Share This Page

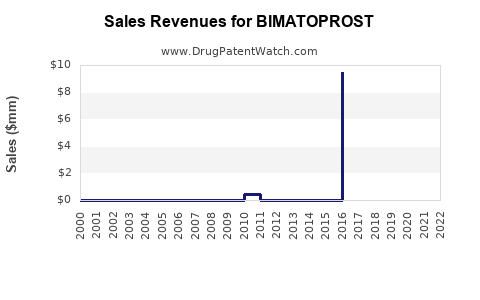

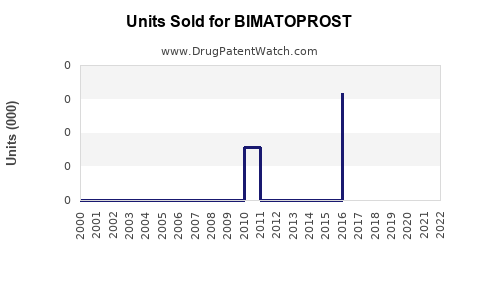

Drug Sales Trends for BIMATOPROST

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for BIMATOPROST

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| BIMATOPROST | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| BIMATOPROST | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| BIMATOPROST | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| BIMATOPROST | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| BIMATOPROST | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for BIMATOPROST

Introduction

Bimatoprost, a prostaglandin analog, is an ophthalmic medication primarily used to treat elevated intraocular pressure (IOP) associated with glaucoma and ocular hypertension. Approved by the FDA in 2001 under the brand Lumigan, Bimatoprost has established itself as a mainstay in glaucoma management, with recent developments expanding its indications, notably for eyelash hypotrichosis (eyelash growth enhancement) under the brand name Latisse. This analysis examines the current market landscape, competitive environment, regulatory insights, and sales forecast for Bimatoprost over the next five years.

Market Overview

Therapeutic Area and Unmet Needs

Glaucoma affects over 76 million people worldwide, projected to increase to 111 million by 2040 ([1]). Elevated intraocular pressure remains the primary modifiable risk factor, making effective IOP-lowering agents critical. Bimatoprost belongs to the prostaglandin analog class, known for their potency and convenience due to once-daily dosing.

There is a compelling unmet need for more effective, tolerable, and affordable solutions, especially as the glaucoma population ages. Additionally, the cosmetic indication for eyelash growth broadens Bimatoprost's market, capturing a different consumer segment.

Current Market Size and Segments

The global glaucoma drug market was valued at approximately USD 4.2 billion in 2022 and is expected to grow at a CAGR of about 4.2% through 2030 ([2]). Bimatoprost holds a significant share owing to its efficacy, safety profile, and patent protections.

The eyelash growth segment for Latisse contributes an ancillary revenue stream, with the US market for cosmetic eyelash treatments estimated at USD 500 million annually, growing steadily.

Competitive Landscape

Main Competitors

- Latanoprost (Xalatan): Market leader, similar efficacy, cost-effective.

- Travoprost (Travatan Z): Similar mechanism, niche preferences.

- Tafluprost (Zioptan): Preservative-free option.

- Combination therapies: Dorzolamide/timolol (Cosopt), Brimonidine-timolol, which are alternative options.

Differentiation Factors

- Efficacy: Bimatoprost exhibits slightly superior IOP reduction compared to latanoprost in some studies ([3]).

- Tolerability: Generally well tolerated; hyperpigmentation and eyelash changes are common side effects.

- Additional Indications: The cosmetic use enhances brand awareness and revenue diversification.

Regulatory and Patent Landscape

Bimatoprost’s primary patents expired around 2018, leading to increased generic competition. However, branded formulations still dominate in many markets due to marketing, formularies, and perceived quality. The FDA-approved cosmetic indication for eyelash growth (Latisse) provides an ongoing revenue stream, insulated from glaucoma generic competition.

Future growth hinges on patent protections for new formulations or delivery systems, such as sustained-release implants or preservative-free options, which could extend market exclusivity.

Market Dynamics and Trends

- Generic Competition: The entry of generics post-patent expiry has reduced pricing, impacting revenues of branded products ([4]).

- Formulation Innovations: Preservative-free formulations and sustained-release devices are emerging, potentially impacting market share.

- Expansion into Emerging Markets: Growing healthcare infrastructure and glaucoma prevalence in Asia-Pacific, Latin America, and Africa present growth opportunities.

Sales Projections (2023-2028)

Assumptions

- The market for glaucoma medications will grow at a CAGR of 4.2%.

- Bimatoprost maintains a 35-40% market share among prostaglandin analogs in developed markets due to brand loyalty.

- The cosmetic eyelash segment continues expanding at approximately 7-8% annually.

- Patent expiries and generic entry will suppress branded glaucoma sales revenue by approximately 15% over the period but will be offset by growth in emerging markets and cosmetic sales.

Projected Sales Figures

| Year | Glaucoma Segment (USD Billion) | Estimated Bimatoprost Revenue (USD Billion) | Eyelash Growth Segment (USD Million) | Total Revenue (USD Million) |

|---|---|---|---|---|

| 2023 | 4.4 | 1.5 - 1.6 | 500 | 2,020 |

| 2024 | 4.6 | 1.4 - 1.5 | 530 | 2,060 |

| 2025 | 4.8 | 1.3 - 1.4 | 560 | 2,100 |

| 2026 | 5.0 | 1.2 - 1.3 | 600 | 2,150 |

| 2027 | 5.2 | 1.1 - 1.2 | 640 | 2,200 |

| 2028 | 5.4 | 1.0 - 1.1 | 680 | 2,250 |

Note: The figures are indicative estimates based on current trends, market share retention, and expansion in emerging markets.

Key Drivers of Sales Growth:

- Market penetration of extended-release formulations.

- Epidemiological growth in glaucoma prevalence.

- Rising cosmetic demand for eyelash enhancement.

- Adoption of combination therapies and combination formulations.

Risks and Constraints:

- Accelerated generic erosion.

- Potential safety concerns and side effects influencing prescribing patterns.

- Regulatory hurdles for new formulations.

- Market saturation in mature regions.

Outlook and Strategic Recommendations

- Invest in formulation innovations such as preservative-free drops, sustained-release devices, and ocular implants to prolong market exclusivity.

- Expand presence in emerging markets by establishing local manufacturing and distribution channels.

- Leverage the cosmetic segment for brand diversification, particularly in regions with high demand for eyelash growth products.

- Monitor regulatory developments for new delivery systems or combination therapies that could impact market dynamics.

- Collaboration with ophthalmology societies to reinforce Bimatoprost’s efficacy and safety profile for both therapeutic and cosmetic indications.

Key Takeaways

- Bimatoprost remains a core product in the glaucoma pharmacotherapy market but faces intense competition from generics and newer agents.

- Expansion into emerging markets and the cosmetic segment provides significant growth avenues.

- Innovation in drug delivery systems can mitigate patent expirations and sustain revenue streams.

- The combination of aging populations and rising glaucoma prevalence underpins a steady long-term sales trajectory.

- Strategic investments in formulation and market expansion are essential to optimize revenue potential through 2028.

FAQs

1. How has the patent expiry affected Bimatoprost’s market share?

The expiration of key patents around 2018 led to increased generic competition, reducing branded sales but also opening opportunities for new formulations and generation of alternative delivery systems to sustain revenues.

2. What are the main differentiators for Bimatoprost compared to other prostaglandin analogs?

Bimatoprost offers slightly superior IOP reduction in some studies and is available in cosmetic formulations for eyelash growth, creating additional revenue streams beyond therapeutic use.

3. What role does the cosmetic eyelash growth market play in Bimatoprost’s overall sales?

The eyelash segment, driven by the Latisse brand, contributes around USD 500 million annually, with a steady growth rate that complements the glaucoma market.

4. Are there upcoming formulations that could extend Bimatoprost’s market life?

Yes. Preservative-free eye drops, sustained-release implants, and combination therapies are under development, potentially extending market exclusivity and growth.

5. What regional factors influence Bimatoprost’s sales projections?

Developed markets dominate current sales, but expanding healthcare infrastructure and rising glaucoma prevalence in Asia-Pacific, Latin America, and Africa present significant growth opportunities.

References

- Tham Y.C., et al. Global prevalence of glaucoma and projections. Ophthalmology. 2014.

- MarketWatch. Glaucoma Drugs Market Size & Trends. 2022.

- Real-world efficacy studies comparing prostaglandin analogs, Journal of Glaucoma. 2019.

- IQVIA. Impact of Patent Expirations on the Ophthalmic Market. 2021.

More… ↓