Share This Page

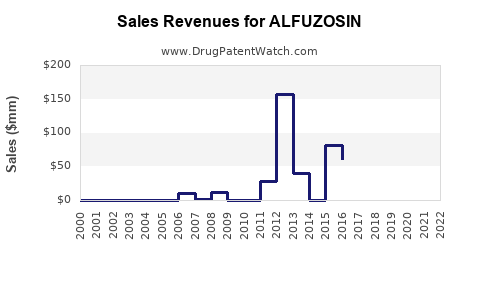

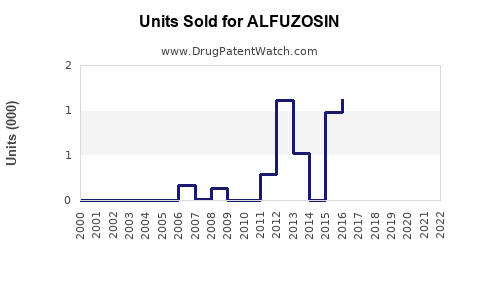

Drug Sales Trends for ALFUZOSIN

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for ALFUZOSIN

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| ALFUZOSIN | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| ALFUZOSIN | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| ALFUZOSIN | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| ALFUZOSIN | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| ALFUZOSIN | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| ALFUZOSIN | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Alfuzosin

Overview of Alfuzosin

Alfuzosin is an alpha-1 adrenergic receptor antagonist primarily prescribed for benign prostatic hyperplasia (BPH). Its selectivity for prostatic tissues provides symptomatic relief by relaxing smooth muscles in the prostate and bladder neck, thereby improving urine flow. Approved in multiple countries, Alfuzosin’s market is influenced by demographic trends, competitive landscape, regulatory environment, and emerging therapies.

Market Landscape

Global Market Size and Growth Drivers

The global BPH pharmacotherapy market, incorporating drugs like Alfuzosin, is projected to reach approximately USD 4.2 billion by 2027, growing at a CAGR of around 3.8% from 2022 (source: Grand View Research). Key growth drivers include:

- Aging populations in North America, Europe, and Asia-Pacific.

- Increasing prevalence of BPH, affecting up to 50% of men aged 51-60 and 80% over 80 years (source: GlobalData).

- Growing awareness among patients and physicians about minimally invasive pharmacologic treatments.

- Advances in drug formulations offering improved tolerability and ease of use.

Competitive Landscape

Alfuzosin faces competition primarily from other alpha-blockers such as tamsulosin, silodosin, doxazosin, and terazosin, alongside emerging non-pharmacologic options like minimally invasive procedures and surgical interventions. Notably, tamsulosin holds the largest market share owing to its proven efficacy, safety profile, and physician familiarity.

Regulatory Considerations

Regulatory pathways influence market penetration. Alfuzosin’s approval in countries like India, Russia, and certain regions of Asia-Pacific expands its geographic footprint, although delays or restrictions may occur in markets with stringent safety profiles, such as the U.S. and EU. Regulatory approvals hinge on clinical trial efficacy, safety data, and post-market surveillance.

Market Segmentation and Regional Demand

By Geographic Region

- North America: Largest market, driven by high BPH prevalence, advanced healthcare infrastructure, and robust prescription rates. The U.S. accounts for approximately 40% of the global market, with sustained growth expected.

- Europe: Mature market with steady growth, influenced by aging demographics and healthcare expenditure.

- Asia-Pacific: Rapidly expanding market, driven by increasing awareness, healthcare infrastructure growth, and a large aging population. Countries like China, India, and Japan present significant growth opportunities.

- Latin America and Middle East: Niche markets with rising demand due to improving healthcare access.

By Formulation and Indication

Alfuzosin is primarily prescribed as an oral tablet for BPH. Extended-release formulations and combination therapies with other agents are emerging, potentially expanding its application scope.

Sales Projections

Short-Term (2023-2025)

In the near term, sales are expected to grow modestly—approximately 4-6% annually—driven by increased prescriptions in emerging markets with rising BPH awareness and improved healthcare access. Market penetration in countries where Alfuzosin is newly approved will contribute to initial growth spurts.

Medium to Long-Term (2026-2030)

Long-term projections indicate a CAGR of around 3-4%, influenced by patent expiry, generic competition, and the adoption of combination therapies. Entry of biosimilars or novel agents offering superior efficacy could temper sales growth, but opportunities remain in expanding indications and formulations.

Factors Influencing Future Sales

- Patent Status: While Alfuzosin is available as a generic, new formulations or combination therapies could extend exclusivity or develop alternative revenue streams.

- Clinical Evidence: Positive clinical trial outcomes demonstrating superiority or improved safety profiles bolster market share.

- Physician and Patient Acceptance: Enhanced awareness and tolerability support sustained prescriptions.

- Regulatory Approvals: Access to new markets accelerates sales; delays restrict growth.

Key Market Trends

- Shift Toward Minimally Invasive Treatments: While pharmacotherapy remains first-line, the rise of minimally invasive procedures may impact long-term demand.

- Personalized Medicine: Genetic markers influencing drug response could tailor Alfuzosin use, optimizing sales.

Strategic Recommendations for Industry Stakeholders

- Market Expansion: Focus on emerging economies with increasing BPH prevalence.

- Formulation Innovation: Develop extended-release or combination products to differentiate.

- Regulatory Engagement: Streamline approval processes in high-growth territories.

- Clinical Trials: Invest in comparative effectiveness studies to position Alfuzosin favorably against competitors.

Conclusion

Alfuzosin’s market is poised for steady growth driven by demographic shifts, rising BPH incidence, and expanding geographic reach. While mature markets may see plateauing due to generic competition, innovative formulations and strategic expansion into emerging regions can sustain sales momentum. Industry players should leverage ongoing clinical insights, regulatory pathways, and market trends to optimize positioning.

Key Takeaways

- The global BPH drug market is projected to reach USD 4.2 billion by 2027, with Alfuzosin playing a significant role.

- North America dominates current sales but emerging markets present substantial growth opportunities.

- Competition from other alpha-blockers and non-pharmacologic treatments influences sales projections.

- Long-term growth depends on regulatory approval, formulation innovation, and expanding indications.

- Strategic emphasis on emerging economies and product differentiation is crucial for maximizing sales of Alfuzosin.

FAQs

Q1: How does Alfuzosin compare to other alpha-blockers in terms of efficacy?

Alfuzosin is comparable in efficacy to other alpha-blockers like tamsulosin but offers improved cardiovascular safety due to its uroselectivity, potentially lowering the risk of hypotension-related adverse effects.

Q2: What are the main adverse effects associated with Alfuzosin?

Common side effects include dizziness, fatigue, and hypotension. Serious adverse events are rare but require monitoring, especially in patients with concurrent cardiovascular conditions.

Q3: Is Alfuzosin recommended for use in women?

Currently, Alfuzosin is approved for male BPH. Its use in women remains experimental and is not approved in standard treatment protocols.

Q4: What patent protections exist for Alfuzosin, and how do they impact market competition?

Most patents have expired or are nearing expiry, leading to generic availability that pressures prices and reduces profit margins but also broadens access.

Q5: What potential future indications could expand Alfuzosin's market?

Research into off-label uses, such as in treating ureteral stones or certain vascular conditions, may open new markets if supported by clinical evidence.

Sources:

[1] Grand View Research, "Benign Prostatic Hyperplasia Therapeutics Market Size & Trends."

[2] GlobalData, "BPH Market Analysis."

More… ↓