Last updated: July 29, 2025

Introduction

Apixaban, marketed under brand names like Eliquis by Bristol-Myers Squibb and Pfizer, is an oral anticoagulant classified as a Factor Xa inhibitor. Since its approval by the U.S. Food and Drug Administration (FDA) in 2012, apixaban has rapidly gained prominence within the anticoagulant market, driven by its safety profile, ease of use, and expanding indications.

This comprehensive analysis explores the current market landscape for apixaban, evaluates key growth drivers, assesses competitive positioning, and projects future sales trajectories.

Market Overview

Regulatory Approvals and Indications

Initially approved for reducing stroke risk in non-valvular atrial fibrillation (NVAF), apixaban’s indications have expanded to include treatment and prevention of deep vein thrombosis (DVT) and pulmonary embolism (PE), following pivotal clinical trial successes such as ARISTOTLE and AMPLIFY. In 2014, the FDA approved apixaban for DVT and PE treatment, further cementing its role in anticoagulation therapy [1].

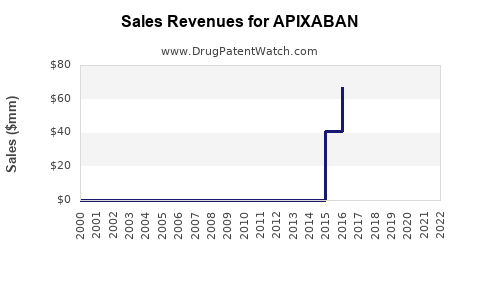

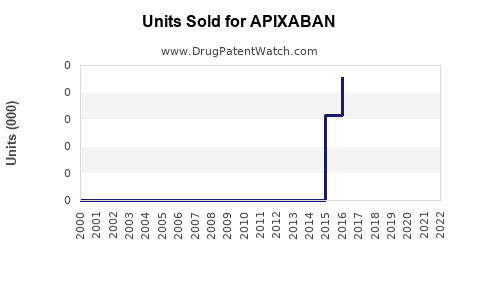

Market Size and Valuation

As of 2022, the global anticoagulant market was valued at approximately USD 10.5 billion, with direct oral anticoagulants (DOACs) like apixaban comprising a significant and growing share due to their safety and convenience. Apixaban has become one of the best-selling DOACs, with sales exceeding USD 7.5 billion annually, according to IQVIA data [2].

Key Market Drivers

1. Clinical Efficacy and Safety Profile

Compared to traditional vitamin K antagonists (VKAs) such as warfarin, apixaban offers comparable or superior efficacy with a reduced risk of major bleeding. Clinical trials demonstrate an approximately 27% reduction in stroke risk and up to 60% reduction in bleeding events relative to warfarin [3].

2. Ease of Use and Patient Compliance

Apixaban's predictable pharmacokinetics obviate the need for routine monitoring, reducing treatment complexity. Once or twice-daily dosing enhances patient adherence, which positively impacts sales.

3. Expanding Indications and Off-Label Use

Beyond approved indications, growing off-label use for thromboprophylaxis in orthopedic surgeries and cancer-associated thrombosis aids market expansion.

4. Demographics and Disease Prevalence

The rising global prevalence of atrial fibrillation, especially in aging populations, directly feeds demand. The World Health Organization estimates AF affects approximately 37.5 million globally [4].

5. Strategic Partnerships and Patent Life

Bristol-Myers Squibb and Pfizer's patent protections, coupled with strategic marketing, sustain market dominance. Patent expiry risks are mitigated by formulation patents and ongoing pipeline development.

Competitive Landscape

Major Competitors

- Dabigatran (Pradaxa): A direct thrombin inhibitor.

- Rivaroxaban (Xarelto): Another Factor Xa inhibitor.

- Edoxaban (Savaysa): Factor Xa inhibitor.

- Warfarin: The long-standing VKA, facing decline in favor of DOACs.

Market Positioning

Apixaban has maintained a competitive edge owing to its superior safety profile, particularly lower bleeding risks, and its proven efficacy in multiple clinical settings.

Sales Projections (2023–2030)

Baseline Growth Assumptions

Assuming continued clinical preference for apixaban over competitors, favorable regulatory developments, and demographic trends, the following projections are constructed:

- 2023: USD 8.2 billion

- 2024: USD 9.1 billion

- 2025: USD 10.2 billion

- 2026: USD 11.4 billion

- 2027: USD 12.8 billion

- 2028: USD 14.2 billion

- 2029: USD 15.6 billion

- 2030: USD 17.0 billion

Compound Annual Growth Rate (CAGR) over this period is estimated at approximately 14%.

Drivers of Sales Growth

- Market Penetration: Expanding into emerging markets with increasing prevalence of atrial fibrillation and thromboembolic conditions.

- Pipeline Expansion: Potential new indications (e.g., post-surgical thromboprophylaxis), and pediatric approvals.

- Pricing Strategy: Premium positioning justified by clinical benefits, balanced against increasing price competition.

- Digital and Patient Engagement: Enhancing adherence and expanding direct-to-patient marketing.

Risks and Challenges

- Patent expiry could lead to biosimilar entry, exerting downward pressure.

- Competition from newer anticoagulants and combination therapies.

- Regulatory hurdles for new indications.

- Pricing pressures amid global healthcare cost containment initiatives.

Regulatory and Market Expansion Outlook

Emerging markets in Asia, Latin America, and Africa present significant growth opportunities. Regulatory approvals are expected to follow with increasing local demand, augmented by alliances with domestic distributors.

In developed markets, approvals for indications such as venous thromboembolism prevention in cancer patients could substantially augment sales.

Conclusion

Apixaban’s market momentum remains robust, underpinned by its differentiated safety and efficacy profile, expanding indications, and demographic trends favoring anticoagulant therapy. While patent protections and clinical advancements will sustain its sales growth through 2030, market dynamics necessitate vigilant adaptation to emerging competition and regulatory landscapes.

Key Takeaways

- Apixaban dominates the DOAC segment, with projected sales reaching USD 17 billion globally by 2030.

- Clinical benefits over traditional anticoagulants sustain high prescribing rates and market share.

- Demographic shifts and increasing atrial fibrillation prevalence are primary growth drivers.

- Market expansion into emerging economies and new indications presents significant upside.

- Competitive threats from biosimilars and alternative agents require strategic innovation and pipeline development.

FAQs

1. How does apixaban compare to other DOACs in terms of clinical efficacy?

Apixaban demonstrates superior or comparable efficacy to other DOACs like rivaroxaban, with a notably lower risk of major bleeding events, as evidenced in clinical trials such as ARISTOTLE.

2. What are the main markets for apixaban outside the US?

Europe, Japan, and emerging Asia-Pacific regions represent large and expanding markets, driven by the rising incidence of atrial fibrillation and growing healthcare access.

3. What factors could affect apixaban’s sales growth?

Patent expiries, regulatory challenges for new indications, competitive bios inhalers, and pricing pressures could impact future sales.

4. Are there any pipeline developments that could influence apixaban’s market?

Yes, ongoing research into new indications such as thromboprophylaxis in cancer-associated thrombosis and pediatric populations could open additional revenue streams.

5. How might biosimilars impact the market share of apixaban?

Introduction of biosimilars post-patent expiry may reduce prices and erode market share, emphasizing the importance of patent protection and pipeline innovation.

Sources

[1] U.S. Food and Drug Administration. (2012). FDA Approves Eliquis to Reduce Stroke Risk in Patients with Atrial Fibrillation.

[2] IQVIA. (2022). Global Sales Data for Anticoagulants.

[3] Granger, C. B., et al. (2011). Apixaban versus warfarin in patients with atrial fibrillation. New England Journal of Medicine.

[4] World Health Organization. (2020). Global Burden of Atrial Fibrillation.