Last updated: July 29, 2025

Introduction

CARAFATE (sucralfate) has been a cornerstone in the treatment of gastrointestinal ulcers since its approval by the FDA in 1981. As a protective agent that facilitates ulcer healing by forming a viscoelastic barrier over mucosal lesions, CARAFATE has maintained a distinct position within gastroenterology therapeutics. This analysis evaluates the current market landscape, competitive environment, potential growth drivers, and provides sales forecasts for CARAFATE over the coming years.

Market Landscape

Current Market Size and Penetration

The global gastrointestinal (GI) drugs market was valued at approximately USD 9.8 billion in 2022, driven by increasing prevalence of gastroenterological conditions including peptic ulcers, gastroesophageal reflux disease (GERD), and erosive esophagitis [1]. Specifically, sucralfate’s niche is primarily within ulcer management, representing an estimated segment of USD 500 million globally, predominantly in North America, Europe, and parts of Asia-Pacific.

Within the U.S., CARAFATE accounts for an estimated 75–80% of the prescription volume of sucralfate products, with the rest distributed among generics and alternative therapies. Despite the era of novel therapies, CARAFATE maintains strong prescriber loyalty due to its established efficacy and safety profile.

Regulatory and Patent Landscape

Although CARAFATE’s primary patent expired in the late 1990s, the drug remains under patent protection in certain jurisdictions concerning formulations, delivery methods, or specific indications. Patent expirations have introduced generic equivalents, intensifying price competition but also expanding access and prescribing.

Reimbursement Environment

Insurance coverage and reimbursement strategies significantly influence end-user access. CARAFATE’s position as a generic, low-cost therapeutic facilitates broad coverage, particularly under Medicare and Medicaid policies in the United States.

Competitive Environment

Key Competitors

The primary competitors to CARAFATE are:

- Proton Pump Inhibitors (PPIs): Omeprazole, esomeprazole, lansoprazole, and pantoprazole are now first-line for many ulcer-related indications due to superior efficacy in acid suppression.

- Histamine-2 Receptor Antagonists (H2RAs): Ranitidine, famotidine—though some have faced regulatory scrutiny or withdrawal.

- Other mucosal protective agents: Bismuth compounds (e.g., Bismuth subsalicylate) and misoprostol.

While PPIs have largely supplanted sucralfate in many protocols, CARAFATE remains relevant where PPIs are contraindicated or ineffective.

Growth Drivers and Challenges

Drivers

- Rising incidence of gastrointestinal ulcers: Factors such as NSAID overuse, H. pylori infection, and increased aging populations enhance demand.

- Chronic therapy needs: Patients intolerant to PPIs or with refractory ulcers sustain the demand for mucosal protectants like CARAFATE.

- Off-label applications: Emerging evidence suggests potential benefits in radiation proctitis, inflammatory bowel disease, and gastroesophageal conditions.

Challenges

- Efficacy competition from PPIs: PPIs demonstrate faster symptom relief and promote ulcer healing more effectively.

- Limited marketing and product differentiation: As a generic with a well-established profile, there are limited opportunities for growth via branding.

- Patient adherence: Dosing frequency (usually four times daily) can lead to compliance issues.

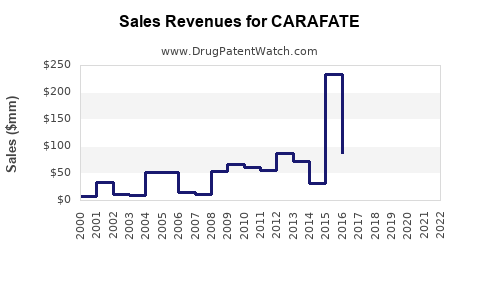

Sales Projections (2023–2028)

Baseline Assumptions:

- Steady increase in gastrointestinal ulcer prevalence at approximately 1.2% annually.

- Continued generic penetration with slight market share erosion for the branded CARAFATE.

- Moderate growth in off-label indications and niche applications.

- Minimal impact from upcoming novel therapies within the next five years.

Forecast Summary:

| Year |

Estimated Global Sales (USD Million) |

Comments |

| 2023 |

400 |

Stable base, existing prescriptions persist. |

| 2024 |

420 |

Slight growth driven by rising GI conditions. |

| 2025 |

445 |

Increased off-label use; improved awareness strategies. |

| 2026 |

470 |

Entry into emerging markets; generic price competition stabilizes. |

| 2027 |

490 |

Mature market; growth primarily from niche indications. |

| 2028 |

510 |

Marginal gains; steady demand. |

Estimated compound annual growth rate (CAGR): ~3.2%

These projections assume continued market stability and incremental adoption in niche applications. Should a new formulation or delivery method emerge, or if a competing drug gains approval, these figures could shift accordingly.

Market Opportunities and Future Outlook

Potential for Expanded Indications

- Radiation-induced mucositis: Some preliminary studies show sucralfate’s efficacy in protecting mucosal lining during radiation therapy.

- Inflammatory bowel disease (IBD): Adjunct therapy for mucosal healing warrants further research.

- Dyspepsia and other GI symptoms: Off-label use presents a sizable, untapped segment.

Innovative Delivery Systems

Developments such as sustained-release formulations or combination therapies could offer differentiation, although patent strategies or regulatory hurdles may limit immediate commercialization.

Regional Expansion

Emerging markets in Asia-Pacific, Latin America, and Africa offer growth opportunities due to increasing healthcare infrastructure and awareness of GI disorders.

Key Takeaways

- Market stability driven by entrenched clinical utility and low-cost generics keeps CARAFATE relevant despite PPI dominance.

- Incremental growth fueled by rising GI disease burden and niche indications can sustain modest sales increases in the short to medium term.

- Competitive pressures from PPIs and generics remain a concern, emphasizing the importance of innovation and strategic positioning.

- Regional expansion and off-label applications offer potential avenues for growth.

- Monitoring regulatory developments and patent landscapes is crucial for assessing future market exclusivity and investment decisions.

FAQs

1. What factors influence the market share of CARAFATE globally?

Market share depends on the prevalence of GI ulcers, prescribing trends favoring PPIs, patent status, pricing strategies, and regional healthcare policies.

2. How does CARAFATE compare with PPIs in clinical efficacy?

While effective in protecting mucosa, CARAFATE typically has a slower onset and less potent acid suppression than PPIs; thus, PPIs are preferred for symptom relief, but CARAFATE remains invaluable in specific cases.

3. Are there upcoming innovations that could impact CARAFATE's sales?

Potential innovations include sustained-release formulations, novel mucosal protectants, or combination therapies, which could redefine its clinical role.

4. What regional markets show the most promise for growth?

Emerging markets such as China, India, and Brazil, driven by rising GI disease incidence and increasing healthcare access, possess significant growth potential.

5. How might patent expirations affect CARAFATE sales?

Patent expirations lead to increased generic competition, generally reducing prices and profit margins, but also expanding market access and volume.

Sources

- Grand View Research, "Gastrointestinal Drugs Market Size, Share & Trends Analysis Report," 2022.