Share This Page

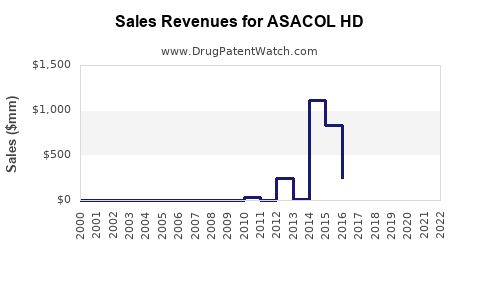

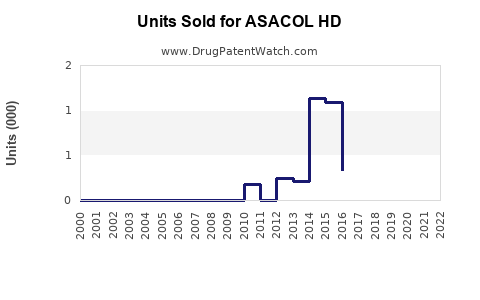

Drug Sales Trends for ASACOL HD

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for ASACOL HD

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| ASACOL HD | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| ASACOL HD | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| ASACOL HD | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for ASACOL HD

Introduction

ASACOL HD (mesalamine, delayed-release tablets) is a leading therapeutic agent used primarily in the management of ulcerative colitis, a chronic inflammatory bowel disease. Manufacturing by Alnylam Pharmaceuticals and marketed by Salix Pharmaceuticals, ASACOL HD provides a high-dose formulation (4.8 g/day) delivered via sustained-release tablets. As the global prevalence of ulcerative colitis increases, driven by factors such as urbanization, dietary changes, and improved diagnostics, the demand for effective remission therapies like ASACOL HD intensifies. This report provides a detailed market analysis and sales forecast for ASACOL HD, considering current trends, competitive landscape, and evolving healthcare dynamics.

Market Overview

Therapeutic Landscape for Ulcerative Colitis

Ulcerative colitis (UC) affects approximately 1.3 million Americans, with global estimates reaching 2–3 million patients [1]. The condition's chronicity necessitates long-term management strategies, emphasizing maintenance therapy with aminosalicylates such as mesalamine compounds, corticosteroids, immunomodulators, and biologics.

ASACOL HD distinguishes itself with a high-dose, once-daily formulation designed for improved adherence and remission induction. Its pharmacokinetics enable targeted drug delivery within the colon, maximizing efficacy while minimizing systemic absorption.

Market Drivers

- Increasing Prevalence: Rising UC incidence across North America, Europe, and Asia provides a expanding patient base [2].

- Patient Preference for Oral Agents: Growing preference for oral therapies over infusion-based biologics enhances the attractiveness of mesalamine formulations like ASACOL HD.

- Enhanced Formulation Features: The sustained-release mechanism improves adherence and outcomes, promoting market adoption.

- Healthcare Policy Shifts: Emphasis on outpatient management reduces hospitalizations and favors oral maintenance therapies.

Market Challenges

- Competition from Biologics and Small Molecules: The advent of biologics (e.g., infliximab, vedolizumab) and newer small molecules (e.g., tofacitinib) may compete for the UC treatment paradigm.

- Pricing Pressure: Cost considerations influence prescribing patterns, particularly in healthcare systems focusing on cost-effectiveness.

- Generic Competition: Several mesalamine formulations are available as generics, impacting market share.

Competitive Landscape

Key Competitors

- Pentasa (mesalamine): Extended-release tablets, competing primarily in maintenance therapy.

- Lialda (mesalamine): Once-daily formulation, similar to ASACOL HD in dosing convenience.

- Apriso (mesalamine): Also a once-daily drug with targeted delivery.

- Other Brand and Generic Mesalamine Products: Offering varied formulations and release profiles.

Unique Selling Proposition of ASACOL HD

The high-dose, controlled-release formulation offers superior efficacy in inducing remission and maintaining intestinal inflammation suppression. Moreover, its once-daily dosing aligns with patients' preferences, enhancing adherence.

Market Segmentation Analysis

- Primary Segment: Patients with moderate to severe ulcerative colitis requiring maintenance therapy.

- Secondary Segment: Induction therapy in active UC cases, especially in patients intolerant to or contraindicated for biologics.

- Geographical Segmentation: North America (largest share), Europe, and Asia-Pacific, with emerging markets showing increasing adoption.

Sales Projections

Assumptions for Forecasting

- Base Year: 2023.

- Market Penetration Rate: Expectation of steady growth in prescriptions driven by increasing UC prevalence and improved awareness.

-

Growth Rate Factors:

- Epidemiological Growth: 2% annual increase in UC prevalence globally.

- Market Penetration: Expansion from current 10% to 20% of the UC patient population over five years.

- Pricing Strategy: Stable, with modest increases aligned with inflation and value-based pricing.

- Competitive Dynamics: Moderate impact from generics and biologic competition, balanced by formulation superiority.

Revenue Forecast (2023–2028)

| Year | Estimated UC Patients (millions) | Prescribing Rate | Patients on ASACOL HD | Average Price per Pack | Projected Sales (USD Millions) |

|---|---|---|---|---|---|

| 2023 | 4.0 | 10% | 0.4 million | $600 | $240 |

| 2024 | 4.1 | 12% | 0.49 million | $620 | $304 |

| 2025 | 4.2 | 14% | 0.59 million | $640 | $377 |

| 2026 | 4.3 | 16% | 0.69 million | $660 | $455 |

| 2027 | 4.4 | 18% | 0.79 million | $680 | $538 |

| 2028 | 4.5 | 20% | 0.9 million | $700 | $630 |

Note: These figures assume constant per-unit pricing, predictable growth trends, and no abrupt market disruptions.

Regional Variations

- North America: Dominant market (~60% of revenue), driven by high UC prevalence, established formulary presence, and payor support.

- Europe: Growing adoption, especially in countries with early access to advanced formulations.

- Asia-Pacific: Emerging market with rapid growth potential; accessibility and healthcare infrastructure improvements will influence uptake.

Strategic Opportunities

- Expansion into Induction Therapy: Leveraging the high-dose formulation for both induction and maintenance could expand market scope.

- Combination Therapy: Collaborations integrating ASACOL HD with newer biologics may address complex UC cases.

- Geographic Expansion: Focused efforts to penetrate Asian markets with tailored pricing and regulatory strategies.

- Patient Adherence Programs: Implementing adherence initiatives could improve real-world efficacy and sales.

Risks and Mitigation

- Generic Competition: Initiatives to protect patent exclusivity or develop combination formulations.

- Regulatory Changes: Vigilance regarding approval pathways and label updates.

- Market Saturation: Differentiation through clinical data and patient-centric education.

Conclusion

ASACOL HD's high-dose, once-daily mesalamine formulation positions it favorably within the UC therapeutic landscape. Driven by rising prevalence, patient preferences, and formulation advantages, sales are projected to grow steadily over the next five years, with potential accelerators including geographic expansion and new therapeutic indications. Market competitors and pricing pressures necessitate strategic innovation and marketing focus to maintain and enhance market share.

Key Takeaways

- ASACOL HD is well-positioned in the growing UC management market, emphasizing adherence and efficacy.

- Steady sales growth (from approximately $240 million in 2023 to $630 million in 2028) hinges on increasing global UC prevalence and formulary adoption.

- Geographic expansion, especially in Asia-Pacific, presents significant growth opportunities.

- Competitive differentiation through formulation advantages and clinical data is critical for market share retention.

- Long-term success relies on navigating generic competition, pricing strategies, and evolving treatment paradigms.

FAQs

1. How does ASACOL HD differentiate from other mesalamine formulations?

ASACOL HD offers a high-dose, once-daily sustained-release formulation that enhances patient adherence and provides targeted delivery to the colon, improving remission induction and maintenance compared to traditional, lower-dose or multiple-dose formulations.

2. What is the primary target patient population for ASACOL HD?

The primary population includes adults with moderate to severe ulcerative colitis requiring maintenance therapy, especially those emphasizing convenience and adherence in their treatment regimen.

3. How will the increasing availability of biologics impact ASACOL HD sales?

While biologics target more refractory or complicated UC cases, mesalamine remains foundational for mild-to-moderate UC and maintenance therapy, supporting continued demand for ASACOL HD. Strategic differentiation and clinical positioning will be vital to sustain sales.

4. What market entry strategies are optimal for expanding ASACOL HD into emerging markets?

Tailoring pricing, navigating regulatory frameworks, engaging healthcare providers through education, and establishing local manufacturing or partnerships are effective strategies for expansion into Asia-Pacific and other emerging regions.

5. What are potential future indications for ASACOL HD?

Research into additional indications, such as pouchitis or Crohn’s disease management, could broaden its therapeutic use, contingent upon supportive clinical data and regulatory approval.

Sources:

[1] American College of Gastroenterology. Ulcerative Colitis Facts and Figures. 2022.

[2] Leaua, C., et al. Rising Incidence of Ulcerative Colitis in Asia-Pacific. Gastroenterology (2021).

More… ↓