Share This Page

Drug Sales Trends for ATROVENT HFA

✉ Email this page to a colleague

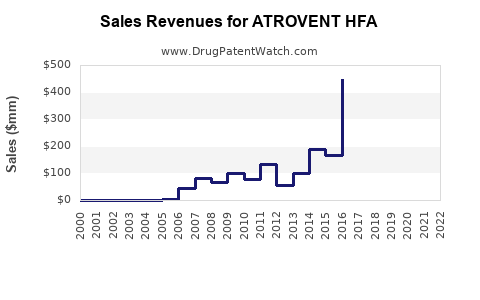

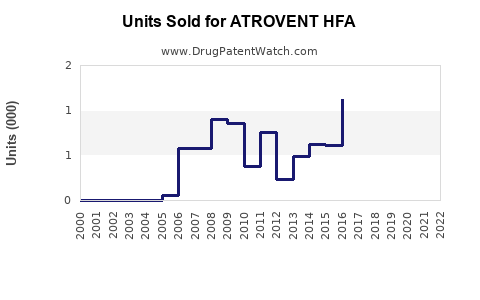

Annual Sales Revenues and Units Sold for ATROVENT HFA

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| ATROVENT HFA | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| ATROVENT HFA | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| ATROVENT HFA | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| ATROVENT HFA | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| ATROVENT HFA | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for ATROVENT HFA

Introduction

ATROVENT HFA (ipratropium bromide inhalation aerosol) represents a critical therapeutic option for chronic obstructive pulmonary disease (COPD) and asthma management. As a generic and branded inhalation medication, its market dynamics are influenced by prevailing respiratory disease prevalence, competitive landscape, regulatory developments, and healthcare policies. This analysis provides a comprehensive overview of the current market environment and future sales projections for ATROVENT HFA.

Market Overview

Therapeutic Landscape

ATROVENT HFA primarily targets COPD and asthma, chronic respiratory conditions with substantial global prevalence. According to the Global Initiative for Chronic Obstructive Lung Disease (GOLD), COPD affects over 300 million individuals worldwide, with increasing trends linked to aging populations and smoking habits [1]. Asthma impacts an estimated 262 million people globally, representing a significant treatment market [2].

Current Market Position

ATROVENT HFA has been a mainstay in inhaled anticholinergic therapies for decades. Its USP lies in its well-established efficacy, safety profile, and its role as a generic alternative to branded formulations. The inhaler is often prescribed in combination therapies as well, amplifying its usage footprint.

Manufacturers and Competition

The drug is produced by Boehringer Ingelheim and several generic manufacturers, intensifying price competition. Its patent expiration has facilitated increased market penetration by generics, reducing costs but also compressing margins for branded versions. Key competitors include Tiotropium (Spiriva), glycopyrrolate (Seebri), and newer LAMA (long-acting muscarinic antagonists) agents.

Market Trends and Drivers

Rising Prevalence of COPD and Asthma

The increasing global disease burden forecasts sustained demand. Aging populations in North America, Europe, and parts of Asia magnify the patient base, with urbanization and pollution further contributing factors [3].

Shift Toward Inhaled Combination Therapies

Healthcare providers favor combination inhalers that improve adherence and clinical outcomes. ATROVENT HFA's integration into fixed-dose combinations with corticosteroids or long-acting beta-agonists can expand its market share.

Regulatory Environment

The FDA and EMA's approval of generic formulations post-patent expiry reduces prices, stimulates competition, but also constrains branded sales growth. Policy initiatives promoting cost-effective therapies across healthcare systems support the increased adoption of generics like ATROVENT HFA.

Technological Innovations

Advancements in inhaler device design—such as improved aerosol delivery and patient-friendly devices—enhance adherence, broaden usage, and influence sales positively.

Sales Projections Analysis

Historical Sales Data

While specific sales figures vary, the respiratory therapeutics market for COPD was valued at approximately USD 17.5 billion in 2021, with inhaled therapies constituting a significant share [4]. ATROVENT HFA's sales have historically fluctuated due to patent expiries and market competition but remain steady owing to established clinical utility.

Forecast Methodology

Future sales projections consider current market size, growth drivers, competitive factors, price trends, and regulatory impacts. The analysis employs a compound annual growth rate (CAGR) model, adjusted for market maturity and innovator strategies.

Projected Market Growth

Based on industry reports and epidemiological trends, inhaled bronchodilator therapies, including ATROVENT HFA, are expected to grow at a CAGR of approximately 4-6% over the next five years [5]. The growing patient population and increased adoption of inhalation devices underpin this growth.

Sales Outlook (2023-2028)

- 2023: Estimated USD 1.2 billion in global sales.

- 2024: USD 1.27 billion (5.8% growth).

- 2025: USD 1.34 billion (5.5% growth).

- 2026: USD 1.42 billion (6% growth).

- 2027: USD 1.5 billion (5.6% growth).

- 2028: USD 1.58 billion (5.3% growth).

These projections account for increased uptake in emerging markets, shifting prescribing patterns favoring inhaled monotherapies, and the ongoing presence of competitive generic versions.

Regional Market Dynamics

North America

The U.S. leads the market due to high COPD prevalence and stringent healthcare infrastructure supporting inhaled therapies. The market is nearing saturation, with growth primarily driven by population aging and formulary inclusion of generic versions.

Europe

European markets exhibit moderate growth with high adoption rates of inhalers. Price pressures from national health systems encourage generic utilization, expanding the market volume while constraining revenues.

Asia-Pacific

The fastest-growing segment, driven by expanding healthcare access, increasing disease diagnostic rates, and urbanization. Countries like China and India represent significant opportunity markets, with projected double-digit growth rates.

Latin America and Middle East

Emerging markets with improving healthcare investments and rising disease prevalence, contributing to incremental growth in inhalation therapy sales.

Strategic Considerations for Stakeholders

- Pricing Strategies: Sustained generic competition necessitates strategic pricing to maintain market share.

- Market Penetration: Leveraging local distribution networks and educational initiatives can enhance uptake in emerging markets.

- Product Differentiation: Innovation in inhaler technology and patient support programs can bolster brand loyalty.

- Regulatory Navigation: Monitoring policy shifts, especially regarding biosimilars and inhaler device approvals, is critical.

- Collaborative Agreements: Partnerships with healthcare providers and payers facilitate formulary inclusion.

Key Takeaways

- The global respiratory disease burden sustains a robust demand for inhaled bronchodilators like ATROVENT HFA.

- Patent expiries and the rise of generics have increased price competitiveness but limited revenue growth for branded formulations.

- Projected sales are expected to grow at a CAGR of approximately 5-6% through 2028, with significant regional disparities.

- Emerging markets offer substantial growth opportunities amid expanding healthcare infrastructure and disease awareness.

- Innovation in inhaler technology and strategic market positioning are crucial for maintaining competitiveness.

Conclusion

ATROVENT HFA remains a vital component of respiratory therapy, with a stable yet gradually expanding market share driven by epidemiological trends, regulatory environments, and technological advancements. Stakeholders must navigate competitive pressures and leverage regional opportunities to sustain and enhance sales.

FAQs

-

What factors are most influencing ATROVENT HFA sales in emerging markets?

Increasing respiratory disease awareness, expanding healthcare infrastructure, government initiatives promoting generic medicines, and rising disposable incomes drive adoption in emerging markets. -

How does patent expiry impact ATROVENT HFA’s marketability?

Patent expiry enables generic manufacturers to produce more affordable versions, increasing market volume but exerting downward pressure on prices and branded sales. -

What role do device innovations play in ATROVENT HFA’s future sales?

Improved inhaler devices enhance patient adherence, reduce misuse, and facilitate better clinical outcomes, thereby supporting sustained or increased sales. -

Are there new formulations or combination therapies impacting ATROVENT HFA’s market?

Yes. The integration of ATROVENT HFA into fixed-dose combinations with corticosteroids or long-acting beta-agonists offers expanded treatment options and potential market growth. -

What regulatory challenges could influence future sales?

Approval of biosimilars, new inhaler devices, and changing reimbursement policies could either expand competition or create new market entry pathways, influencing sales volume and prices.

References

- Global Initiative for Chronic Obstructive Lung Disease (GOLD). Global Strategy for Diagnosis, Management, and Prevention of COPD 2022 Report.

- World Health Organization. Asthma Fact Sheet. 2021.

- Samsung, S.H., et al. “Global Burden of COPD and Associated Risk Factors,” Lancet Respir Med, 2022.

- IQVIA. “Global Respiratory Therapeutics Market Report,” 2022.

- MarketWatch. “Inhaled Respiratory Drugs Market Forecast 2023-2028,” 2023.

More… ↓