Share This Page

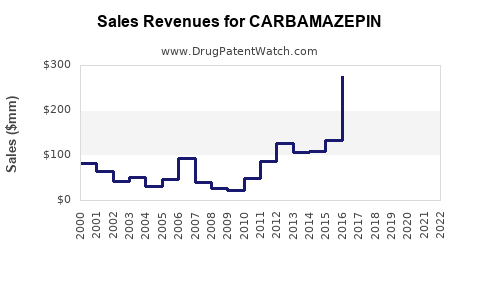

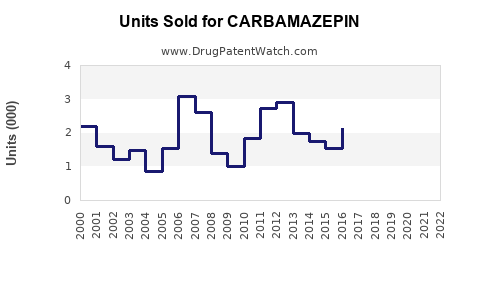

Drug Sales Trends for CARBAMAZEPIN

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for CARBAMAZEPIN

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| CARBAMAZEPIN | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| CARBAMAZEPIN | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| CARBAMAZEPIN | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| CARBAMAZEPIN | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Carbamazepine

Introduction

Carbamazepine, a staple anticonvulsant and mood stabilizer, has maintained a significant position in the pharmaceutical landscape since its initial approval. Its indications primarily include epilepsy, bipolar disorder, and trigeminal neuralgia. Despite the emergence of newer therapeutic agents, carbamazepine’s sustained efficacy, affordability, and longstanding clinical familiarity sustain its demand. This report delivers a robust market analysis and sales projection for carbamazepine, emphasizing current dynamics, growth drivers, existing competitive pressures, regulatory landscapes, and future market opportunities.

Market Landscape Overview

Historical Context and Current Market Size

Carbamazepine’s global market has experienced steady growth, historically driven by the high prevalence of epilepsy worldwide, estimated at approximately 50 million cases globally [1]. In 2021, the global anticonvulsant drug market was valued at approximately USD 4.2 billion and is projected to reach USD 6.2 billion by 2027, with carbamazepine constituting roughly 15-20% of this market share due to its entrenched use.

Geographic Segments

- North America: Dominates the market, owing to high diagnosis rates, advanced healthcare infrastructure, and approved use of carbamazepine for multiple indications.

- Europe: Similar to North America, with high prescription prevalence.

- Asia-Pacific: Exhibits fastest growth, driven by increasing epilepsy prevalence, expanding healthcare access, and pricing advantages.

Key Players

The market is characterized by a mix of branded formulations and generic versions. Major pharmaceutical companies include Novartis, Sun Pharma, Teva Pharmaceutical Industries, and Mylan. Their market shares fluctuate based on patent statuses and regional regulatory approvals.

Market Drivers

Prevalence and Diagnosis of Epilepsy

Epilepsy affects an estimated 50 million individuals globally, with higher prevalence in low- and middle-income countries (LMICs). Increased awareness, improved diagnostic techniques, and public health initiatives contribute to rising treatment rates where carbamazepine remains a first-line therapy.

Cost-Effectiveness and Established Use

Carbamazepine’s low cost and long-standing clinical reputation make it a preferred option, especially in resource-limited settings, bolstering its sustained demand.

Regulatory Approvals and Expanded Indications

Regulatory agencies globally affirm carbamazepine's safety and efficacy, with some approvals for mood stabilizing and neuralgia treatments, further supporting demand.

Availability of Generic Forms

Patent expirations and the proliferation of generic manufacturing substantially reduce costs, broadening access and consumption.

Market Challenges and Competitors

Emergence of Newer Agents

Newer antiepileptic drugs (AEDs), such as levetiracetam and lacosamide, offer improved safety profiles and fewer drug interactions. Their increasing adoption in certain markets threatens carbamazepine’s dominance.

Safety Concerns

Risk of agranulocytosis, hyponatremia, and Stevens-Johnson syndrome has moderated prescribing practices in some regions.

Regulatory Constraints

Stringent safety regulations and monitoring requirements intensify market entry barriers and impose compliance costs.

Market Trends and Innovations

- The shift toward personalized medicine is prompting research into pharmacogenomics to predict adverse reactions, especially HLA-B*1502 allele associations with severe skin reactions.

- Governments and non-governmental organizations (NGOs) are actively promoting AED access in LMICs, potentially increasing carbamazepine utilization.

Sales Projections

Assumptions and Methodology

Projections consider current market size, growth drivers, patent statuses, and competitive landscape over a 5-year horizon (2023-2028). Growth rates are adjusted regionally based on market dynamics, with a weighted average growth of approximately 4-6% annually.

Projected Market Growth

- 2023: USD 800 million in global sales (including branded and generic forms).

- 2025: USD 950 million, driven by expansion in Asia-Pacific and increased utilization in bipolar disorder.

- 2028: USD 1.2 billion, as demand stabilizes in mature markets but accelerates in developing regions.

Regional Sales Forecasts

| Region | 2023 (USD Million) | 2025 (USD Million) | 2028 (USD Million) | CAGR (2023-2028) |

|---|---|---|---|---|

| North America | 300 | 330 | 370 | ~4% |

| Europe | 250 | 280 | 330 | ~5% |

| Asia-Pacific | 150 | 200 | 270 | ~10% |

| Rest of World | 100 | 140 | 180 | ~7% |

Market Opportunities

- Rising epilepsy awareness and diagnosis in Asia and Africa.

- Potential for expanding formulations, such as controlled-release and combination therapies.

- Growing research into pharmacogenomics may optimize prescribing, expanding utilization.

Regulatory and Patent Outlook

While several formulations are off-patent, some branded formulations and newer delivery mechanisms hold patent protections, influencing market segmentation. Regulatory agencies in emerging markets facilitate easier registration of generic carbamazepine, enhancing accessibility.

Conclusion: Key Market Dynamics and Outlook

Despite challenges from newer AEDs with improved safety profiles, carbamazepine’s affordability, proven efficacy, and extensive clinical use sustain its market relevance. Projected CAGR of approximately 4-6% indicates incremental growth, especially propelled by expanding markets in Asia-Pacific and LMICs.

Key Takeaways

- Stable Demand: Carbamazepine remains a mainstay for epileptic and neuralgic conditions globally.

- Growth Drivers: Rising epilepsy prevalence, especially in LMICs, and broad generic availability underpin growth.

- Competitive Factors: Competition from newer AEDs and safety concerns necessitate ongoing pharmacovigilance and innovation.

- Future Opportunities: Pharmacogenomic insights, expanded formulations, and increased access initiatives could further propel sales.

- Market Sentiment: Strategic positioning in emerging markets presents significant revenue growth potential amid global health initiatives.

FAQs

Q1: How does the patent status of carbamazepine influence its market sales?

Patent expirations have led to the proliferation of generic formulations, drastically reducing prices and expanding accessibility, thereby maintaining sales volumes despite competition from newer drugs.

Q2: What are the main safety concerns impacting carbamazepine's market?

Risks of severe dermatological reactions, blood dyscrasias, and drug interactions have prompted regulatory warnings. Pharmacogenetic testing helps mitigate some safety issues, influencing prescribing patterns.

Q3: Which regions are expected to drive the most growth for carbamazepine?

Asia-Pacific and Africa are projected to witness the fastest growth due to increasing epilepsy prevalence, expanding healthcare infrastructure, and supportive healthcare policies.

Q4: How does the competition from newer AEDs affect carbamazepine?

While some newer drugs offer improved safety profiles, cost considerations and established efficacy make carbamazepine still relevant, especially in resource-limited settings.

Q5: What innovation trends are influencing the future of carbamazepine?

Development of new formulations (e.g., controlled-release), pharmacogenomic-guided prescribing, and combination therapies are key trends shaping its future market trajectory.

Sources:

- World Health Organization. Epilepsy Fact Sheet. 2022.

More… ↓