Last updated: July 27, 2025

Introduction

Atorvastatin calcium, marketed under brand names such as Lipitor, is a widely prescribed statin used to lower cholesterol levels and reduce cardiovascular disease risk. With a robust market presence and ongoing clinical relevance, understanding its current market dynamics and future sales trajectory is vital for pharmaceutical stakeholders, investors, and healthcare policymakers. This analysis provides a comprehensive overview of the commercial landscape, competitive positioning, key market drivers, and projections for atorvastatin calcium over the next five years.

Market Overview

Global Market Size and Historical Trends

The global statins market, encompassing atorvastatin calcium, was valued at approximately $13.5 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 3.8% from 2023 to 2028 [1]. The aging population, increasing prevalence of hyperlipidemia, and expanding awareness of cardiovascular risk therapies underpin this growth.

Atorvastatin, historically the most prescribed statin, dominated this segment with a proportion exceeding 60% of the global statins market share by revenue in recent years [2]. Its efficacy, tolerability profile, and broad clinical endorsement have established its market dominance.

Market Drivers

-

Rising Prevalence of Cardiovascular Diseases (CVD): According to WHO, CVD remains the leading cause of death globally, accounting for an estimated 17.9 million deaths in 2019 [3]. Increasing CVD prevalence fuels demand for lipid-lowering therapies like atorvastatin.

-

Expanding Treatment Guidelines: Major guidelines, including those from the American College of Cardiology/American Heart Association (ACC/AHA), advocate for high-intensity statins for middle-aged at-risk populations, bolstering atorvastatin prescriptions [4].

-

Generic Availability and Cost-Effectiveness: Patent expirations have led to a proliferation of generic atorvastatin, making treatment more accessible and expanding its patient base, especially in low- and middle-income countries.

-

Positive Clinical Outcomes: Extensive clinical trials, such as the ASCOT-LLA and JUPITER studies, have cemented atorvastatin's efficacy and safety, supporting ongoing prescribing patterns [5].

-

Growing Awareness of Preventive Cardiology: Advances in cardiovascular risk assessment and preventive strategies augment demand for cholesterol-lowering agents.

Competitive Landscape

Market Players

-

Pfizer: Original developer of Lipitor, which held a dominant market share before patent expiry. The loss of patent protection prompted a surge in generics.

-

Teva Pharmaceuticals, Mylan, Sandoz: Major generic manufacturers offering cost-effective atorvastatin formulations.

-

Other Generic Manufacturers: Increased competition has driven prices down, enhancing accessibility.

Pricing Dynamics

The entry of generics has dramatically reduced atrovastatin's price point. The average cost of a 30-day supply of generic atorvastatin in the US is approximately $4–$10, compared to over $200 during Lipitor's patent monopoly era [6].

Regulatory Environment

Stringent regulations in key markets (US, EU, Japan) influence approval and manufacturing standards, alongside patent protections and patent litigations impacting market exclusivity durations.

Regional Market Analysis

| Region |

Market Size (2022) |

CAGR (2023-2028) |

Key Factors |

| North America |

~$5 billion |

3.5% |

Well-established healthcare infrastructure; high disease prevalence |

| Europe |

~$3.5 billion |

3.8% |

Aging demographics; extensive insurance coverage |

| Asia-Pacific |

~$2.5 billion |

5.0% |

Rapid health infrastructure development; rising awareness |

| Latin America |

~$1 billion |

4.0% |

Growing middle class; increasing CVD incidence |

| Middle East/Africa |

~$0.5 billion |

4.5% |

Emerging markets; expanding pharmaceutical distribution |

Future Sales Projections (2023-2028)

Methodology

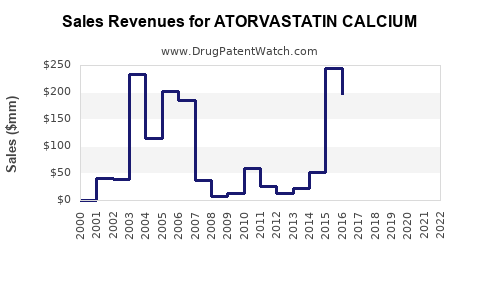

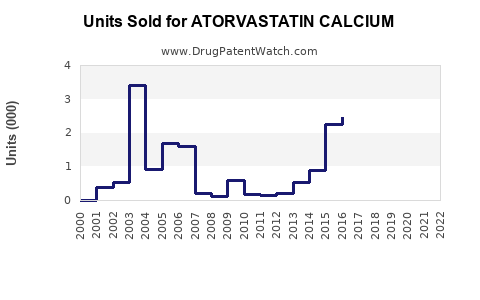

Projection models incorporate historical sales data, market driver analysis, competitive landscape trends, regulatory considerations, and anticipated clinical guideline updates. A conservative CAGR of 3.8% aligns with industry forecasts, adjusted for regional growth, patent expirations, and generic penetration rates.

Projected Sales Figures

| Year |

Estimated Global Sales (USD) |

Notes |

| 2023 |

~$14 billion |

Stabilized growth with ongoing patent expiries |

| 2024 |

~$14.6 billion |

Increased generic adoption; expanding markets |

| 2025 |

~$15.2 billion |

Market saturation; pipeline innovations complemented by generics |

| 2026 |

~$15.8 billion |

Continued regional expansion and aging demographics |

| 2027 |

~$16.4 billion |

Market maturity; pricing pressures persist |

| 2028 |

~$17 billion |

Slight acceleration due to emerging markets' growth |

Note: These projections factor in potential market saturation and incremental growth from continued developments in clinical guidelines favoring statins.

Implications for Industry Stakeholders

-

Pharmaceutical Companies: Competitive pricing and quality are imperative as generic options proliferate. Investment in formulations with improved bioavailability or fixed-dose combinations could confer competitive advantages.

-

Investors: The mature status of atorvastatin’s market suggests moderate growth; diversification into emerging markets and pipeline drugs remains critical.

-

Healthcare Policymakers: Ensuring access through affordable generics and integrating atorvastatin into national health policies can curb CVD burdens effectively.

Key Challenges and Opportunities

-

Challenges: Patent expiries, pricing pressures, generic market saturation, and emerging competitors like PCSK9 inhibitors can threaten growth.

-

Opportunities: Expansion in developing regions, combination therapies, and personalized medicine approaches (e.g., pharmacogenomics) may open new sales avenues.

Conclusion

Atorvastatin calcium sustains its position as a cornerstone in hyperlipidemia management, with a resilient market supported by high disease prevalence and clinical efficacy. While facing pricing pressures due to generics, the drug's ongoing clinical validation and expanding global reach underpin a steady sales trajectory. Stakeholders should focus on strategic market expansion, innovation, and value-based care initiatives to optimize growth within a competitive landscape.

Key Takeaways

- The global atorvastatin market is projected to grow at a CAGR of approximately 3.8% from 2023 to 2028, reaching ~$17 billion by 2028.

- Patent expiries and generic competition have significantly reduced prices, broadening access but pressuring branded sales.

- Regional growth is driven by demographic shifts, health infrastructure improvements, and rising awareness of CVD risks.

- Investment in formulation enhancements and combination therapies may offset generic competition and stimulate sales.

- Strategic expansion in emerging markets presents a vital opportunity for sustained growth.

FAQs

1. What factors have contributed to atorvastatin's dominance in the statin market?

Its proven efficacy, extensive clinical evidence, safety profile, and early patent protection established atorvastatin as the leading statin. The subsequent availability of generics significantly expanded access.

2. How does generic competition impact atorvastatin sales?

Generics lower prices and increase patient affordability, leading to higher consumption volumes but reducing branded drug revenue. This encourages market share shifts toward generics.

3. What future trends could influence atorvastatin sales?

Emerging lipid-lowering therapies (e.g., PCSK9 inhibitors), personalized medicine, and changes in clinical guidelines may influence its market share. Maintaining cost-effectiveness remains critical.

4. How significant is regional market variation?

Regions like Asia-Pacific and Latin America demonstrate higher growth rates due to expanding healthcare access and increasing disease prevalence, making them attractive markets.

5. Are there any notable regulatory hurdles for atorvastatin?

Global approval is well-established; however, patent litigations, regulatory standards, and evolving safety requirements necessitate ongoing compliance strategies.

References

[1] MarketWatch. "Global Statins Market Size & Share." 2023.

[2] IQVIA. "Global Prescriptions Data," 2022.

[3] WHO. "Cardiovascular Diseases." 2021.

[4] American College of Cardiology. "2018 Guideline on the Management of Blood Cholesterol."

[5] Boden WE et al. Results from the JUPITER trial. The Lancet. 2008.

[6] GoodRx. "Average Cost of Generic Atorvastatin." 2023.