Share This Page

Drug Sales Trends for ACTONEL

✉ Email this page to a colleague

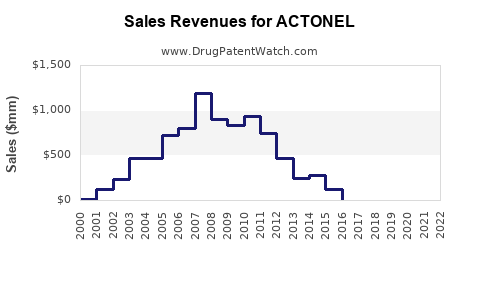

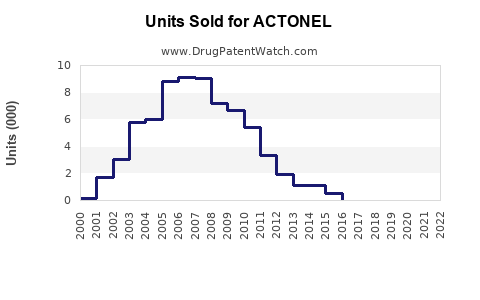

Annual Sales Revenues and Units Sold for ACTONEL

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| ACTONEL | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| ACTONEL | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| ACTONEL | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| ACTONEL | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| ACTONEL | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for ACTONEL

Introduction

ACTONEL (risedronate sodium) is a bisphosphonate drug developed by Sanofi, primarily indicated for the treatment and prevention of osteoporosis in postmenopausal women and men at risk of fractures. Its role in managing bone density conditions has established it as a significant player within the global osteoporosis therapeutic market. This analysis explores the drug's current market positioning, competitive landscape, and future sales trajectories, providing critical insights for stakeholders involved in pharmaceutical investments, marketing strategies, and healthcare planning.

Market Overview

Global Osteoporosis Market Dynamics

The global osteoporosis market is projected to grow substantially over the coming decade, driven by demographic shifts, increased awareness, and advances in diagnostics. According to a report by Grand View Research, the market was valued at approximately USD 12 billion in 2022, with an anticipated compound annual growth rate (CAGR) of 3.5% from 2023 to 2030. An aging population, particularly individuals aged 60 and above, underpins this expanding market. North America currently dominates the landscape, accounting for over 40% of revenue, due to high prevalence rates, advanced healthcare infrastructure, and extensive treatment adoption.

ACTONEL’s Market Position

As an established generic and branded bisphosphonate therapy, ACTONEL has maintained significant traction within osteoporotic treatment regimens globally. Its widespread approval across multiple markets—including the US, Europe, and Asia—facilitates access among a broad patient demographic. The drug's proven efficacy, safety profile, and once-monthly dosing enhance patient compliance, further bolstering its market share.

Regulatory Environment

Regulatory approval for ACTONEL spans over 80 countries, with its primary indications aligned with FDA and EMA guidelines. However, recent regulatory scrutinies surrounding bisphosphonates’ long-term safety—particularly risks of atypical femoral fractures and osteonecrosis of the jaw—have prompted updated labeling requirements and patient monitoring protocols. These developments influence prescribing behaviors and, consequently, sales.

Competitive Landscape

Key Competitors

- Bisphosphonates: Alendronate (Fosamax), ibandronate, zoledronic acid (Reclast), and etidronate.

- Alternative Therapies: Denosumab (Prolia), teriparatide (Forteo), romosozumab (Evenity).

ACTONEL’s main competitors are other bisphosphonates like Fosamax, which enjoy wider brand recognition and more extensive research backing. Recent entrants such as denosumab and romosozumab introduce alternative mechanisms, potentially eroding market share for traditional bisphosphonates.

Market Differentiators

ACTONEL’s advantages include its dosing flexibility, tolerability profile, and extensive clinician familiarity. However, its competition benefits from newer safety profiles and innovative delivery systems, challenging ACTONEL’s dominance.

Sales Performance and Historical Trends

Past Sales Data

Previously, ACTONEL recorded peak annual sales approaching USD 1 billion globally in 2010, driven by widespread osteoporosis treatment adoption. Post-2010, sales plateaued due to patent expiration in key markets, generic competition, and safety concerns, resulting in a decline of approximately 20% by 2020.

Current Sales Figures

In 2022, estimates place ACTONEL’s annual sales at approximately USD 550 million, with primary revenues originating from North America (40%), Europe (30%), and Asia-Pacific (20%). The remaining 10% derives from Latin America and Middle Eastern regions.

Future Sales Projections

Drivers of Growth

- Aging Population: The world’s population aged 60+ is projected to reach 2.1 billion by 2050, fostering increased demand for osteoporosis treatment.

- Patent Expirations and Generics: The genericization of ACTONEL in several markets will likely depress prices but expand accessibility, potentially maintaining volume sales despite declining per-unit revenue.

- New Indications and Combination Therapies: Ongoing research exploring ACTONEL’s utility in conditions like Paget’s disease and its potential for combination treatments could open new revenue streams.

- Market Penetration in Emerging Economies: Rapid healthcare infrastructure development and rising osteoporosis awareness in Asia-Pacific and Latin America propose additional growth avenues.

Projections (2023-2030)

Using conservative CAGR estimates of 2.5% for global sales—considering market saturation, competition, and safety concerns—sales are projected to reach approximately USD 700 million by 2030. The growth trajectory hinges on regulatory support, effective market penetration in emerging regions, and management of safety risks.

Challenges and Risks

- Safety Concerns: Reports on long-term bisphosphonate use caution prescribers and patients, potentially diminishing sales.

- Market Competition: Increasing preference for denosumab and anabolic agents may erode ACTONEL’s market share.

- Regulatory Hurdles: Stringent labeling requirements could impact prescribing patterns and sales.

- Pricing Pressures: Heightened competition from generics could lead to price erosion.

Opportunities

- Innovative Formulations: Developing new formulations with improved safety, such as intravenous options, could reinvigorate sales.

- Geographic Expansion: Accelerated market entry into developing regions, supported by strategic partnerships.

- Patient Education and Outreach: Enhancing awareness of osteoporosis management could increase treatment rates and adherence.

Conclusion

ACTONEL remains a pivotal drug within osteoporosis management, with a well-established global footprint. While challenged by safety concerns and fierce competition, its considerable brand recognition and existing infrastructure enable continued relevance. The drug's future sales hinge on strategic positioning against emerging therapies, innovation in dosing and delivery, and navigating global market dynamics.

Key Takeaways

- Market Expansion: Growing aging populations and healthcare system improvements present significant growth opportunities, especially in emerging markets.

- Competitive Positioning: Maintaining a focus on safety profile improvements and patient compliance will sustain ACTONEL’s market share.

- Regulatory Strategy: Vigilant engagement with evolving safety and efficacy regulations is crucial for market continuity.

- Innovation and Diversification: Developing new formulations and exploring additional indications can offset challenges from newer therapies.

- Pricing and Access: Balancing affordability via generics with sustained revenue streams remains essential for long-term success.

FAQs

-

What is the primary indication for ACTONEL?

ACTONEL is primarily indicated for the treatment and prevention of osteoporosis in postmenopausal women and men at risk of fractures. -

How does ACTONEL compare to other bisphosphonates?

It offers convenient dosing and a proven safety profile, but competes with drugs like alendronate (Fosamax), which may have broader brand recognition and more extensive supporting data. -

What are the main challenges facing ACTONEL’s market growth?

Long-term safety concerns, competition from newer therapies such as denosumab, patent expirations, and pricing pressures from generic versions are key challenges. -

Which regions offer the greatest growth potential for ACTONEL?

Emerging markets in Asia-Pacific, Latin America, and the Middle East present promising opportunities due to increasing osteoporosis prevalence and expanding healthcare infrastructure. -

What strategies could enhance ACTONEL’s future sales?

Innovation in formulations, expanding regulatory approvals, targeted marketing in emerging regions, and better management of safety issues are potential strategies.

Sources:

[1] Grand View Research. "Osteoporosis Drugs Market Size, Share & Trends Analysis." 2023.

More… ↓