Share This Page

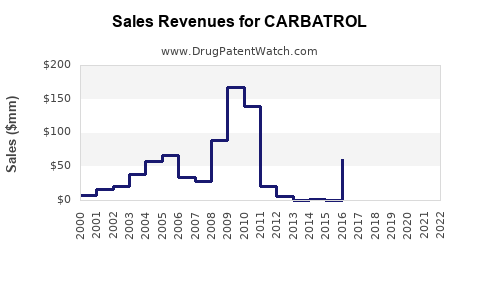

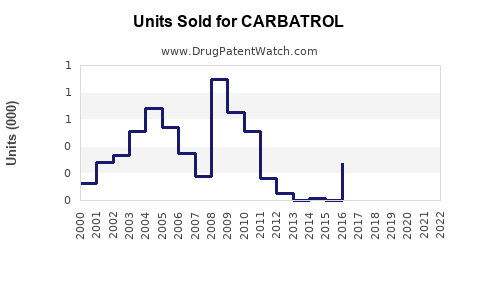

Drug Sales Trends for CARBATROL

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for CARBATROL

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| CARBATROL | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| CARBATROL | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| CARBATROL | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for CARBATROL (Extended-Release Carbamazepine)

Introduction

CARBATROL, an extended-release formulation of carbamazepine, is a well-established drug primarily indicated for epilepsy and bipolar disorder. Its unique pharmacokinetic profile offers advantages over immediate-release formulations, including improved compliance and stable plasma concentrations. As the landscape of neurological and psychiatric treatment evolves, understanding the market dynamics for CARBATROL is critical for stakeholders aiming to optimize sales strategies and regulatory positioning.

Market Overview

Therapeutic Indications and Usage

CARBATROL’s primary indications include:

- Partial and generalized tonic-clonic seizures

- Bipolar disorder maintenance therapy

The expanding prevalence of epilepsy and bipolar disorder globally sustains demand for effective, long-acting antiseizure medications (ASMs). The World Health Organization estimates approximately 50 million people worldwide suffer from epilepsy, with a significant portion requiring lifelong medication [1]. Similarly, bipolar disorder affects approximately 1-2% of the population, emphasizing a sizable patient base for extended-release formulations like CARBATROL.

Competitive Landscape

CARBATROL operates in a competitive arena, primarily against other formulations of carbamazepine, such as Tegretol XR, and alternative long-acting ASMs including oxcarbazepine, lamotrigine, and valproate. Brand loyalty, perceived efficacy, and side effect profiles influence market share.

Key competitors include:

- Tegretol XR: The primary competitor, sharing the same active ingredient but varying in formulations and pricing strategies.

- Lamotrigine and Oxcarbazepine: Growing in popularity due to favorable safety profiles.

- Vagus nerve stimulation and newer agents: Emerging options that may impact long-term market share.

Regulatory Status and Patent Landscape

CARBATROL’s patent protections have largely expired, opening the market to generic formulations. Nonetheless, its brand recognition and reputation for efficacy sustain its market presence. Regulatory approvals and off-label uses can influence competitive dynamics and market expansion.

Market Drivers and Barriers

Drivers

- Increasing Prevalence of Epilepsy and Bipolar Disorder: Rising diagnosis rates support sustained demand.

- Patient Compliance: The convenience of extended-release formulations improves adherence, favoring CARBATROL over multiple daily dosing.

- Physician Preference for Stable Plasma Levels: Evidence suggests prolonged-release options reduce breakthrough seizures and adverse events.

- Generic Availability: Post-expiry of patents reduces costs, broadening access.

Barriers

- Pricing and Reimbursement Constraints: Cost-sensitive healthcare systems can limit prescriptions.

- Side Effect Profile: Potential side effects, including SJS/TEN (Stevens-Johnson syndrome), influence prescribing habits.

- Availability of Alternatives: Emergence of new ASMs with improved safety or efficacy profiles shifts market preferences.

Regional Market Analysis

North America

North America remains the largest market owing to high epilepsy and bipolar disorder prevalence, advanced healthcare infrastructure, and insurance coverage. The American Epilepsy Society reports about 3 million adults with epilepsy in the U.S. alone [2]. The presence of established prescribing routines and extensive use of branded medications sustain CARBATROL sales.

Europe

European markets exhibit steady growth driven by aging populations, increased diagnosis, and regulatory approvals. Cost containment pressures promote generic use, which could potentially dilute branded CARBATROL’s market share but nonetheless maintain volume, especially in managed care settings.

Asia-Pacific

The fastest-growing region due to rising prevalence, expanding healthcare access, and increasing awareness. Countries like India, China, and Japan present significant opportunities for expanded use, especially in the orphan drug segment with favorable government policies.

Sales Projections (2023-2028)

Methodology

Forecasts integrate historical sales data, demographic trends, clinical adoption rates, patent status, and competitive pressures. The analysis assumes steady growth in Diagnosed Patient Population, with a shift towards generic drugs influencing volume but maintaining brand relevance.

Short-term (2023-2025)

Initial growth phase driven by:

- Ongoing new patient initiations.

- Physician preference for extended-release formulations due to better compliance.

- Increasing adoption in bipolar disorder management.

Projected global sales of CARBATROL are estimated at $150 million in 2023, with an annual increase of 4-6% driven predominantly by North America and Europe, where brand recognition remains strong and generics are integrated into formularies.

Mid to Long-term (2026-2028)

Factors influencing long-term sales include:

- Market Penetration of Generics: As patent expirations become widespread, generic carbamazepine formulations will dominate, possibly reducing brand sales by up to 40%.

- Emergence of New Therapeutics: Innovative therapies and gene treatments could reduce the overall patient pool. However, for now, CARBATROL’s clinical position sustains a baseline demand.

Forecasted sales are projected at $160 million by 2028, with slight fluctuations accounting for generic competition, regulatory changes, and clinician preferences.

Strategic Opportunities

- Expanding Indications: Investigating new uses such as neuropathic pain or off-label psychiatric treatments may bolster sales.

- Formulation Innovations: Developing even more stable or combination formulations can attract new patients.

- Market Penetration in Emerging Economies: Affordable pricing strategies and local partnerships facilitate growth in underpenetrated regions.

Key Challenges and Risks

- Pricing and Reimbursement Pressures: Payers favor generics, constraining brand growth.

- Regulatory Hurdles: Variability in approval processes across regions can delay expansion.

- Safety Concerns: Adverse effects impose cautious prescribing, especially in vulnerable populations.

Conclusion

While CARBATROL maintains a strong market position due to its efficacy and favorable pharmacokinetics, the landscape’s evolving nature, characterized by patent expirations, generic competition, and emerging therapies, tempers growth prospects. Strategic focus on regional expansion, indication diversification, and formulation innovation can sustain and potentially enhance its market footprint over the next five years.

Key Takeaways

- Market Potential: Approximately $150–$160 million in annual revenues projected through 2028, with growth primarily in North America and Europe.

- Competitive Dynamics: Generics significantly influence market share; brand loyalty remains critical but challenged by cost considerations.

- Regional Opportunities: Asia-Pacific presents rapid growth potential; tailored strategies are essential.

- Strategic Focus: Diversification of indications, formulation innovations, and cost-effective access are vital for long-term success.

- Risks to Monitor: Price pressures, safety concerns, and regulatory delays must be proactively managed.

FAQs

Q1: How does patent expiry impact CARBATROL sales?

Patent expiration facilitates generic entry, leading to price competition and reduced brand sales. However, strong brand recognition and formulation differences can sustain a niche market.

Q2: What are the primary competitors to CARBATROL?

Tegretol XR (generics included), and alternative long-acting ASMs like lamotrigine, oxcarbazepine, and valproate.

Q3: Which regions offer the greatest growth opportunities for CARBATROL?

The Asia-Pacific region, due to rising prevalence and expanding healthcare infrastructure, presents significant growth potential.

Q4: What strategies can manufacturers employ to maintain market share?

Investing in indication expansion, formulation enhancements, and global market access while managing cost and safety perceptions.

Q5: How might emerging therapies affect the future of CARBATROL?

Innovative treatments may reduce the size of the epileptic and bipolar patient populations or shift prescribing patterns, posing long-term market risks.

References

[1] WHO. Epilepsy Fact Sheet. World Health Organization. 2022.

[2] American Epilepsy Society. Epilepsy Statistics. 2023.

More… ↓