Share This Page

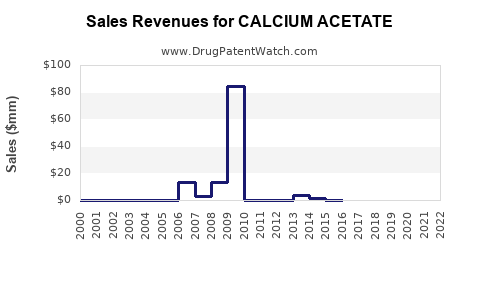

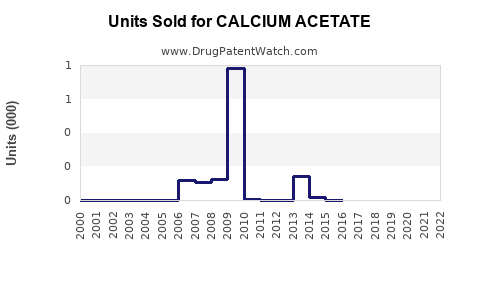

Drug Sales Trends for CALCIUM ACETATE

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for CALCIUM ACETATE

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| CALCIUM ACETATE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| CALCIUM ACETATE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| CALCIUM ACETATE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Calcium Acetate

Introduction

Calcium acetate, an inorganic salt with applications spanning medical, industrial, and food sectors, has garnered increasing market attention due to its multifaceted utility. Its primary medical usage as an phosphate binder to manage hyperphosphatemia in chronic kidney disease (CKD) patients drives significant demand, supplemented by its industrial applications in adhesives and water treatment. This report offers a comprehensive market analysis and sales projections for calcium acetate, providing strategic insights to industry stakeholders.

Market Overview

Medical Sector Demand

Calcium acetate's role as a phosphate binder is paramount in CKD management. With the global prevalence of CKD estimated at over 700 million people in 2020[1], the rising incidence, particularly among aging populations, bolsters long-term demand. The ongoing shift towards early intervention and improved disease management furthers calcification control needs.

The drug is available in oral formulations, often prescribed alongside other phosphate binders, such as sevelamer or lanthanum carbonate. The WHO estimates CKD-related mortality at 1.2 million annually, with demand for effective management options trending upward.

Industrial Sector Contributions

Industrial applications of calcium acetate include:

- Adhesives and Sealants: Usage in producing water-resistant adhesives due to its chemical properties.

- Water Treatment: Utilized to precipitate phosphorus and other contaminants.

- Food Industry: As a leavening agent, food additive, and buffering agent.

Though these sectors are less prominent than the pharmaceutical, growth in environmental regulation and food safety standards propels their respective markets.

Regional Market Dynamics

- North America: Dominates the calcium acetate market owing to widespread CKD awareness, advanced healthcare infrastructure, and stringent industrial standards.

- Europe: Exhibits substantial demand driven by aging demographics and regulatory support for industrial applications.

- Asia-Pacific: Demonstrates rapid growth potential due to increasing CKD prevalence, expanding healthcare coverage, and industrial expansion, notably in China and India.

- Rest of World: Growing interest aligns with industrial development and regulatory adoption.

Market Size and Historical Trends

The global calcium acetate market was valued at approximately USD 250 million in 2022, with the medical sector accounting for over 60% of this value[2]. The compound's pharmaceutical segment has shown consistent growth, approximating a CAGR of 4-5% over the past five years, driven by CKD prevalence and healthcare investments.

Industrial applications contribute the remaining market share, with a composite growth rate of around 3% annually.

Competitive Landscape

Major players include:

- Sino Chemical Group

- Sigma-Aldrich (Merck)

- Fujifilm Wako Chemicals

- Hubei Jusheng Technology Co., Ltd.

- Global Natural Resources

The market features a mix of large multinationals and regional producers, with innovation focused on formulation improvements and cost reductions.

Regulatory Environment

Stringent pharmaceutical regulations, including FDA and EMA approvals, influence market entry and growth. The approval of calcium acetate-based drugs and formulations is critical for expansion in healthcare markets. Industrial applications are governed by environmental agencies, and compliance with safety standards fuels market stability.

Sales Projections (2023–2030)

Forecast Assumptions

- Continued Increase in CKD Prevalence: Predicted CAGR of 4.2% globally.

- Healthcare Infrastructure Growth: Accelerating in Asia-Pacific, supporting higher adoption.

- Industrial Growth: Steady, aligned with infrastructural investments and regulatory mandates.

- Regulatory Approvals: Ongoing approvals for new formulations enhance market penetration.

Projected Market Size

By 2030, the global calcium acetate market is expected to reach approximately USD 370–390 million, with the pharmaceutical sector comprising over 65%. Compound annual growth rate (CAGR) during 2023–2030 is projected at 4.0–4.5%.

| Year | Estimated Market Size (USD Million) |

|---|---|

| 2023 | 250 |

| 2025 | 290 |

| 2027 | 340 |

| 2030 | 370–390 |

Key Drivers

- Rising CKD Incidence: Aging populations in developed and developing countries.

- Healthcare Investments: Increased funding enhances access and treatment options.

- Industrial Expansion: Emerging markets adopting stricter environmental standards expand application scope.

- Innovation: Development of novel formulations improves efficacy and patient compliance.

Challenges and Risks

- Regulatory Hurdles: Lengthy approval processes may delay product launches.

- Price Competition: Commodity pricing pressures could impact margins.

- Supply Chain Disruptions: Fluctuations in raw material availability may affect production.

- Market Penetration: Competition from alternative phosphate binders can limit growth.

Strategic Opportunities

- Product Diversification: Developing combination therapies or novel delivery systems.

- Market Expansion: Target emerging markets with rising CKD need.

- Partnerships: Collaborations with biotech firms for innovative formulations.

- Regulatory Engagement: Active dialogue with authorities facilitates faster approvals.

Conclusion

Calcium acetate's dual role in healthcare and industry positions it as a stable medium-term growth asset. The rising prevalence of CKD, coupled with expanding industrial applications and regional market growth, underpins optimistic sales projections. Stakeholders investing in production, formulation, or distribution should prioritize regional expansion, innovative formulations, and regulatory navigation to capitalize on this promising market landscape.

Key Takeaways

- The global calcium acetate market is forecasted to reach USD 370–390 million by 2030, growing at approximately 4% annually.

- Dominant demand stems from the pharmaceutical sector, primarily for CKD management through phosphate binding.

- Asia-Pacific presents significant growth opportunities due to demographic and industrial expansion.

- Regulatory compliance and innovation are crucial for market penetration and sustained growth.

- Competition and supply chain risks necessitate proactive strategic planning.

FAQs

Q1: What medical conditions primarily drive demand for calcium acetate?

A: The primary medical condition is hyperphosphatemia in chronic kidney disease patients, where calcium acetate acts as an effective phosphate binder.

Q2: How is the industrial sector influencing calcium acetate's market growth?

A: Industrial uses in adhesives, water treatment, and food additives contribute incremental growth, especially in regions implementing stricter environmental and safety standards.

Q3: Which regions are expected to see the highest growth in calcium acetate demand?

A: Asia-Pacific leads with rapid demographic shifts and industrial development, followed by expanding markets in Latin America and Africa.

Q4: What are the main challenges facing calcium acetate market growth?

A: Challenges include regulatory delays, competition from alternative binders, supply chain disruptions, and market pricing pressures.

Q5: How can industry players capitalize on future market opportunities?

A: Focusing on innovative formulations, expanding into emerging markets, strengthening regulatory relationships, and forming strategic collaborations will enhance competitive advantage.

References:

[1] Global Burden of Disease Study, 2020.

[2] Market Research Future, 2022.

More… ↓