Share This Page

Drug Sales Trends for AVODART

✉ Email this page to a colleague

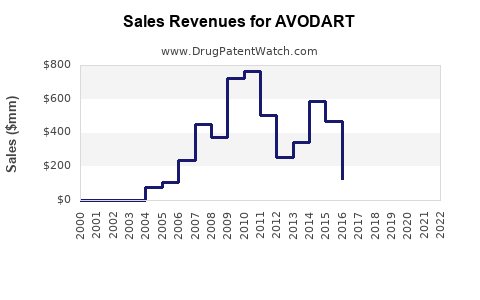

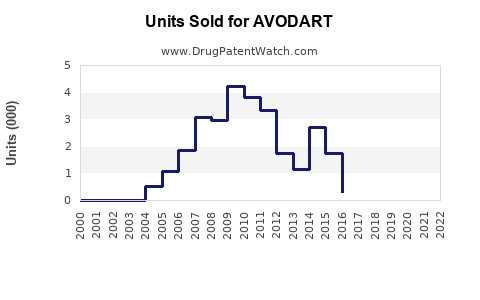

Annual Sales Revenues and Units Sold for AVODART

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| AVODART | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| AVODART | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| AVODART | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| AVODART | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| AVODART | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for AVODART (Dutasteride)

Introduction

AVODART (dutasteride) is a medication primarily used to treat benign prostatic hyperplasia (BPH). Given its established therapeutic profile and extensive patent protections, understanding its market landscape and forecasting future sales are crucial for pharmaceutical stakeholders and investors. This report offers a comprehensive market analysis of AVODART, examining current sales dynamics, competitive positioning, regulatory influences, and projecting future revenue streams.

Pharmacological Profile and Therapeutic Indications

Dutasteride, marketed under AVODART, inhibits 5-alpha-reductase enzymes (types I and II), decreasing dihydrotestosterone (DHT) levels. DHT promotes prostate growth; thus, dutasteride reduces prostate size, alleviating BPH symptoms. Additionally, emerging research suggests potential applications for androgenic alopecia (male pattern baldness), expanding its market scope.

Current Market Landscape

Global Sales Performance

Since its approval in 2002 in Japan and subsequently in the US (2009), AVODART has established itself as a leading BPH therapy. According to IQVIA data, global sales peaked around $1.3 billion in 2021, maintaining a steady growth trajectory despite increased competition. The US remains the largest market, accounting for approximately 60% of sales, driven by high BPH prevalence among aging males and clinical familiarity with dutasteride.

Key Markets and Regional Dynamics

- United States: Holds dominant position with established prescribing patterns, insurance reimbursements, and extensive clinical guidelines endorsing dutasteride.

- Europe: Growing adoption, particularly in the UK, Germany, and France, fueled by ongoing clinical studies and guideline endorsements.

- Asia-Pacific: Emerging market with expanding awareness; countries like Japan and China exhibit increased BPH treatment prevalence, but sales are still constrained by pricing and regulatory barriers.

Market Penetration and Competition

The primary competitor is finasteride (Proscar, Propecia), a selectively targeting Type II 5-alpha-reductase, versus dutasteride's dual inhibition, providing broader efficacy. Tadalafil (Cialis), used off-label for BPH and with FDA approval for BPH-LUTS, represents a parallel therapeutic class.

Patent and Regulatory Landscape

Patent exclusivity for AVODART in major markets extends to approximately 2024-2026, with generic versions anticipated thereafter. Patent cliffs threaten future sales volumes, prompting the manufacturer to diversify indications.

Drivers of Market Growth

- Aging Population: The global demographic shift towards older populations elevates BPH prevalence, projected to increase annual diagnostics and prescriptions.

- Clinical Practice Guidelines: Recommendations from the American Urological Association (AUA) and European Urological Association (EAU) favor dutasteride for suitable BPH cases, bolstering demand.

- Combination Therapy Potential: Combining dutasteride with alpha-blockers like tamsulosin improves symptomatic relief, expanding prescriber options.

- Emerging Indications: Ongoing research into conditions such as male pattern baldness and prostate cancer prevention could unlock new markets.

Challenges Impacting Sales Projections

- Generic Competition: Patents expiring within the next few years threaten revenue streams. The influx of generics typically results in substantial price erosion, reducing per-unit sales.

- Pricing Pressures: Reimbursement policies and cost-containment measures, especially in Europe and emerging markets, constrain profit margins.

- Side-Effect Profile: Concerns regarding sexual dysfunction and other adverse effects influence physician prescribing behavior.

- Market Saturation: In mature markets like the US and Europe, the growth rate may plateau as most eligible patients are already treated.

Sales Projections (2023–2030)

Base Scenario

- 2023: Sales hover around $1.2 billion, reflecting stabilized demand, patent protections, and ongoing adoption.

- 2024–2026: Post-patent expiry, sales decline by 15–20% annually due to generic competition; projected to stabilize around $600–$800 million.

- 2027–2030: Potential stabilization at $400–$700 million, contingent on development of new indications, combination therapies, and regional market expansions.

Optimistic Scenario

- Successful expansion into new indications (e.g., male pattern baldness, prostate cancer prevention) could offset declines, with potential sales reaching upwards of $1 billion by 2030.

Conservative Scenario

- Market share erosion and pricing pressures could limit sales to approximately $300 million by 2030, primarily confined to remaining resistant markets.

Strategic Opportunities and Threats

Opportunities

- New Indications: Capitalizing on ongoing research for alopecia and prostate cancer.

- Formulation Innovations: Development of extended-release or combination formulations.

- Regional Expansion: Accelerated entry into emerging markets with tailored pricing strategies.

Threats

- Generics: Rapid adoption post-patent expiry reducing market share.

- Competitive Therapies: Emergence of new drug classes offering superior efficacy or safety profiles.

- Regulatory Challenges: Stringent approval criteria in global markets could delay new indications or formulations.

Regulatory and Market Outlook

Regulators favor treatments with proven safety. The upcoming expiry of patents will catalyze market entry of generics, substantially affecting sales, unless the company leverages intellectual property for new formulations or indications. Persistent clinical evidence supporting dutasteride's broader therapeutic benefits could fortify its market position despite generic competition.

Key Takeaways

- Market Dominance: AVODART holds a significant share in the BPH treatment market, primarily driven by the aging demographic and clinical adoption.

- Patents and Generics: Patent expiration around 2024–2026 poses a substantial risk; strategic planning for product differentiation is essential.

- Growth Drivers: Expansion into indications like male pattern baldness and prostate cancer prevention, along with combination therapy offerings, present lucrative opportunities.

- Market Challenges: Pricing pressures, competition, and adverse effects necessitate ongoing innovation and marketing strategies.

- Future Outlook: Sales are expected to decline post-patent expiry but could be stabilized or amplified through new uses and regional growth initiatives.

Conclusion

AVODART’s future sales trajectory will hinge on navigating patent cliffs, expanding indications, and competitive positioning. While near-term sales face erosion due to generic entry, strategic diversification offers pathways to sustain and grow revenue streams.

FAQs

1. When does patent protection for AVODART expire, and what impact will this have?

Patent protection in major markets is set to expire around 2024–2026. This will likely lead to a surge in generic versions, significantly reducing branded sales and prompting the manufacturer to diversify into new indications and formulations.

2. What are the main competitors to AVODART in BPH treatment?

Finasteride (Proscar), another 5-alpha-reductase inhibitor, is the primary competitor. Tadalafil (Cialis), used off-label for BPH, also competes by offering a different mechanism for symptomatic relief.

3. Are there emerging indications that could sustain AVODART’s sales?

Yes, ongoing research suggests potential for dutasteride in treating male pattern baldness and in prostate cancer prevention, which could expand its market beyond BPH.

4. How do regional differences affect AVODART’s market potential?

In the US and Europe, mature markets with high BPH prevalence and established prescribing patterns provide stable revenue bases. In Asia-Pacific and Latin America, growth opportunities depend on regulatory processes, affordability, and healthcare infrastructure.

5. What strategies can enhance AVODART’s market longevity?

Developing new formulations, securing approvals for additional indications, pursuing regional expansion, and strategic pricing can help maintain competitiveness as patent protections expire.

Sources

- IQVIA. (2022). Global Prescription Drug Market Data.

- U.S. Food and Drug Administration (FDA). (2022). AVODART (dutasteride) Approval History.

- European Medicines Agency (EMA). (2022). Market Authorization grants for Dutasteride in Europe.

- American Urological Association. (2021). Guidelines for the Treatment of BPH.

- MarketResearch.com. (2022). Urology Drug Market Trends and Forecasts.

More… ↓