Share This Page

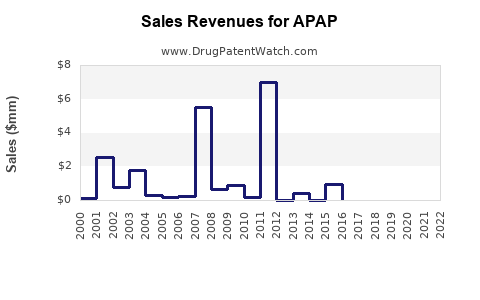

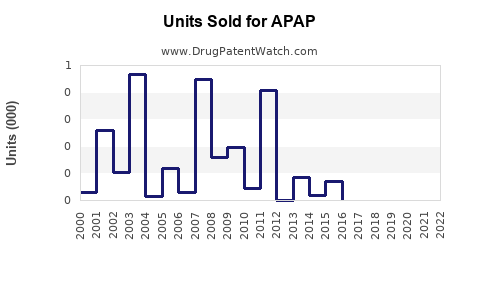

Drug Sales Trends for APAP

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for APAP

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| APAP | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| APAP | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| APAP | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Acetaminophen (APAP)

Introduction

Acetaminophen, also known as paracetamol (market code: APAP), remains one of the most widely used over-the-counter (OTC) analgesic and antipyretic drugs globally. Its extensive acceptance stems from its efficacy, safety profile when used appropriately, and broad therapeutic applications for pain relief and fever reduction. This report delineates the current market landscape, competitive dynamics, and future sales projections for APAP, considering evolving consumer trends, regulatory environments, and healthcare needs.

Market Overview

Global Market Size

The global acetaminophen market was valued at approximately USD 1.3 billion in 2021 and is expected to grow at a compound annual growth rate (CAGR) of around 4% over the next five years, reaching approximately USD 1.75 billion by 2027 [1]. The steady expansion reflects ongoing demand in both developed and emerging markets, driven by factors such as increasing prevalence of pain-related conditions, fever, and self-medication practices.

Key Market Segments

- Over-the-Counter (OTC): Dominates the market, accounting for nearly 85% of sales, due to its widespread availability and user familiarity.

- Prescription: Represents a smaller but significant segment, often for formulations requiring specific dosing or combination with other drugs.

- Formulations: Tablets, capsules, liquids, and suppositories, with tablets and liquids being predominant, especially in pediatric and adult formulations.

Market Drivers

Growth Factors

- Rising Incidence of Chronic Pain and Fever: Aging populations and lifestyle-related health issues continue to increase demand for analgesics.

- Self-Medication Trends: Growing consumer preference for OTC drugs simplifies access, especially in regions with limited healthcare infrastructure.

- Generic Drug Market Expansion: Low-cost manufacturing has facilitated broad availability, supported by patent expirations of branded products.

- Product Innovation: Development of combination therapies with other analgesics or anti-inflammatory agents enhances therapeutic options.

Healthcare Dynamics

- Regulatory Approvals: Favorable regulatory pathways in many jurisdictions promote extensive distribution.

- Public Awareness: Campaigns highlighting the safety and efficacy of acetaminophen bolster consumer confidence.

Market Challenges

- Safety Concerns: Elevated risks of hepatotoxicity when exceeding recommended doses [2], have led to regulatory scrutiny, labeling changes, and dosage restrictions—potentially impacting sales.

- Availability of Alternatives: Non-steroidal anti-inflammatory drugs (NSAIDs) and opioids offer alternatives for certain indications, influencing market share.

- Regulatory Regulations: Controlling measures, such as package size limitations and consumer warnings, may temper growth.

Competitive Landscape

Leading pharmaceutical companies dominate the APAP market, with key players including Johnson & Johnson, GlaxoSmithKline, and Sanofi. The market is characterized by:

- High Generic Penetration: Facilitating price competition.

- Strategic Partnerships and Mergers: To expand product portfolios and geographic reach.

- Regional Variations: The prominence of local manufacturers in emerging markets.

Regional Analysis

North America

- Largest market share, driven by high healthcare awareness, OTC sales, and chronic pain prevalence.

- Regulatory bodies like the FDA enforce strict labeling, which curbs misuse but maintains demand.

Europe

- Similar demand with increased regulation.

- Market growth stimulated by aging populations.

Asia-Pacific

- Fastest growing region owing to population size, rising healthcare infrastructure, and consumer willingness to adopt OTC medications.

- Increasing prevalence of infectious and chronic diseases.

Latin America and Middle East & Africa

- Emerging markets with expanding distribution channels.

- Local manufacturing and regulatory reforms facilitate growth.

Sales Projections (2023-2027)

Forecast Summary

Based on current data and growth trends, wholesale sales of APAP are projected to increase approximately 4% annually. Factors influencing this include regulatory adjustments, innovative formulations, and consumer behavior shifts.

| Year | Estimated Market Value (USD billions) |

|---|---|

| 2023 | 1.35 |

| 2024 | 1.41 |

| 2025 | 1.47 |

| 2026 | 1.55 |

| 2027 | 1.72 |

Segment-Specific Outlook

- The OTC segment will dominate, contributing over 80% of the total sales.

- Pediatric formulations are expected to see increased demand, propelled by vaccination efforts and pediatric fever management.

- Combination products will likely grow modestly, anchored in established safety profiles.

Impact of Regulatory and Safety Trends

The increasing emphasis on drug safety has led regulatory agencies worldwide to tighten guidelines around dosage and labeling. The FDA’s recent advisories on hepatotoxic risks prompt manufacturers to invest in consumer education and dosage form innovations—such as controlled-release formulations. This may temporarily temper growth but ultimately foster consumer confidence and sustainable sales.

Future Opportunities

- Formulation Innovations: Extended-release and combination products targeting specific pain management needs.

- Regional Expansion: Market penetration in Africa and Southeast Asia, driven by increasing healthcare access and infrastructure improvements.

- Digital Engagement: E-commerce platforms and telemedicine partnerships enhance consumer access.

- Sustainability Initiatives: Eco-friendly manufacturing and packaging may serve as market differentiators.

Key Market Trends

- Emphasis on safety and appropriate dosing.

- Growing demand for pediatric-specific formulations.

- Expansion of combination drug therapies.

- Regulatory shifts favoring safety information clarity.

- Rising consumer preference for natural and alternative therapies impacting the OTC landscape.

Key Takeaways

- The global APAP market is poised for steady growth driven by aging populations, disease prevalence, and OTC accessibility.

- Regulatory challenges demand adaptive strategies; manufacturers must prioritize safety communications.

- Emerging markets present significant opportunities for expansion due to demographic shifts and healthcare development.

- Innovations in formulations and combination therapies will sustain consumer interest and sales.

- Sustained growth depends on balancing affordability, safety, and innovation—aligning with healthcare policy trends.

FAQs

1. How has regulatory scrutiny affected acetaminophen sales?

Regulatory agencies have introduced stricter dosage labeling and safety warnings, which initially slowed sales growth. However, these measures bolster consumer confidence and reduce adverse event risks, supporting long-term market health.

2. What are the primary therapeutic uses of APAP?

APAP is primarily used for mild to moderate pain relief—such as headaches, dental pain, menstrual cramps—and to reduce fever. Its safety profile makes it a preferred choice in pediatric and adult formulations.

3. Which regions are expected to drive future APAP demand?

The Asia-Pacific region is projected to lead growth, driven by expanding healthcare infrastructure, increased urbanization, and rising demand for OTC medications. North America and Europe will continue to sustain high demand, influenced by aging populations and chronic illnesses.

4. What are the emerging product trends in the APAP market?

Innovations include controlled-release formulations, pediatric-friendly liquids, combination drugs for multi-symptom relief, and eco-friendly packaging.

5. How can manufacturers mitigate safety concerns impacting the APAP market?

By implementing transparent labeling, public education on safe dosing, developing lower-dose formulations, and promoting alternative pain management options, manufacturers can address safety concerns and foster consumer trust.

References

[1] MarketsandMarkets. (2022). "Acetaminophen (Paracetamol) Market Size, Share & Trends."

[2] U.S. Food and Drug Administration. (2021). "Hepatotoxicity Associated with Acetaminophen Use."

More… ↓