Last updated: July 28, 2025

Introduction

ADVAIR DISKUS, a combination inhaled therapy containing fluticasone propionate and salmeterol xinafoate, addresses the management of asthma and chronic obstructive pulmonary disease (COPD). Approved by the FDA in 2010, it has established itself as a leading inhaler for respiratory diseases. This report examines the current market landscape, competitive positioning, regulatory environment, sales drivers, and forecasted financial performances pertinent to ADVAIR DISKUS.

Market Landscape

Global Respiratory Disease Market

The respiratory therapeutics market is poised for sustained growth, driven primarily by the rising prevalence of asthma and COPD worldwide. According to GlobalData, the global respiratory drug market was valued at over USD 32 billion in 2022, with an expected compound annual growth rate (CAGR) of approximately 6% over the next five years [1]. The increasing burden on aging populations, coupled with environmental factors such as pollution and tobacco use, fuels demand.

Key Market Segments

- Asthma: Affects approximately 262 million individuals globally (as per WHO), with prevalence rates rising in both developed and developing nations.

- COPD: Expected to be the third-leading cause of death worldwide by 2030, with a patient count exceeding 200 million [2].

Market Players and Competitive Dynamics

ADVAIR DISKUS competes primarily with other fixed-dose combination inhalers, notably:

- Symbicort (budesonide/formoterol)

- Breo Ellipta (fluticasone furoate/vilanterol)

- Spiriva (tiotropium bromide)

- Other generic formulations as patents expire

The dominant patent protections and brand recognition provide ADVAIR DISKUS with a competitive moat. However, patent expirations could open the market to generics, impacting sales.

Regulatory and Reimbursement Environment

Regulatory approvals across major markets like the U.S., EU, Japan, and emerging economies ensure wide access for ADVAIR DISKUS. While the drug’s patent exclusivity yields strong pricing power, reimbursement policies significantly influence sales, especially in cost-conscious markets. The U.S. Medicaid and Medicare systems, along with private insurers, impact formulary placements.

Market Penetration and Adoption

Current Market Share

In the U.S., ADVAIR DISKUS holds approximately 35% of the inhaled combination therapy market for asthma and COPD [3]. It benefits from strong physician familiarity, patient adherence, and comprehensive marketing strategies by GlaxoSmithKline (GSK).

Physician and Patient Dynamics

- Physician Preferences: Pulmonologists and primary care physicians favor ADVAIR DISKUS for its efficacy, ease of use, and safety profile.

- Patient Adherence: The device’s once-daily dosing enhances compliance, critical for chronic disease management.

Unmet Needs and Future Opportunities

Despite its established position, unmet needs persist for personalized therapy, inhaler technique education, and patients with comorbidities. There is scope to expand in emerging economies where respiratory disease burdens are escalating but access remains limited.

Sales Projections

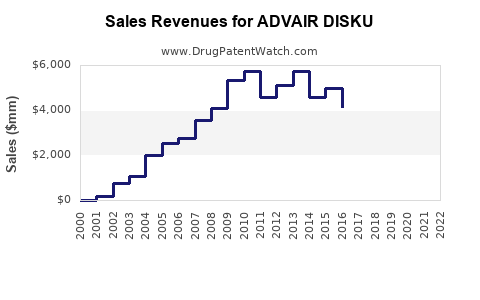

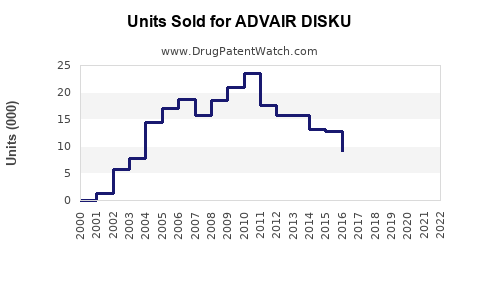

Historical Performance

From 2017 to 2022, sales of ADVAIR DISKUS have ranged between USD 4.5 billion and USD 6 billion annually globally, with steady growth owing to increased diagnoses and adherence initiatives [4].

Forecast Assumptions

- Market Growth Rate: 6% CAGR aligned with global respiratory market trends.

- Patent and Regulatory Risks: Limited short-term patent cliffs; potential for biosimilar entry after patent expiry in key markets.

- Pricing Dynamics: Slight pricing increases in mature markets; price erosion anticipated in markets with high generic penetration.

- Adoption Trends: Steady increase in use owing to growing prevalence and improved healthcare access in developing economies.

Projected Sales (2023–2028)

| Year |

Estimated Global Sales (USD billions) |

CAGR |

Key Drivers |

| 2023 |

6.2 |

— |

Continued market penetration, new market entries |

| 2024 |

6.56 |

6% |

Expanding user base, increased COPD diagnoses |

| 2025 |

6.95 |

6% |

Pending patent expiries, biosimilar competition remains limited |

| 2026 |

7.36 |

6% |

Adoption acceleration in Asian markets, generic threats in select regions |

| 2027 |

7.78 |

6% |

Market saturation near mature markets, new formulation approvals |

| 2028 |

8.23 |

6% |

Increased demand, technology-driven improvements |

This projection assumes no major regulatory hurdles or disruptive generics entering critical markets before patent expiry timelines.

Strategic Variables Impacting Future Sales

Patent Expiry and Biosimilar Competition

The primary risk to sustained revenue stems from patent expiry in the U.S. and EU, anticipated around 2027–2028. The emergence of biosimilars or generics could commoditize the product, pressuring prices and reducing market share.

Pipeline and Innovation

Innovative formulations, once-daily combinations, or adjunct therapies could sustain sales growth beyond traditional forecasts. GSK’s R&D pipeline includes newer inhaler devices and biologics targeting severe asthma phenotypes.

Market Expansion and Access Programs

Broadening access through managed care initiatives and price reductions in emerging markets could significantly increase volume, offsetting some patent risks.

Regulatory and Market Access Outlook

Understanding regional regulatory pathways and reimbursement policies will be critical for maintaining growth trajectories. For instance, positive formulary decisions in large markets like the U.S. and China provide a platform for sales expansion.

Key Drivers and Challenges

- Drivers: Rising prevalence of respiratory diseases, global aging populations, adherence benefits of once-daily dosing, expansion into emerging markets.

- Challenges: Patent expiration, generic competition, pricing pressures, evolving treatment guidelines favoring newer therapies, and inhaler device innovations.

Conclusion

ADVAIR DISKUS's market position is robust, supported by its efficacy, physician preference, and adherence advantages. While current sales are expected to grow steadily at a 6% CAGR over the next five years, potential patent losses and biosimilar entry pose medium-term risks. Strategic focus on expanding access, innovating delivery systems, and pipeline development will be essential to sustain long-term revenues.

Key Takeaways

- ADVAIR DISKUS is a dominant inhaler in the respiratory therapeutics market with projected steady growth.

- The global respiratory market’s CAGR of approximately 6% supports optimistic sales forecasts through 2028.

- Patent expiration and biosimilar competition are critical risks; proactive innovation and market expansion are strategies to mitigate these.

- Growing prevalence of asthma and COPD, especially in developing countries, offers significant growth opportunities.

- Market access strategies and reimbursement policies will heavily influence future revenue streams.

FAQs

1. When are the patent expirations likely for ADVAIR DISKUS?

Patent protection for ADVAIR DISKUS in the U.S. and EU is anticipated to expire around 2027–2028, opening opportunities for generic competition.

2. How does ADVAIR DISKUS differentiate itself from competitors?

Its once-daily dosing, robust efficacy data, and strong physician brand loyalty reinforce its competitive positioning.

3. What markets present the highest growth potential?

Emerging markets such as China, India, and Southeast Asia show high growth potential due to rising respiratory disease burdens and expanding healthcare infrastructure.

4. How do regulatory policies impact sales projections?

Favorable regulatory environments facilitate market access, while restrictive reimbursement policies can limit usage and growth, especially in cost-sensitive regions.

5. What is the strategic outlook for sustaining sales post-patent expiry?

Innovation in inhaler technology, development of biosimilars, and expansion into new indications or combinations are critical to maintaining market share and revenue levels.

References

[1] GlobalData, "Respiratory Drugs Market Analysis," 2022.

[2] WHO, "Chronic Respiratory Diseases Fact Sheet," 2021.

[3] IQVIA, "Market Share Data for Respiratory Therapies," 2022.

[4] GSK Annual Reports, 2017–2022.