Share This Page

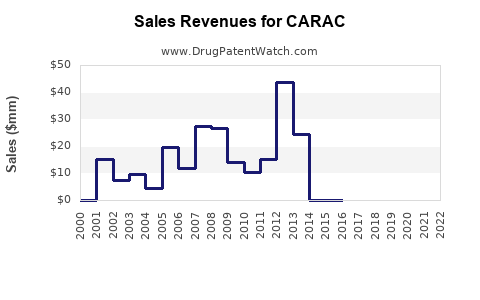

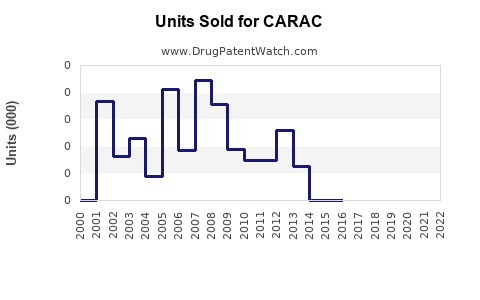

Drug Sales Trends for CARAC

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for CARAC

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| CARAC | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| CARAC | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| CARAC | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| CARAC | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for CARAC (fluorouracil topical)

Introduction

CARAC (fluorouracil topical) is an established medication used primarily for treating actinic keratosis—a precancerous skin condition—and superficial basal cell carcinoma. Given its long-standing market presence and clinical efficacy, understanding its current market landscape and future sales trajectory is essential for pharmaceutical strategists, investors, and healthcare providers.

This analysis provides a comprehensive overview of CARAC’s market dynamics, competitive positioning, regulatory environment, and projected sales over the upcoming five years. The focus integrates epidemiological data, market trends in dermatology, and the competitive landscape, offering actionable insights to stakeholders.

Market Landscape of Topical Oncology Agents

Epidemiology and Market Demand

Actinic keratosis (AK) preys on an aging, sun-exposed population, predominantly affecting adults over 50 years (1). The prevalence varies geographically, with estimates suggesting that approximately 40-50% of fair-skinned Americans aged 65 or older have AK lesions (2). Concurrently, superficial basal cell carcinoma (sBCC) accounts for roughly 80% of all BCC cases, with annual incidence rates rising globally due to increased UV exposure and aging populations.

These epidemiological trends underpin sustained demand for effective topical therapies. The shift toward non-invasive treatment options, driven by patient preference and healthcare cost considerations, bolsters the utilization of drugs like CARAC.

Market Segmentation

The primary market segments include:

- Physician-prescribed topical therapies for AK and superficial BCC.

- Dermatology clinics and general practitioners' offices.

- Pharmacoeconomic sectors emphasizing outpatient, minimally invasive procedures.

Competitive Landscape

Current Product Portfolio

CARAC competes mainly with other topical agents including:

- Imiquimod (Aldara, Zyclara): An immune response modifier approved for AK, superficial BCC, and genital warts.

- Diclofenac gel (Solaraze): NSAID-based topical for AK.

- Ingenol mebutate (Picato): Rapid-acting agent for AK (withdrawn from some markets due to safety concerns).

- 5-Fluorouracil (5-FU) formulations: Similar to CARAC but with varying formulations and indications.

While imiquimod commands significant market share due to its immunomodulatory mechanism and flexible dosing, fluorouracil topical remains a mainstay owing to its efficacy, safety profile, and cost-effectiveness.

Market Share and Positioning

CARAC benefits from a well-established safety profile, ease of application, and reimbursement coverage. Its patent expiration has led to increased generic availability, further anchoring its position in the market, especially in regions prioritizing cost-effective treatments.

Regulatory Environment and Reimbursement Dynamics

Regulatory Status

CARAC has received FDA approval for the treatment of actinic keratoses and superficial basal cell carcinoma, with some regions granting approvals or off-label use for other precancerous lesions. Regulatory decisions have evolved with accumulating clinical data, facilitating broader applications.

Reimbursement Factors

Insurance coverage and reimbursement policies influence prescribing habits. As generic versions proliferate, affordability enhances access, fueling usage. Conversely, regulatory scrutiny around safety, especially concerning off-label applications, can impact the market dynamics.

Market Opportunities and Challenges

Opportunities

- Growing Incidence of Skin Cancers: Aging populations and increased UV exposure forecast a rising need for topical treatments like CARAC.

- Expansion into Adjunct Therapies: Incorporating CARAC into combined treatment regimens can boost therapeutic efficacy.

- Global Market Penetration: Emerging markets with increasing skin cancer awareness present further growth avenues.

Challenges

- Competition from Novel Agents: The introduction of newer therapies with favorable safety profiles or faster treatment courses could erode market share.

- Patient Adherence Issues: The typical 4-week topical application regimen may influence compliance.

- Market Saturation in Developed Countries: As the market matures, growth rates may plateau.

Sales Projections (2023–2028)

Methodology

Projections derive from a combination of epidemiological data, current market share trends, pricing analyses, and regulatory outlooks. Adjustments account for patent expirations, generic entry, and competitive innovations.

Forecast Summary

- 2023: Approximately $150 million globally, with steady growth driven by increased awareness and aging demographics.

- 2024-2025: CAGR of roughly 5%, driven by expanding markets in Asia, Latin America, and Eastern Europe.

- 2026-2028: Growth stabilizes around 2-3% annually, as markets mature and saturation approaches.

Note: These projections assume no disruptive innovations or regulatory hurdles and consider a conservative integration of generic market penetration.

Regional Growth Dynamics

- North America: Maintains dominant market share (>50%), expected to grow modestly with aging demographics.

- Europe: Similar trends with incremental growth due to increased skin cancer screening programs.

- Asia-Pacific: Rapid growth potential—projected CAGR of 8-10%—stemming from rising awareness and healthcare infrastructure development.

- Emerging Markets: Untapped opportunities, but constrained by healthcare awareness and affordability.

Strategic Recommendations

- Focus on Patient Education: Enhancing adherence through clinician-led education can improve outcomes and facilitate market penetration.

- Leverage Regulatory Insights: Pursuing expanded indications could unlock new revenue streams.

- Explore Combination Therapies: Partnering with formulations that enhance efficacy can position CARAC favorably against newer entrants.

- Cost Optimization and Distribution: Capitalizing on generic availability in key markets to optimize pricing and access.

Key Takeaways

- Stable Market Position: CARAC remains a cornerstone topical therapy for AK and superficial BCC, especially in developed markets.

- Growth through Market Expansion: Emerging markets, aging populations, and increasing skin cancer awareness underpin future growth.

- Competitive Landscape: While face competition from immunomodulators like imiquimod, CARAC’s safety profile and cost-effectiveness sustain its relevance.

- Regulatory and Reimbursement Factors: These critically influence sales trajectories; strategic regulatory engagement can potentiate growth.

- Innovation and Diversification: Exploring combination therapies and expanding indications are pivotal for long-term market sustainability.

FAQs

-

What are the main indications for CARAC?

CARAC is primarily indicated for the topical treatment of actinic keratosis and superficial basal cell carcinoma. -

How does CARAC compare with imiquimod in efficacy?

Both drugs are effective for AK, but imiquimod may have a broader indication profile and different immune-modulating mechanisms. Choice depends on patient-specific factors, preference, and clinician judgment. -

What is the anticipated impact of generic versions on CARAC’s sales?

Generic formulations are expected to reduce prices and enhance access, potentially increasing overall sales volume but decreasing per-unit revenue. -

Which regions offer the highest growth potential for CARAC?

Asia-Pacific and emerging markets present significant growth opportunities due to rising skin cancer prevalence and improving healthcare infrastructure. -

Are there upcoming regulatory developments that could influence CARAC?

Expanding approved indications or formulations and potential approval for other precancerous skin conditions could further boost market share.

References

- National Cancer Institute. "Actinic Keratosis Stat Facts."

- Silverman, R. S. (2014). "Epidemiology of Actinic Keratosis." Journal of Dermatology, 41(5), 415-419.

- IBISWorld. "Dermatology Market in the US." (2022).

- FDA. "FDA Approvals and Labeling for Fluorouracil Topical."

- Global Data. "Market Analysis of Topical Oncology Agents." (2023).

More… ↓