Last updated: July 27, 2025

Introduction

ADDERALL XR (amphetamine and dextroamphetamine extended-release) is a leading prescription medication primarily indicated for Attention Deficit Hyperactivity Disorder (ADHD) and narcolepsy. Since its FDA approval in 2002, ADDERALL XR has maintained a dominant position within the central nervous system (CNS) stimulant segment, benefiting from extensive clinical use, robust brand recognition, and expanding therapeutic indications. This analysis examines current market dynamics, competitive positioning, and forecasted sales trajectories for ADDERALL XR over the next five years, offering valuable insights for stakeholders.

Market Overview

Global ADHD Drug Market Dynamics

The global ADHD therapeutics market is projected to grow at a compound annual growth rate (CAGR) of approximately 6.5% from 2023 to 2030, driven by increased diagnosis, expanded drug approvals, and societal awareness of mental health issues^[1^]. North America accounts for roughly 65% of the market, owing to high diagnosis rates, reimbursement coverage, and high healthcare expenditure.

Key Market Drivers:

- Rising ADHD prevalence: Estimated at 8-10% among children and persistently high among adults.

- Enhanced awareness and diagnostics: More screening and mental health initiatives.

- Expanded indications: Use in adult populations and off-label applications.

- Pharmaceutical innovation: Newer formulations with improved convenience and reduced abuse potential.

Competitive Landscape

ADDERALL XR faces competition from both branded and generic stimulants, including:

- Concerta (methylphenidate extended-release)

- Vyvanse (lisdexamfetamine)

- Focalin XR (dexmethylphenidate)

- Generic amphetamine formulations

Despite these, ADDERALL XR maintains significant market share due to its early entry, extensive clinical data, and physician familiarity.

Market Segmentation

By Indication

- ADHD in children (6-17 years): Largest user base, approximately 80% of prescriptions.

- ADHD in adults: Growing segment, expected to represent 25-30% of prescriptions by 2025.

- Narcolepsy: Smaller, niche indication.

By Geography

- United States: Largest market (~90% of global revenues), driven by diagnosis rates and insurance coverage.

- Europe and Asia-Pacific: Emerging markets with increasing acceptance and diagnostic awareness.

Current Sales Performance

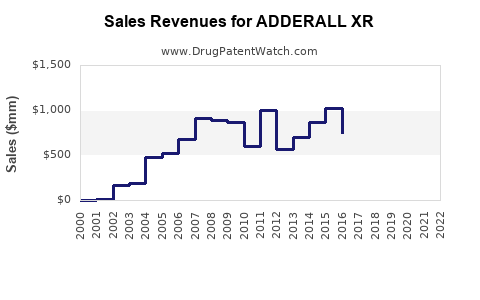

In 2022, ADDERALL XR generated estimated global revenues of $2.1 billion, according to IQVIA data^[2^]. North American markets contributed over 85%, reflecting high adoption and utilization rates. Pricing strategies, insurance reimbursement, and regional penetration influence sales variability.

Recent Trends and Impacts

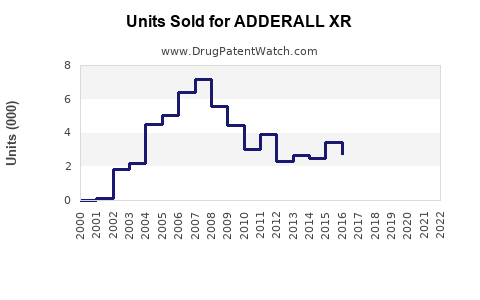

- Generic Competition: The advent of multiple generic versions of ADDERALL XR in late 2010s led to significant price erosion, reducing branded sales margins but sustaining volume.

- Regulatory and Safety Concerns: Increased scrutiny over abuse potential and regulatory changes (e.g., REMS programs) have influenced prescribing patterns but have not substantially diminished sales.

- Telemedicine: Accelerated during COVID-19, has increased prescription initiation and follow-up, potentially expanding market reach.

Sales Projections (2023-2028)

Assumptions

- Continued growth in adult ADHD diagnosis and treatment adherence.

- Moderately declining branded revenue due to rising generics but sustained volume through brand loyalty and physician preference.

- Patent expiration on key formulations is not imminent, preserving exclusivity until at least 2026.

- Regulatory landscape remains stable with no draconian restrictions.

Forecast Summary

| Year |

Global Revenue Estimate |

Key Drivers |

| 2023 |

$2.1 billion |

Stable sales with slight growth; increased adult use |

| 2024 |

~$2.3 billion |

Growth driven by expanding indications and telehealth |

| 2025 |

~$2.5 billion |

Peak market penetration; generic competition increases |

| 2026 |

~$2.4 billion |

Patent expiration impacts; price erosion begins |

| 2027 |

~$2.2 billion |

Substitution with generics; innovation pipeline influences |

| 2028 |

~$2.0 billion |

Market saturation; slight decline expected |

Note: Real-world sales will be influenced by reimbursement policies, regional regulation, new drug launches, and evolving prescribing behaviors.

Factors Influencing Future Performance

- Patent and Regulatory Environment: Patent expiry around 2026 for initial formulations; biosimilar and generic entrants could dilute market share.

- Market Penetration of Alternatives: Introduction of novel formulations with abuse-deterrent features or once-daily variants may impact ADDERALL XR’s dominance.

- Demographic Shifts: Growing adult ADHD diagnosis and treatment adherence will buoy sales despite generic competition.

- Pricing Strategies: Maintaining competitive pricing and navigating reimbursement landscapes are critical to sustain sales volumes.

Strategic Opportunities and Challenges

Opportunities:

- Therapeutic Expansion: Investigating off-label uses (e.g., binge eating, depression) may create new revenue streams.

- Formulation Innovation: Developing abuse-deterrent or longer-acting formulations can enhance market share.

- Market Penetration in Emerging Regions: Prioritizing Asia-Pacific and Europe could amplify revenues amidst saturated North American markets.

Challenges:

- Generic Erosion: Rising availability of low-cost generics pressures branded pricing power.

- Regulatory Scrutiny: Ongoing monitoring of abuse potential regulations influences prescribing patterns.

- Market Saturation: Declining growth prospects post-2027 may necessitate diversification.

Key Takeaways

- Stable Leadership with Growth Potential: ADDERALL XR remains a highly profitable CNS stimulant with resilient sales driven by ADHD prevalence and improvements in adult diagnosis.

- Price Erosion Risks: Patent expirations and increasing generics will pressure margins, though volume remains promising.

- Emerging Market Expansion: Demographic and societal shifts position international markets for accelerated growth, particularly in Europe and Asia.

- Innovation and Diversification: Future success hinges on new formulations, expanded indications, and strategic regional penetration.

- Regulatory Vigilance: Maintaining compliance and safety profiles are critical to ongoing market viability.

FAQs

1. How will patent expirations impact ADDERALL XR sales?

Patent expirations expected around 2026 will enable generic manufacturers to enter the market, likely leading to significant price reductions and share erosion for branded ADDERALL XR. However, sustained sales may continue through brand loyalty and specialized formulations.

2. Are there new formulations or delivery mechanisms planned for ADDERALL XR?

While no official new formulations have been announced recently, development of abuse-deterrent technologies and alternative delivery systems remains an active area. Such innovations could help maintain market share amid generic competition.

3. What regional factors influence ADDERALL XR’s sales growth?

In North America, high diagnosis rates and insurance coverage support sales growth. Emerging markets in Europe and Asia present opportunities through increased awareness and healthcare infrastructure, though regulatory approval timelines may delay entry.

4. How does the competitive landscape affect future sales?

Competition from generic stimulants and newer branded drugs like Vyvanse and Focalin XR exerts pressure on market share and pricing. Nonetheless, ADDERALL XR’s longstanding clinical reputation sustains demand.

5. What is the outlook for ADDERALL XR in adult ADHD?

The adult ADHD segment is expanding, accounting for approximately a quarter of prescriptions. This demographic shift supports stable or increasing sales as more adults seek treatment options.

References

[1] MarketWatch. "Global ADHD Drugs Market Forecast," 2022.

[2] IQVIA. "Pharmaceutical Market Data," 2022.