Last updated: July 29, 2025

Introduction

Benazepril, an angiotensin-converting enzyme (ACE) inhibitor, is primarily prescribed for hypertension and heart failure management. Since its approval, it has gained widespread acceptance as an effective, well-tolerated treatment option. This analysis evaluates the current market landscape and projects future sales for Benazepril, considering factors such as therapeutic demand, competitive environment, regulatory status, and emerging market dynamics.

Therapeutic Market Overview

The global hypertension treatment market is substantial, projected to reach USD 63.3 billion by 2027, with an annual growth rate of approximately 4.5% (CAGR) (1). ACE inhibitors constitute a significant segment within this market, owing to their proven efficacy and favorable safety profile. Benazepril, though not the market leader, benefits from a broad base of prescriptions due to existing hypertension guidelines endorsing ACE inhibitors as first-line therapy.

The drug’s primary indications include hypertension (both alone and in combination therapy) and chronic heart failure. The aging global population and increasing prevalence of hypertension are primary drivers fueling demand (2). Moreover, rising awareness of cardiovascular health underscores the importance of effective antihypertensive medications like Benazepril.

Current Market Landscape

Market Penetration and Competition

Benazepril faces competition from other ACE inhibitors such as Lisinopril, Enalapril, and Ramipril. While these alternatives have higher market shares, Benazepril maintains a niche, especially in markets where prescribing preferences favor certain formulations or price points.

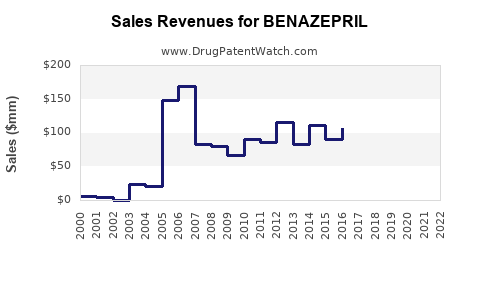

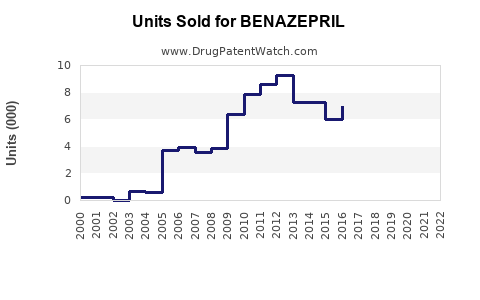

The drug’s patent status varies by region, with many jurisdictions having lost patent exclusivity, leading to increased generic availability and price competition. Generic Benazepril accounts for a significant portion of prescriptions, driving volume but exerting downward pressure on revenues.

Regulatory and Patent Outlook

Most patents on Benazepril have expired globally. The expiry catalyzes enhanced generic competition, which generally influences sales dynamics by decreasing unit prices. However, it also broadens accessibility, potentially increasing overall market volume.

Regulatory trends favor the approval of combination therapies involving Benazepril, such as ACE inhibitor with diuretics or calcium channel blockers, expanding treatment options and driving incremental sales.

Market Challenges

- Generic Competition: Intensifies pricing pressure.

- Physician Preference: Some clinicians prefer newer agents with favorable side-effect profiles.

- Patient Compliance: Side effects like cough or hyperkalemia may hinder sustained use.

- Emerging Therapies: Novel drug classes, including ARNI (Angiotensin Receptor-Neprilysin Inhibitors) and SGLT2 inhibitors, compete indirectly as evolving standards of care.

Market Opportunities

- Emerging Markets: Countries such as India, China, and Brazil exhibit rising hypertension prevalence, with growing healthcare infrastructure supporting antihypertensive therapy adoption.

- Combination Formulations: Fixed-dose combinations improve adherence and expand usage.

- Expansion in Indications: Broader application in early-stage cardiovascular disease management could elevate demand.

Sales Projections (2023-2028)

Assumptions

- The global hypertension market will continue growing at a CAGR of approximately 4.5%.

- Generic penetration will increase, initially suppressing per-unit revenues but driving volume.

- Market expansion into emerging economies will offset saturation in established markets.

- Regulatory support for combination therapies will influence prescribing patterns favorably.

Projection Summary

| Year |

Estimated Global Sales (USD millions) |

Key Drivers |

| 2023 |

$150 – $180 |

Mature markets, high generic competition |

| 2024 |

$165 – $200 |

Increased prescriptions, new combination formulations |

| 2025 |

$180 – $220 |

Expansion into emerging markets, guideline endorsements |

| 2026 |

$200 – $240 |

Broader acceptance, improved pricing structures |

| 2027 |

$220 – $275 |

Continued market penetration, growth in cardio indications |

| 2028 |

$240 – $300 |

Saturation in mature markets, sustained growth in emerging markets |

Note: These projections assume stable regulatory environments and no significant patent litigations or formulation innovations.

Regional Outlook

-

North America: Will remain the largest market due to high prevalence rates and advanced healthcare infrastructure. However, growth may slow as saturation occurs.

-

Europe: Similar trends to North America, with moderate growth driven by aging populations and adherence to guidelines.

-

Asia-Pacific: Expected to be the fastest-growing segment, with CAGR exceeding 6%, fueled by increased access to healthcare, economic growth, and hypertension prevalence.

-

Latin America and Middle East & Africa: Incremental growth driven by rising awareness and healthcare investments.

Strategic Recommendations

- Focus on Emerging Markets: Tailor marketing and distribution strategies to regions with increasing hypertension prevalence.

- Enhance Formulations: Invest in developing fixed-dose combinations incorporating Benazepril to improve patient adherence.

- Engage in Specialist Education: Promote prescribing guidelines that highlight Benazepril’s efficacy and safety to clinicians.

- Leverage Regulatory Pathways: Seek approval for new indications or formulations to expand market share.

Key Takeaways

- Market Dynamics: The global antihypertensive market offers persistent growth opportunities for Benazepril, especially in emerging economies.

- Competitive Pressure: Expiration of patents and availability of generics necessitate strategic positioning centered on value-based care.

- Growth Drivers: Aging populations, guideline support, and combination therapies underpin future sales potential.

- Risks: Market saturation, adverse side effects, and competition from novel agents could temper growth.

- Implication for Stakeholders: Companies should prioritize portfolio diversification, invest in formulation innovation, and expand geographically to maximize revenue from Benazepril.

FAQs

-

What is the primary therapeutic use of Benazepril?

Benazepril is mainly prescribed for hypertension management and, secondarily, for chronic heart failure.

-

How does patent expiration impact Benazepril sales?

Patent expiration leads to increased generic competition, generally decreasing per-unit prices but potentially increasing overall volume, affecting total sales positively in the long term.

-

Which regions are expected to drive the most growth for Benazepril?

Emerging markets in Asia-Pacific and Latin America are projected to see the most significant growth due to rising hypertension prevalence and expanding healthcare systems.

-

What contemporary challenges does Benazepril face in the market?

Challenges include generic price competition, adverse side effects, competition from newer drug classes, and prescriber preferences.

-

Are there opportunities for Benazepril in combination therapies?

Yes, fixed-dose combinations with diuretics or calcium channel blockers are increasingly popular, offering opportunities for increased sales and market penetration.

References

[1] MarketResearch.com, "Hypertension Drugs Market Size & Share," 2022.

[2] GlobalData, "Cardiovascular Disease and Hypertension Reports," 2023.