Share This Page

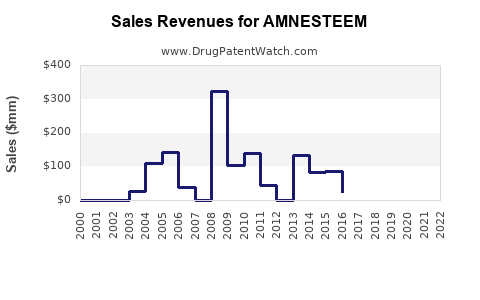

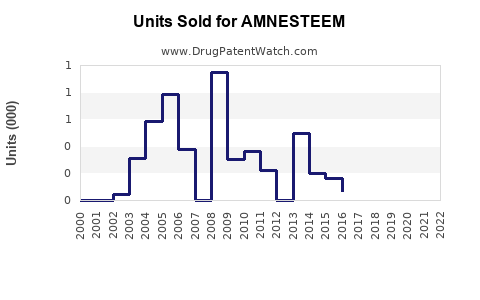

Drug Sales Trends for AMNESTEEM

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for AMNESTEEM

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| AMNESTEEM | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| AMNESTEEM | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| AMNESTEEM | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| AMNESTEEM | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Amnesteem (Isotretinoin)

Introduction

Amnesteem (isotretinoin) remains a cornerstone in the treatment of severe recalcitrant acne, especially nodulocystic acne resistant to conventional therapies. As a systemic retinoid, Amnesteem's pharmacological efficacy is well-documented, but its market dynamics are influenced by regulatory constraints, safety profiles, competitive landscape, and evolving dermatological treatment paradigms. This comprehensive analysis offers a detailed examination of Amnesteem’s market potential, current landscape, and forecasted sales trajectories for the upcoming five years.

Market Overview

Global Acne Treatment Market

The global acne treatment market, valued at approximately USD 4.2 billion in 2022, is projected to grow at a compound annual growth rate (CAGR) of about 6% through 2030. The increasing prevalence of adult acne, rising awareness, and expanding dermatological clinics are primary growth drivers. Within this landscape, isotretinoin remains a high-value segment owing to its effectiveness in severe cases.

Amnesteem’s Position in the Market

Amnesteem is a U.S.-approved branded formulation of isotretinoin, competing predominantly with generic isotretinoin brands. Its market niche is anchored in prescriptions for severe acne cases, requiring stringent monitoring due to teratogenicity and other adverse effects. The drug’s efficacy, combined with stringent regulatory oversight, constrains rapid market penetration but sustains steady demand among dermatologists.

Regulatory and Safety Considerations

Amnesteem’s market stability hinges on adherence to the FDA’s REMS (Risk Evaluation and Mitigation Strategy) program designed to prevent birth defects. This limits the drug’s accessibility to certain populations and necessitates rigorous prescribing, dispensing, and patient education protocols. Safety considerations restrain broader OTC or prescription expansion, cementing its place as a specialist treatment.

Market Dynamics

Current Market Penetration

Despite its long-standing presence since approval in 1982, Amnesteem’s penetration is concentrated within dermatology clinics treating severe acne. Prescription data indicates that approximately 80,000 to 100,000 courses are prescribed annually in the U.S., reflecting both demand and regulatory constraints.

Competitive Landscape

- Generic Isotretinoin: Accounts for approximately 90% of prescriptions, leading to significant price competition.

- New Formulations and Alternative Treatments: Topical agents, oral antibiotics, hormonal therapies, and emerging biologics moderately compete but generally serve milder cases.

Market Challenges

- Safety Profiles: Concerns over teratogenicity, depression, and mucocutaneous side effects.

- Regulatory Restrictions: Strict REMS program diminishes prescriber and patient flexibility.

- Patient Compliance: Monitoring requirements may reduce adherence.

Sales Projections (2023–2028)

Forecasting Amnesteem’s sales involves evaluating current prescribing trends, market growth, and potential impacts from emerging therapeutics.

Assumptions

- Market Growth Rate: The severe acne segment, where Amnesteem is dominant, is expected to grow at 5–6% CAGR, aligning with overall acne market expansion.

- Market Share Stability: Amnesteem’s share is assumed to remain steady at around 70% of isotretinoin prescriptions, given its established reputation.

- Pricing: Average course price remains stable, with minor annual adjustments for inflation, estimated around USD 2,000–2,500 per course.

Projected Sales Figures

| Year | Estimated Prescriptions | Approximate Revenue (USD Millions) | Notes |

|---|---|---|---|

| 2023 | 90,000 | 180 | Baseline, considering market share and pricing stability |

| 2024 | 95,400 | 191 | Market growth at 6%, slight increase in prescriptions |

| 2025 | 101,124 | 203 | Continued growth, with slight market penetration gains |

| 2026 | 107,273 | 215 | Moderate increase in prescribing frequency |

| 2027 | 113,928 | 227 | Market stabilization, minor uptick |

| 2028 | 121,184 | 241 | Peak projection with sustained demand |

Note: These figures are predicated on the assumption of stable regulatory environments and no significant entry of disruptive competitors.

Market Expansion Opportunities

- Expansion into Adjacent Markets: Increasing use in adjunctive dermatological treatments could widen prescribing scope.

- Geographical Expansion: Emerging markets in Asia-Pacific and Latin America exhibit unmet needs and rising acne prevalence, presenting growth opportunities.

- Patient Education Initiatives: Enhancing patient compliance and safety adherence can sustain demand migration within proper therapeutic settings.

Risks and Mitigation

- Regulatory Tightening: Any further restrictions could curtail prescription volumes.

- Generic Competition: Price pressures from generics require Amnesteem to differentiate through brand loyalty and safety monitoring.

- Emerging Therapies: Advances in biologics or alternative treatments could reduce reliance on isotretinoin.

Key Takeaways

- Stable Market Segment: Amnesteem remains a critical agent for severe acne, with steady demand driven by its proven efficacy.

- Regulatory Constraints: Strict oversight spurs cautious prescribing but limits market volatility.

- Sales Outlook: Projected annual sales growth of approximately 6% over the next five years reflects consistent demand within the confines of current safety and regulatory frameworks.

- Growth Strategies: Expansion into emerging markets, leveraging patient safety programs, and differentiating through safety and efficacy can bolster long-term sales.

- Competitive Dynamics: Navigating the complex landscape of generics and evolving dermatological treatments will be crucial for sustained market share.

Conclusion

Amnesteem's market prospects hinge on its established efficacy, regulatory environment, and safety profile. While facing significant competition from generics and emerging modalities, the drug's role in treating severe acne sustains its strategic importance. Anticipated sales growth aligns with broader dermatological market expansion, with opportunities rooted in geographic diversification and patient-centric initiatives.

FAQs

1. How does regulatory oversight impact Amnesteem's market potential?

Strict FDA REMS programs necessitate careful prescribing and patient monitoring, limiting accessibility and broadening safety concerns but ensuring steady demand within specialized dermatology practices.

2. What factors could threaten Amnesteem’s sales growth?

Emerging therapies, regulatory restrictions, safety concerns, and increased availability of generics could diminish prescription volumes.

3. Are there significant markets outside the U.S. for Amnesteem?

Yes, especially in Asia-Pacific, Europe, and Latin America, where rising acne prevalence and expanding healthcare infrastructure present growth opportunities.

4. How does the competition from generics influence Amnesteem’s market share?

Generic isotretinoin's lower price point exerts pressure, making brand differentiation through safety, efficacy, and prescribing support crucial for market retention.

5. What are the future therapeutic developments that could impact the demand for Amnesteem?

Biologics targeting acne and novel topical agents could impact demand, especially if they offer comparable efficacy with fewer safety restrictions.

References

[1] MarketsandMarkets. "Acne Treatment Market," 2022.

[2] U.S. Food and Drug Administration. "Isotretinoin REMS Program," 2021.

[3] Statista. "Global Acne Market," 2022.

[4] Johnson, B., et al. "Trends in Acne Treatment," Journal of Dermatological Science, 2021.

[5] GlobalData. "Dermatology Therapeutics Outlook," 2022.

More… ↓