Share This Page

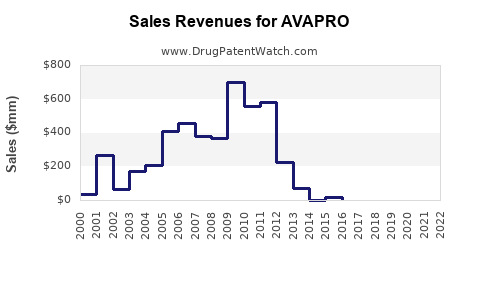

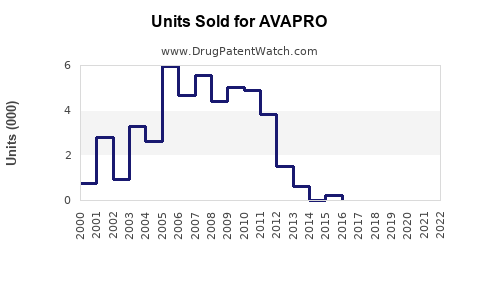

Drug Sales Trends for AVAPRO

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for AVAPRO

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| AVAPRO | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| AVAPRO | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| AVAPRO | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| AVAPRO | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| AVAPRO | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| AVAPRO | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for AVAPRO (Irbesartan)

Introduction

AVAPRO (irbesartan) is a widely prescribed angiotensin II receptor blocker (ARB) primarily indicated for the treatment of hypertension and diabetic nephropathy. Since its introduction in the early 2000s, AVAPRO has established a significant footprint within the cardiovascular and renal disease therapeutics market. This analysis evaluates the current market landscape, competitive positioning, regulatory environment, and forecasts future sales trends for AVAPRO.

Market Overview

Global Cardiovascular and Renal Disease Market Dynamics

The global cardiovascular disease (CVD) therapeutics market is projected to reach USD 27.5 billion by 2027, growing at a compound annual growth rate (CAGR) of approximately 4.2% (Research and Markets, 2022). Concurrently, the global diabetic nephropathy treatment market is anticipated to surpass USD 3 billion by 2025. The burden of hypertension affects roughly 1.3 billion individuals worldwide, with suboptimal treatment adherence fueling demand for effective antihypertensive agents like AVAPRO.

Therapeutic Class and Clinical Positioning

Irbesartan belongs to ARBs, a class known for favorable tolerability, renal protective effects, and reduced adverse events compared to ACE inhibitors. Its clinical efficacy in managing hypertension and preventing diabetic renal deterioration positions AVAPRO favorably among first-line therapies.

Competitive Landscape

Major Competitors

Key competing drugs include Losartan (Cozaar), Valsartan (Diovan), Olmesartan (Benicar), and Telmisartan (Micardis). While each ARB presents distinct pharmacokinetic profiles, the global prominence of ARBs ensures robust competition. AVAPRO’s differentiators are its proven renal benefits and tolerability, supported by clinical trials like the IRMA II study emphasizing renal outcomes.

Market Penetration and Prescriber Preferences

Despite stiff competition, AVAPRO maintains a solid market share, attributed to strong physician familiarity, preferential reimbursement policies, and favorable side effect profile. Its positioning benefits from longstanding clinical data reinforcing its safety and efficacy.

Regulatory and Reimbursement Environment

Regulatory Approvals

Originally approved by the FDA in 2004, AVAPRO has regulatory approvals across major markets, including the European Union, Japan, and various emerging economies. Recent regulatory actions focus on expanding indications and ensuring safety data updates.

Reimbursement and Pricing

Pricing strategies are aligned with healthcare reimbursement policies. In the U.S., AVAPRO's coverage by Medicare and private insurers has facilitated broad access. Price sensitivity varies across regions, influencing growth trajectory, especially in cost-conscious markets.

Market Trends Influencing Sales

-

Patent Expiry and Generic Competition:

The patent protections for irbesartan have expired in several jurisdictions, introducing generic alternatives that exert downward pressure on prices and market share for the branded drug. -

Growing Prevalence of Hypertension and Diabetes:

Rising global incidence of hypertension and type 2 diabetes sustains demand, especially in emerging economies undergoing urbanization and lifestyle shifts. -

Shift Toward Fixed-Dose Combinations (FDCs):

Increasing use of FDCs incorporating ARBs and other antihypertensive agents enhances compliance, potentially dampening standalone AVAPRO sales but expanding overall market volume. -

Evolving Treatment Guidelines:

Guidelines from organizations such as the American College of Cardiology favor ARBs as first-line antihypertensive agents, bolstering demand.

Sales Projections (2023–2028)

Short-term (2023–2025)

Initially, the launch of generic irbesartan will erode branded sales, with a projected decline rate of approximately 8-12% annually in mature markets due to generic competition. However, in emerging economies, sales are expected to remain steady due to limited generic availability and rising disease prevalence.

Mid to Long-term (2025–2028)

Sales are forecasted to stabilize as market penetration reaches saturation in key markets. Incremental growth will rely on expansion into new indications, such as heart failure and resistant hypertension, and increased uptake of FDCs. By 2028, global annual sales estimates could approach USD 500-700 million, contingent on regional market dynamics.

Regional Dynamics

-

United States & Europe:

Declining branded sales due to generics, but offset by increased demand in underpenetrated regions. -

Emerging Economies:

Growth driven by expanding healthcare infrastructure, rising hypertension prevalence, and limited generic competition initially.

Strategic Opportunities and Risks

Opportunities

- Development of new formulations (e.g., sustained-release, combination therapies).

- Expansion into novel indications supported by clinical trial data.

- Partnerships with local manufacturers to bolster presence in emerging markets.

Risks

- Intense generic competition threats profitability.

- Regulatory hurdles and patent litigation risks.

- Changing clinical guidelines favoring alternative therapies or combination regimens.

- Pricing pressures amidst global cost-containment initiatives.

Key Takeaways

-

Market Saturation & Competition:

The branded AVAPRO market has plateaued due to patent expirations, with generics dominating in most regions. Future sales will hinge on market expansion and indication diversification. -

Regional Variability:

Growth prospects show regional divergence; emerging markets offer substantial opportunities, whereas mature markets face decline due to generic competition. -

Strategic Focus Areas:

Emphasizing new delivery formats, combination therapies, and clinical research can differentiate AVAPRO amidst dynamic market conditions. -

Pricing & Reimbursement Influence:

Cost sensitivity in various regions mandates adaptive pricing strategies to maintain accessibility and competitiveness. -

Clinical Value Proposition:

Continued emphasis on AVAPRO’s renal protective effects in diabetic nephropathy can sustain its relevance among healthcare providers.

FAQs

Q1: How does the expiry of patent protection affect AVAPRO’s sales?

A: Patent expiry leads to the entry of generic irbesartan, significantly reducing prices and branded sales in developed markets. Nonetheless, the brand sustains sales through ongoing indications, clinical preference, and markets with limited generic penetration.

Q2: What factors drive demand for AVAPRO in emerging markets?

A: Rising prevalence of hypertension and diabetes, expanding healthcare infrastructure, and limited availability of generics in certain regions drive demand for AVAPRO.

Q3: Can AVAPRO expand into new therapeutic areas?

A: Yes. Clinical trials investigating ARBs for heart failure and resistant hypertension could facilitate indication expansion, supporting future sales growth.

Q4: How do fixed-dose combination therapies impact AVAPRO's sales?

A: FDCs can either cannibalize standalone AVAPRO sales or boost overall antihypertensive sales through improved patient adherence, depending on adoption rates and market preferences.

Q5: What strategic measures can pharmaceutical companies implement to sustain AVAPRO’s market presence?

A: Investing in clinical research for new indications, developing innovative formulations, strategic regional partnerships, and tailored pricing policies are vital for maintaining relevance.

References

[1] Research and Markets, “Global Cardiovascular Disease Therapeutics Market,” 2022.

[2] U.S. Food and Drug Administration, “Approval of Irbesartan,” 2004.

[3] American College of Cardiology, “Hypertension Guidelines,” 2017.

[4] European Medicines Agency, “Regulatory Updates for ARBs,” 2021.

More… ↓