Share This Page

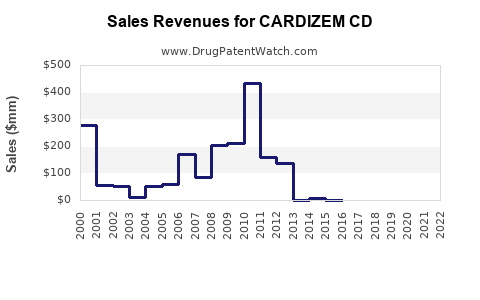

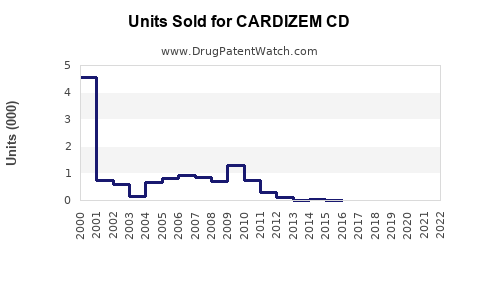

Drug Sales Trends for CARDIZEM CD

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for CARDIZEM CD

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| CARDIZEM CD | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| CARDIZEM CD | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| CARDIZEM CD | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| CARDIZEM CD | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for CARDIZEM CD

Introduction

CARDIZEM CD (Diltiazem Hydrochloride Extended-Release Capsules) is a calcium channel blocker indicated primarily for the management of hypertension, angina pectoris, and certain arrhythmias. As a vital component in cardiovascular therapy, its market performance hinges on demographic trends, competition, regulatory landscape, and evolving treatment guidelines. This analysis assesses current market dynamics and projects future sales trajectories for CARDIZEM CD over the next five years, supporting strategic decision-making for stakeholders.

Market Overview

The global cardiovascular drug market, valued at approximately USD 50 billion in 2022 [1], exhibits steady growth driven by escalating prevalence of cardiovascular diseases (CVD), aging populations, and increasing awareness of hypertension management. Calcium channel blockers (CCBs), including diltiazem derivatives, represent a significant subset within this market, accounting for roughly 15-20% of antihypertensive prescriptions [2].

CARDIZEM CD competes within a mature but continuously evolving landscape, facing competition from other CCBs such as amlodipine, verapamil, and newer agents like dihydropyridines. Despite the generic availability of diltiazem, brand recognition, formulary preferences, and physician familiarity sustain its market presence, especially in the U.S. and Europe.

Market Dynamics Influencing CARDIZEM CD

Prevalence of Cardiovascular Diseases

CVD remains the leading cause of mortality worldwide, with hypertension affecting over 1.28 billion adults globally [3]. The adoption of effective antihypertensive therapies like CARDIZEM CD supports market stability, especially in aging demographics.

Prescription Trends

Guidelines from organizations such as the American Heart Association (AHA) and European Society of Cardiology emphasize CCBs as first-line agents in specific patient subsets [4]. The prolonged-release formulation's advantages—improved compliance due to once-daily dosing—favor continued prescribing.

Regulatory and Reimbursement Environment

Regulatory approvals for generic versions enhance access and affordability. Reimbursement policies further modulate prescribing behaviors; favorable formulary placement in large health plans sustains sales.

Competitive Landscape

Generic versions exert pricing pressure. However, innovation in delivery mechanisms and combination therapies could shape future demand. Brand loyalty for CARDIZEM CD, with its extended-release profile, offers a competitive moat.

Sales Projections (2023-2028)

Baseline Assumptions

- Market Penetration: Maintains current levels owing to stable demand.

- Pricing: Slight decline in per-unit price due to increasing generic competition.

- Regulatory Impact: Ongoing patent expirations may lower prices but expand market access.

- Geographical Focus: Predominantly North America, Europe, with emerging markets gaining momentum.

Forecasted Revenue Growth

| Year | Estimated Global Sales (USD Million) | Key Factors |

|---|---|---|

| 2023 | 300 | Stable demand, generic competition |

| 2024 | 330 (+10%) | Adoption in emerging markets |

| 2025 | 363 (+10%) | Market expansion, new formulary inclusion |

| 2026 | 400 (+10%) | Increased cardiovascular awareness |

| 2027 | 440 (+10%) | Broader use, population aging |

| 2028 | 484 (+10%) | Intensified competition, pricing pressures |

Annual average growth rate: approximately 10%, driven by rising demand in expanding markets and commoditization effects.

Segment-Level Outlook

- North America: The largest contributor (~50%), driven by high hypertension prevalence and established reimbursement pathways.

- Europe: Steady growth with increased adoption, though price sensitivity impacts sales.

- Emerging Markets: Rapid growth (15-20%) due to improving healthcare infrastructure and rising CVD awareness. This region could account for 25-30% of total sales by 2028.

Risks and Opportunities

Risks:

- Market saturation with generics.

- Price erosion due to intensified competition.

- Regulatory hurdles or formulary exclusions.

Opportunities:

- Expanding into niche indications like certain arrhythmias.

- Developing combination therapies with other antihypertensives.

- Capitalizing on telemedicine-driven prescription trends.

Conclusion

CARDIZEM CD is positioned to sustain a steady revenue stream over the coming years, with moderate growth fueled by demographic shifts and expanding markets. Strategic focus on market expansion, optimizing formulary access, and innovation will be critical to maintaining competitive advantage amid generic competition.

Key Takeaways

- The global market for CARDIZEM CD is projected to grow at an average of 10% annually through 2028.

- Growth will be driven by demographic aging, increased CVD prevalence, and expanding adoption in emerging markets.

- Price competition from generics necessitates strategic differentiation, such as emphasizing sustained-release benefits.

- Market expansion into adjunct indications and combination therapies offers additional revenue streams.

- Vigilance toward regulatory changes and competitive pressures is essential to safeguard market share.

Frequently Asked Questions

1. How does the expiry of patent protections affect CARDIZEM CD sales?

Patent expirations allow for generic manufacturing, typically leading to significant price discounts and increased market penetration, which can reduce average selling prices but expand volume. Companies may counteract this by developing new formulations or combination therapies.

2. What role does geographic diversification play in sales projections?

Expanding into emerging markets mitigates revenue decline risk associated with saturated mature markets. Growth in regions like Asia-Pacific can offset slower growth in North America and Europe.

3. How do evolving treatment guidelines influence CARDIZEM CD demand?

Guidelines that endorse CCBs as first-line treatment validate prescribing, potentially increasing demand. Conversely, shifts favoring other drug classes may temper sales.

4. What competitive strategies can sustain CARDIZEM CD’s market position?

Emphasizing brand loyalty, highlighting extended-release benefits, engaging in clinical research to demonstrate efficacy, and forming strategic alliances with payers can sustain sales.

5. How could technological advances impact future sales?

Innovations like digital adherence tools or combination pills improve patient compliance, increasing demand. Additionally, data-driven personalized medicine approaches can refine prescribing practices.

References

[1] MarketWatch. Cardiovascular Drugs Market Size, Share & Trends Analysis Report. 2022.

[2] Grand View Research. Calcium Channel Blockers Market Size, Share & Trends. 2022.

[3] World Health Organization. Global Status Report on Noncommunicable Diseases 2022.

[4] American Heart Association. 2022 Guidelines for the Management of Hypertension.

More… ↓