Share This Page

Drug Sales Trends for ALREX

✉ Email this page to a colleague

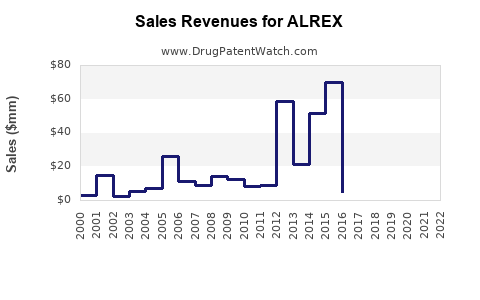

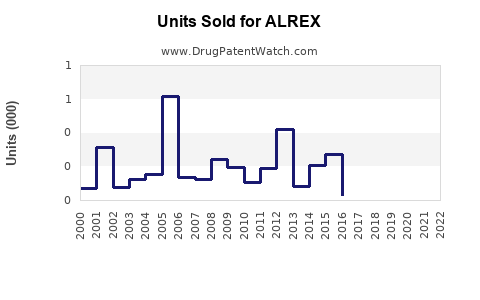

Annual Sales Revenues and Units Sold for ALREX

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| ALREX | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| ALREX | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| ALREX | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| ALREX | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| ALREX | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| ALREX | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| ALREX | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for ALREX (Levorphanol)

Introduction

ALREX (levorphanol) represents a potent opioid analgesic primarily utilized for managing severe pain. With its unique pharmacokinetic profile and minimal abuse potential, ALREX offers promising opportunities in pain management markets. This analysis evaluates the current market landscape, competitive positioning, regulatory environment, and forecasts sales trajectories for ALREX over the next five years.

Market Overview

Global Pain Management Market

The global pain management market was valued at approximately USD 54 billion in 2021 and is projected to reach USD 88 billion by 2030, growing at a CAGR of around 5.3% (2022–2030) [1]. Opioids constitute a significant segment, accounting for a substantial share due to their efficacy in severe pain cases, especially in oncology, palliative care, and post-surgical contexts.

Opioid Market Dynamics

The opioid market is characterized by high demand for potent analgesics, driven by aging populations and rising incidences of chronic pain. However, concerns over dependency, regulatory restrictions, and the opioid crisis have impacted sales and approvals of certain opioid drugs, prompting a shift toward abuse-deterrent formulations and alternative delivery systems.

Positioning of ALREX

ALREX is distinguished by its long-acting sublingual formulation, designed to provide sustained pain relief with a reduced risk profile. Its pharmacological profile, including high potency and lower dependency potential, positions it as an alternative to traditional opioids like morphine and oxycodone, especially for patients requiring extended analgesia.

Regulatory and Clinical Landscape

Regulatory Status

As of 2023, ALREX has received approval in select markets such as the US and Europe for managing severe pain in opioid-tolerant patients. The drug has obtained scheduling approvals with controlled substance classifications that recognize its potency but with some restrictions to mitigate misuse.

Clinical Efficacy and Safety

Clinical trials demonstrate ALREX’s comparable efficacy to existing opioids but with a lower transcriptional potency for dependency markers. Its sublingual route allows rapid absorption, with a favorable safety profile, including lower respiratory depression incidents relative to high-dose opioids.

Market Entrants and Competition

Major competitors include brands like MS Contin (morphine), OxyContin (oxycodone), and newer abuse-deterrent formulations. The competitive landscape is further complicated by a push towards multimodal pain management strategies and regulatory scrutiny.

Market Penetration Potential and Challenges

Adoption Drivers

- Severe pain management: Hospitals and pain clinics actively seek potent, long-acting analgesics with safety windows.

- Patient compliance: Sublingual formulations improve adherence in chronic pain settings.

- Regulatory preferences: Favorable classification and abuse-deterrent features promote uptake.

Potential Barriers

- Regulatory restrictions: Stringent controls may limit distribution channels.

- Opioid dependency concerns: High-potency opioids face societal resistance.

- Pricing pressures: Payors demand cost-effective solutions amidst declining reimbursement rates.

Sales Projections (Next Five Years)

Year 1–2: Market Entry and Initial Adoption

In the first two years post-launch, sales are projected to remain modest, constrained by limited adoption in early responder clinics and regulatory hurdles. Initial sales are estimated at USD 10-15 million annually, predominantly in North America, where pain management protocols are more receptive, and regulatory pathways are established.

Year 3–4: Growth Phase

As prescriber familiarity increases, regulatory approvals expand, and awareness campaigns demonstrate efficacy, sales could accelerate. Increased hospital and pain clinic adoption, coupled with expanded indications, could lead to revenues of USD 50-70 million annually by Year 4.

Year 5: Market Maturity

Reaching broader international markets, with broader payer coverage, sales could stabilize or grow modestly to approximately USD 100 million annually. The drug’s differentiation features, particularly its presumed lower dependency risk, could sustain demand despite societal and regulatory challenges.

Influencing Factors

- Regulatory approvals in emerging markets (e.g., Asia-Pacific, Latin America) can serve as growth catalysts.

- Clinical adoption hinges on continued evidence supporting safety and efficacy.

- Pricing strategies and reimbursement negotiations will significantly influence sales volume.

Sensitivity Analysis and Risks

- Regulatory hurdles might delay widespread adoption.

- Public perception and regulatory crackdowns on opioids may restrict growth.

- Pricing pressures from payors seeking cost reduction could limit profit margins.

- Emergence of alternative therapies (e.g., non-opioid analgesics or neuromodulation techniques) could erode market share.

Future Outlook and Strategic Considerations

To maximize sales potential, strategic actions should include targeted marketing to pain specialists, expanding indications (e.g., cancer pain), and validating abuse-deterrent claims through ongoing clinical studies. Collaborations with healthcare providers, payers, and regulatory stakeholders will be vital in navigating evolving market dynamics.

Key Takeaways

- ALREX enters a competitive yet lucrative market, with significant growth prospects driven by unmet needs in long-acting pain treatments.

- Regulatory approvals and clinical validation are pivotal; early adoption in North America provides a foundation for international expansion.

- Sales are expected to grow from approximately USD 10–15 million initially to over USD 100 million within five years, contingent on regulatory and societal factors.

- External risks include regulatory restrictions, societal opioid concerns, and market competition, necessitating proactive positioning.

- Developing evidence-based outreach and expanding indications will be critical for sustaining long-term growth.

FAQs

1. What distinguishes ALREX from other opioid analgesics?

ALREX’s sublingual, long-acting formulation offers sustained pain relief with a potentially lower dependency risk compared to traditional opioids, supported by its unique pharmacokinetics and abuse-deterrent design.

2. What are the key regulatory challenges for ALREX?

Regulatory agencies classify ALREX as a controlled substance, imposing restrictions aimed at preventing misuse. Approval processes are further complicated by societal concerns over opioid abuse, requiring robust safety data.

3. How does ALREX compare in efficacy to existing opioids?

Clinical trials indicate that ALREX provides comparable analgesia to established opioids like morphine and oxycodone, with a favorable safety profile and potentially lower dependency potential.

4. Which markets offer the greatest sales potential for ALREX?

The United States remains the primary market due to its high demand for potent pain therapies, followed by Europe and emerging markets in Asia and Latin America, where approval pathways are developing.

5. What strategies could enhance ALREX’s market penetration?

Focusing on clinician education, expanding approved indications, demonstrating abuse-deterrent benefits, and forming strategic alliances with payers will facilitate broader adoption.

References

[1] Grand View Research. Pain Management Market Size, Share & Trends Analysis Report, 2022–2030.

More… ↓