Share This Page

Drug Sales Trends for Advair

✉ Email this page to a colleague

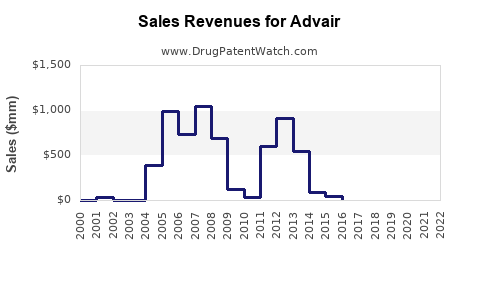

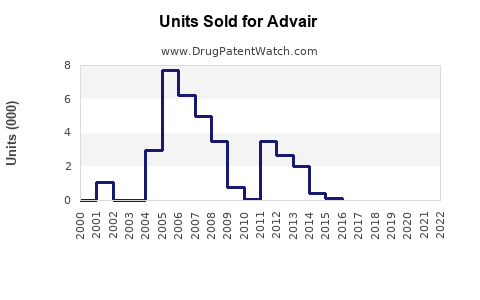

Annual Sales Revenues and Units Sold for Advair

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| ADVAIR | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| ADVAIR | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| ADVAIR | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| ADVAIR | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| ADVAIR | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| ADVAIR | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Advair

Introduction

Advair, a combination inhaler containing fluticasone propionate and salmeterol xinafoate, has been a cornerstone in the management of asthma and chronic obstructive pulmonary disease (COPD) since its approval. Its pharmacological efficacy, longstanding market presence, and evolving competitive landscape necessitate a detailed market analysis and sales forecast. This report synthesizes current market dynamics, competitive pressures, regulatory trends, and epidemiological factors influencing Advair’s future sales trajectory, offering key insights for stakeholders.

Market Overview

Global Respiratory Drug Market

The global respiratory drugs market was valued at approximately US$24.4 billion in 2021 and is projected to grow at a CAGR of 4.3% through 2028 [1]. Key segments include inhaled corticosteroids (ICS), long-acting beta-agonists (LABAs), combination inhalers, and other supportive therapies. Advair, as a leading combination inhaler, occupies a significant market share within this segment, particularly in developed regions.

Historical Sales Performance

Prior to patent expiry and the advent of generics, Advair reported peak annual sales exceeding US$9 billion worldwide (2014–2015) [2]. However, sales waned following patent challenges and the entrance of biosimilar competitors, reflective of typical brand erosion in pharmaceutical markets.

Epidemiological Trends

Asthma affects approximately 262 million individuals globally, while COPD impacts over 200 million, with increasing prevalence driven by aging populations, smoking rates, and environmental factors [3]. These epidemiological trends underpin a constantly expanding potential patient pool requiring inhaler therapies like Advair or its generics.

Competitive Landscape

Patent Challenges and Generic Entry

Advair’s patent protection expired in the U.S. in 2019, leading to the entry of generic versions by multiple manufacturers. While generics typically exert downward pressure on prices and sales, branded versions like Advair maintain market share through physician preferences and treatment protocols, particularly where biosimilars are not yet entrenched.

Emerging Alternatives

Newer fixed-dose combination inhalers, such as Trelegy Ellipta (GSK) and Breztri Aerosphere (AstraZeneca), offer expanded therapeutic options with potentially better compliance or reduced side effects, intensifying competition.

Regulatory and Reimbursement Impacts

Various health authorities and payers have adopted strict formularies and cost-containment measures. For instance, in the U.S., Medicare and Medicaid favor lower-cost generics, impacting Advair’s profitability. Conversely, in regions with delayed biosimilar uptake or regulatory barriers, Advair sustains higher sales.

Market Dynamics Influencing Sales

Physician Prescribing Trends

Physicians tend to prescribe cost-effective generics once patents expire, although some markets and physicians continue to prefer branded inhalers for perceived efficacy or patient preference. Educational campaigns emphasize the clinical equivalence of generics, but brand loyalty persists.

Patient Adherence and Device Preference

Advair’s device design and delivery mechanism influence adherence and prescribing choice. Small molecule formulations and inhaler devices with improved usability could impact sales, especially in demographics with inhaler technique challenges.

Regulatory and Patent Litigation

Ongoing patent litigations are common, sometimes delaying generic entry and sales decline. Post-legal resolution, the market rapidly shifts toward generics, affecting sales projections.

Sales Projection Methodology

Data Assumptions

- Post-patent expiration sales decline: A conservative decline of 10–15% annually as generics enter the market.

- Market penetration of generics: Estimated to reach 80–90% within 2–3 years post-patent expiry.

- Regional variations: U.S. and Europe exhibit a faster decline due to generic competition; emerging markets may sustain higher sales levels due to delayed access.

- New formulations or indications: Potential incremental sales if Advair or its successors are approved for new indications.

Forecast Summary

| Year | Estimated Global Sales (USD billion) | Notes |

|---|---|---|

| 2023 | $1.25 | Transition phase; generic competition gaining momentum |

| 2024 | $0.95 | Expanded generic penetration; branded sales decline continues |

| 2025 | $0.70 | Market stabilization; potential growth if reformulations or new indications emerge |

| 2026 | $0.55 | Further erosion barring unique product differentiators |

| 2027 | $0.45 | Predominantly generic market; small residual branded sales |

Market Opportunities and Risks

- Opportunities: Development of once-daily formulations, personalized inhaler devices, or adjunct therapies may extend product lifecycle.

- Risks: Accelerated generic uptake, regulatory hurdles, and compensation pressures in high-income markets threaten sustained sales.

Conclusion

Advair’s sales landscape is transitioning from a blockbuster branded inhaler to a primarily generic market played out across global markets. While initial decline post-patent expiry was steep, residual sales persist due to brand loyalty, device preference, and regional market delays in generic adoption. Market growth will hinge on device innovation, pipeline developments, and healthcare policy decisions impacting affordability and accessibility.

Key Takeaways

- Market Erosion: Advair’s sales are poised for continued decline driven by generic competition, with projections indicating a gradual decrease over the next five years.

- Patent and Regulatory Dynamics: Patent expiries have opened the market to generics, with regulatory environments dictating the pace and extent of sales erosion.

- Strategic Focus: Companies should prioritize device innovation, explore new indications, and consider pipeline diversification to extend market relevance.

- Regional Variability: U.S. and European markets will see faster declines compared to emerging markets where generics' adoption lags.

- Investment Implication: Stakeholders should calibrate expectations, emphasizing portfolio diversification and R&D investments in next-generation inhaled therapies.

FAQs

1. How has Advair’s patent expiration affected its market sales?

Patent expiration in 2019 led to widespread generic entry, resulting in a significant decline in Advair’s branded sales. The brand’s global revenue dropped from over US$9 billion pre-patent expiry to a fraction of that within a few years, primarily due to price competition and generic substitution.

2. What are the primary competitors to Advair in the inhaler market?

Emerging inhalers such as Trelegy Ellipta (GSK), Breztri Aerosphere (AstraZeneca), and other combination inhalers offer similar or expanded efficacy with different device features, intensifying competitive pressure.

3. Can Advair’s sales rebound through new market strategies?

Rebound prospects are limited post-patent, but targeted strategies like device innovation, new therapeutic indications, and patient adherence programs can sustain residual sales or facilitate niche market advantages.

4. What regions are most affected by Advair’s sales decline?

The United States and Europe experience rapid sales erosion due to mature markets and swift generic uptake. Conversely, regions like Asia-Pacific and Latin America may see delayed declines owing to regulatory and market access differences.

5. What is the outlook for Advair’s successor formulations?

Next-generation formulations with improved dosing regimens, inhaler devices, or combination therapies could sustain or grow sales if approved for new indications or if they improve patient compliance effectively.

References

[1] MarketsandMarkets, “Respiratory Drugs Market,” 2022.

[2] IQVIA, “Pharmaceutical Market Reports,” 2015–2022.

[3] Global Initiative for Asthma, “Global Strategy for Asthma Management and Prevention,” 2022.

More… ↓