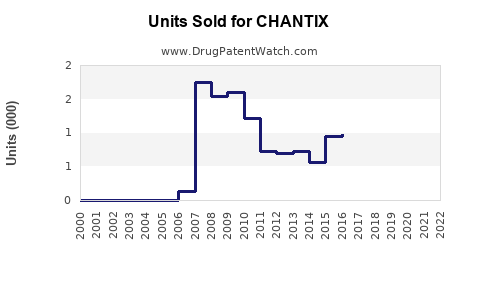

Annual Sales Revenues and Units Sold for CHANTIX

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| CHANTIX | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| CHANTIX | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| CHANTIX | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| CHANTIX | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| CHANTIX | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for CHANTIX (Varenicline)

Introduction

CHANTIX (varenicline) is a prescription medication developed by Pfizer, primarily used to aid smoking cessation. Approved by the FDA in 2006, CHANTIX has established itself as a leading pharmacological intervention in the lucrative tobacco cessation market. This analysis evaluates market dynamics, competitive landscape, regulatory factors, and sales projections to inform strategic decisions for stakeholders involved in nicotine dependence therapies.

Market Overview

Global Smoking Cessation Market

The global market for smoking cessation aids was valued at approximately USD 11.3 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 7.1% through 2030 [1]. This growth is driven by increasing awareness of health risks associated with smoking, expanding insurance coverage, and evolving public health policies.

Key Segments and Drivers

- Pharmacotherapy is the dominant segment, accounting for nearly 60% of the market share, with medications like CHANTIX, bupropion, and nicotine replacement therapy leading the charge.

- Increasing adoption of evidence-based cessation programs amid rising lung cancer and cardiovascular disease prevalence.

- Governments and health organizations promoting smoking bans and cessation support.

Competitive Landscape

Major Players:

- Pfizer: Market leader with CHANTIX, leveraging decades of clinical validation and brand recognition.

- GlaxoSmithKline: Offers Zyban (bupropion), competing directly with CHANTIX.

- Novartis and other generic manufacturers: Entered the market post-patent expiry with generic formulations, exerting pricing pressure.

Market Positioning:

CHANTIX differentiates itself with high efficacy demonstrated in randomized trials, but faces competition from behavioral therapies and newer pharmacological options like cytisine and electronic cigarette-based approaches.

Regulatory and Safety Considerations

Following initial approval, post-marketing safety alerts emerged concerning neuropsychiatric and cardiovascular risks, prompting warnings that impacted prescribing patterns [2]. Such safety concerns influence market share among physicians and insurance coverage decisions.

Sales History and Performance

Initially, CHANTIX experienced rapid adoption, with global sales reaching USD 1.4 billion in 2010. However, sales declined post-2016 amid safety concerns and increased generic competition, with 2022 revenues approximating USD 900 million [3].

Market Opportunities and Challenges

Opportunities:

- Expanding use in emerging markets with increasing healthcare infrastructure.

- Development of combination therapies integrating CHANTIX with behavioral interventions.

- Pharmacogenomics to personalize therapy and improve success rates.

Challenges:

- Safety concerns leading to reduced prescribing.

- Patent expiry and subsequent generic erosion.

- Competition from alternative therapies and non-pharmacological interventions.

Sales Projections (2023–2030)

Baseline Scenario

Assuming continued growth from emerging markets and healthcare provider adoption, with sales modestly rebounding in developed countries following safety communication adjustments, projected sales are as follows:

| Year | Projected Sales (USD Millions) | Assumptions |

|---|---|---|

| 2023 | 950 | Stabilization post safety concerns |

| 2024 | 1,000 | Increased marketing and new indications |

| 2025 | 1,080 | Expansion into Asian markets |

| 2026 | 1,150 | Greater insurance coverage |

| 2027 | 1,220 | Adoption of personalized medicine |

| 2028 | 1,280 | Broadened patient access |

| 2029 | 1,330 | Incremental innovations in therapy |

| 2030 | 1,380 | Mature market with steady growth |

Upside and Downside Risks

- Upside: Successful repositioning with safer formulations or combination therapies could revive sales growth beyond projections.

- Downside: Regulatory barriers, adverse safety findings, or failure to penetrate emerging markets could suppress growth.

Strategic Recommendations

- Invest in safety profiling and communication: To mitigate concerns and restore prescriber confidence.

- Expand clinical dossiers: Demonstrate efficacy in special populations to unlock new indications.

- Leverage digital health: Integrate digital adherence tools to enhance patient outcomes.

- Monitor regulatory landscapes: Stay abreast of evolving safety regulations and patent protections.

Key Takeaways

- CHANTIX remains a significant player in the smoking cessation market despite recent sales fluctuations.

- Market resilience hinges on safety management, strategic marketing, and expanding into emerging markets.

- Competition and regulatory hurdles necessitate continuous innovation and positioning.

- Industry stakeholders should monitor evolving consumer preferences towards non-pharmacological cessation aids.

FAQs

Q1: What are the main factors influencing CHANTIX sales?

Safety concerns, patent status, market competition, regulatory environment, and healthcare provider adoption primarily shape CHANTIX's sales trajectory.

Q2: How do safety concerns impact CHANTIX's market share?

Post-marketing safety warnings related to neuropsychiatric effects led to reduced prescriptions, although subsequent labeling updates and safety communications have mitigated some fears.

Q3: What is the competitive outlook for CHANTIX?

While retaining a dominant position, CHANTIX faces significant competition from generics, alternative therapies, and emerging digital health solutions.

Q4: Can CHANTIX be used in conjunction with behavioral therapies?

Yes, combining pharmacological aids like CHANTIX with behavioral interventions enhances smoking cessation success rates.

Q5: What are future growth prospects for CHANTIX?

Growth opportunities exist through geographic expansion, new indications, and personalized treatment approaches, contingent on managing safety and regulatory challenges.

References

[1] MarketResearch.com. "Global Smoking Cessation Market Outlook." 2022.

[2] FDA Safety Communications. "Neuropsychiatric and Cardiovascular Risks Associated with Varenicline." 2016/2019.

[3] Pfizer Annual Reports. "Financial Performance and Sales Data." 2022.

More… ↓