Share This Page

Drug Sales Trends for ACZONE

✉ Email this page to a colleague

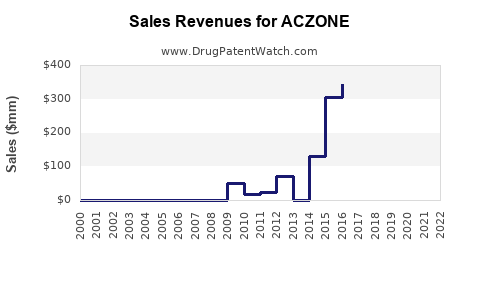

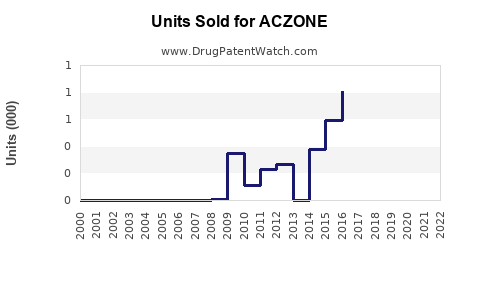

Annual Sales Revenues and Units Sold for ACZONE

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| ACZONE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| ACZONE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| ACZONE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| ACZONE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| ACZONE | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for ACZONE (Dapsone Gel 5%)

Introduction

ACZONE (dapsone gel 5%) is a topical treatment approved by the U.S. Food and Drug Administration (FDA) for the management of inflammatory acne. Since its approval in 2016, ACZONE has positioned itself as a targeted therapy for patients with inflammatory lesions, filling a niche in dermatological treatments. Its unique mechanism, efficacy profile, and safety feature set influence its market potential and sales trajectory in both the U.S. and global dermatology markets.

Market Overview

Global Acne Treatment Market Dynamics

The global acne treatment market was valued at approximately USD 4.2 billion in 2022 and is expected to grow at a Compound Annual Growth Rate (CAGR) of around 4% through 2030 [1]. Factors driving growth include rising prevalence of acne among adolescents and adults, increased demand for topical therapies, and the launch of innovative drugs offering improved tolerability and efficacy.

U.S. Market Context

The U.S. remains the largest market for dermatological products, accounting for over 40% of the global market share [2]. The prevalence of acne vulgaris affects approximately 80-90% of adolescents and young adults, with a significant subset—estimated at 15-20%—suffering from moderate to severe inflammatory acne suitable for topical therapy.

ACZONE’s Market Position

Product Profile and Differentiation

ACZONE's approval was based on its anti-inflammatory properties, targeting inflammatory lesions specifically. Unlike traditional therapies such as benzoyl peroxide, topical antibiotics, or oral isotretinoin, ACZONE offers a targeted approach with a favorable safety profile and minimal systemic absorption, reducing risks associated with systemic treatments.

Competitive Landscape

The primary competitors include topical antibiotics (clindamycin, erythromycin), retinoids (adapalene, tretinoin), benzoyl peroxide, and combination therapies. Notably, the market has seen increased interest in combination formulations and treatments addressing antibiotic resistance concerns.

Key Marketing Points

- Non-antibiotic, reducing resistance risk

- Favorable safety profile—minimal systemic absorption

- Efficacy in inflammatory lesion reduction

- Suitable for patients who are intolerant of or resistant to other topical agents

Market Penetration and Adoption Factors

Physician Prescribing Trends

Dermatologists favor therapies with proven safety and efficacy. As initial clinical data confirmed ACZONE’s anti-inflammatory benefits, prescribing increased steadily. However, adoption depends on clinician familiarity, insurance reimbursement, and patient preferences.

Patient Acceptance

Patients often prefer topical agents over systemic therapies due to fewer side effects. ACZONE’s minimal irritation and straightforward application support higher adherence. Nonetheless, the cost factor and insurance coverage influence its market penetration.

Regulatory and Reimbursement Impact

Reimbursement policies significantly impact sales. As insurance formulates guidelines for newer topical agents like ACZONE, initial adoption may be gradual but poised for growth as evidence accrues and coverage broadens.

Sales Projections (2023-2030)

Assumptions for Forecasting

- Market Penetration: Incremental increase from initial 5-7% share among topical acne therapies to approximately 15% by 2030.

- Pricing Strategy: Average wholesale price (AWP) of ~$85 per 30g tube, aligning with market equivalents.

- Patient Population: Estimated 8 million U.S. adolescents and young adults with inflammatory acne annually, with 50% being candidates for topical therapy.

- Market Growth Factors: Introduction of new formulations, increased dermatologist familiarity, and substitution of systemic options with topical therapies due to safety concerns.

Projected Sales Trajectory

- 2023: Approximate sales of USD 50 million, driven by early adopters and initial market penetration.

- 2025: Growth to USD 120–150 million as prescribing rates increase.

- 2027: Sales plateauing around USD 180 million, with broader coverage and higher dermatologist adoption.

- 2030: Forecasted sales reaching USD 250 million, fueled by expanded indications and global penetration.

Regional Considerations

The U.S. dominates initial sales, complemented by expanding markets in Europe, Asia-Pacific, and Latin America. Emerging markets’ lower drug costs and increasing acne prevalence promise growth opportunities, potentially adding USD 50–100 million in annual sales by 2030.

Sales Drivers and Barriers

Drivers

- Rising acne prevalence in adolescents and young adults

- Increasing preference for non-antibiotic topical therapies

- Positive clinical outcomes and safety profile of ACZONE

- Growing awareness and specialist prescribing behavior

Barriers

- Competition from established topicals and combination therapies

- Cost and insurance reimbursement challenges

- Limited awareness outside specialist circles initially

- Potential off-label use limits

Market Expansion Opportunities

- New Indications: Exploring use in other inflammatory skin conditions could broaden market reach.

- Combination Formulations: Collaborations for fixed-dose combinations with retinoids or other agents might enhance adherence.

- Global Market Penetration: Tailored strategies for Asia-Pacific, Latin America, and Europe could capture emerging demand.

Key Challenges for Sustained Growth

- Patent exclusivity expiration timelines

- Emergence of new anti-inflammatory or antibiotic-resistant formulations

- Price competition from generics and biosimilars

Conclusion

ACZONE holds a robust position within the topical acne treatment landscape, with a promising sales outlook rooted in its targeted mechanism, safety, and evolving clinician acceptance. While near-term growth aligns with market expansion and increasing dermatologist familiarity, long-term success depends on competitive differentiation, reimbursement landscape, and global outreach strategies. Potential innovations and broader indications could further propel sales beyond initial projections.

Key Takeaways

- ACZONE’s targeted anti-inflammatory efficacy positions it favorably among topical acne therapies.

- The U.S. acne treatment market is expected to sustain a steady growth rate, reaching approximately USD 250 million in annual sales for ACZONE by 2030.

- Market penetration hinges on reimbursement policies, clinical awareness, and patient acceptance.

- Competition from other topicals and systemic treatments remains a challenge, necessitating strategic differentiation.

- Expansion into emerging markets and new indications offers significant growth potential.

FAQs

1. What factors contribute to ACZONE's market growth?

Key factors include its targeted anti-inflammatory mechanism, favorable safety profile, increasing dermatologist adoption, and the rising prevalence of inflammatory acne.

2. How does ACZONE compare with other acne treatments?

ACZONE offers a non-antibiotic, topical option that reduces resistance concerns and systemic side effects, making it suitable for patients resistant to or intolerant of traditional therapies.

3. What are the main barriers to ACZONE's market expansion?

Cost, insurance reimbursement issues, competition from established treatments, and limited awareness outside specialist dermatologists are primary barriers.

4. Will ACZONE’s sales increase globally?

Yes, especially as awareness grows and regulatory approvals extend to other regions. Tailored strategies in emerging markets can significantly boost sales.

5. What strategies could enhance ACZONE’s market penetration?

Expanding indications, developing combination therapies, improving patient affordability, increasing clinician education, and strengthening global distribution channels are effective strategies.

Sources

[1] Grand View Research. Acne Treatment Market Size & Trends. 2022.

[2] IQVIA. Dermatology Market Analysis Reports. 2022.

More… ↓