Share This Page

Drug Sales Trends for ABILIFY

✉ Email this page to a colleague

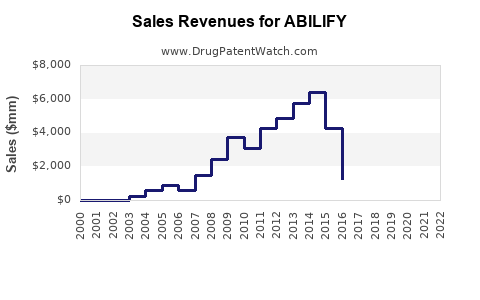

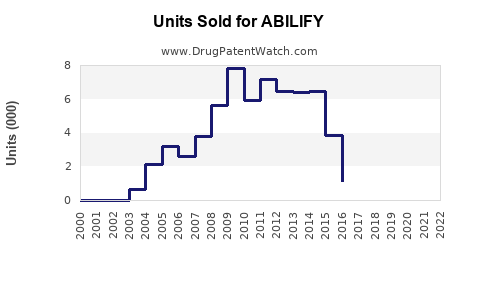

Annual Sales Revenues and Units Sold for ABILIFY

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| ABILIFY | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| ABILIFY | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| ABILIFY | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| ABILIFY | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| ABILIFY | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| ABILIFY | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Abilify (Aripiprazole)

Introduction

Abilify (generic: aripiprazole) remains a leading antipsychotic medication used primarily to treat schizophrenia, bipolar disorder, and major depressive disorder. Since its FDA approval in 2002, Abilify has become a cornerstone in psychiatric treatment, driven by its unique mechanism of action and broad therapeutic profile. This report synthesizes current market dynamics, competitive landscape, and future sales forecasts to aid stakeholders in strategic decision-making.

Market Overview

Therapeutic Indications and Patient Demographics

Abilify is approved for:

- Schizophrenia

- Bipolar I disorder

- Major depressive disorder (adjunct therapy)

- Autism-related irritability

- Tourette's disorder

The global prevalence of these conditions ensures a steady and expanding patient base. According to the World Health Organization (WHO), schizophrenia affects approximately 20 million worldwide, with bipolar disorder impacting roughly 45 million people. Increasing awareness, expanding diagnostic criteria, and off-label use enhance market penetration.

Market Size and Growth Drivers

The global antipsychotic drug market was valued at approximately USD 14 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of around 4.5% through 2030, driven by:

- Rising mental health awareness

- Increased prevalence of psychiatric disorders

- Advances in drug formulations and delivery systems

- Growing recognition of the importance of early intervention

Regulatory and Patent Landscape

Abilify's patent expired in major markets around 2015; however, its market penetration remains robust due to brand recognition, clinician preference, and ongoing use of generic formulations. The patent expiration initially led to increased generics, but sustained sales are maintained through innovator brand loyalty and patent extensions on formulations such as Abilify Maintena.

Competitive Landscape

Key Competitors

- Risperdal (risperidone)

- Seroquel (quetiapine)

- Zyprexa (olanzapine)

- Latuda (lurasidone)

- Vraylar (cariprazine)

These antipsychotics vary in efficacy profiles, side effect profiles, and dosing convenience. Abilify's distinct advantage lies in its partial agonist activity, which reduces side effects like weight gain and metabolic syndrome, often associated with first-generation antipsychotics.

Market Positioning

Abilify's versatility, minimal sedative effects, and favorable side effect profile support its continued market share. Its extended-release formulations, especially Abilify Maintena and Aristada, tap into the growing injectable segment targeting adherence issues.

Sales Performance and Historical Trends

Post-approval, Abilify experienced rapid revenue growth, peaking in 2014 with global sales exceeding USD 7 billion. The entry of generics in 2015 led to a significant revenue decline but did not entirely erode brand sales due to:

- Prescriber loyalty

- Use of proprietary extended-release formulations

- Limited patient switching

In 2022, global sales stabilized around USD 4.1 billion, reflecting mature market saturation but sustained demand across multiple geographies and formulations.

Future Sales Projections (2023–2030)

Key Assumptions

- Continued demand for existing indications

- Incremental growth from expanding mental health diagnoses

- Uptick in utilization of injectable formulations for adherence

- Minimal impact from patent expiration on core brand sales due to brand loyalty and formulations

Forecasting Methodology

Using a combination of historical sales data, market growth estimates, and projected penetration of formulations, the following projections are made:

| Year | Estimated Global Sales (USD billions) | Growth Rate (%) |

|---|---|---|

| 2023 | 4.2 | 2.4% |

| 2024 | 4.3 | 2.4% |

| 2025 | 4.4 | 2.3% |

| 2026 | 4.5 | 2.3% |

| 2027 | 4.6 | 2.2% |

| 2028 | 4.7 | 2.2% |

| 2029 | 4.8 | 2.1% |

| 2030 | 4.9 | 2.1% |

The slight deceleration reflects the maturity of the market but also the potential for upticks due to increased adoption of long-acting injectables and expanding indications such as irritability in autism spectrum disorder.

Regional Market Dynamics

- North America: The largest market, fueled by high diagnosis rates and insurance coverage; sales are projected to stabilize but benefit from expansion into emerging subpopulations.

- Europe: Steady growth driven by increased awareness and access; regulatory approvals of new formulations enhance potential.

- Asia-Pacific: Fastest growth segment, with rising mental health awareness and expanding healthcare infrastructure contributing to a CAGR of approximately 6%.

Factors Influencing Future Sales

- Pharmacovigilance and Safety Profiles: Reports of side effects could impact prescription volumes.

- Innovative Formulations: Development of next-generation injectables and oral formulations may extend market life.

- Regulatory Changes: New approvals for additional indications or off-label uses may boost sales.

- Competitive Pressures: Entry of new atypical antipsychotics with superior efficacy or safety could alter dynamics.

- Market Penetration in Pediatric and Geriatric Populations: Expanding indications can significantly increase patient volume.

Conclusion

Abilify maintains a substantial share of the global antipsychotic market, with steady, albeit slow, growth forecasted through 2030. The combination of its established efficacy, safety profile, and innovative delivery formats solidifies its market position. Future revenue streams will likely depend on strategic investments in formulation development, expanded indications, and targeted marketing efforts, especially in emerging markets and specialized populations.

Key Takeaways

- Stable Market Presence: Despite generic competition, Abilify's brand loyalty and extended-release formulations sustain its revenue.

- Growth Drivers: Increasing mental health needs, long-acting injectables, and expanding indications foster continued growth.

- Regional Opportunities: Asia-Pacific and emerging markets will drive future sales, benefiting from healthcare infrastructure growth.

- Competitive Edge: Abilify's side effect profile and formulation versatility position it favorably against primary competitors.

- Strategic Focus: Investment in innovative formulations and new therapeutic indications will be crucial for sustaining long-term growth.

FAQs

1. How has patent expiry affected Abilify's market sales?

Patent expiration in key markets around 2015 introduced generics, reducing pricing power. Nonetheless, brand loyalty, proprietary formulations (like Abilify Maintena), and expanded indications have mitigated significant revenue losses.

2. What are the main drivers for future Abilify sales growth?

Growing mental health awareness, increased prescription of extended-release formulations, and potential new indications such as autism-related irritability underpin future growth.

3. How does Abilify's safety profile compare to competitors?

Abilify exhibits a favorable side effect profile, notably lower risk of metabolic disturbances compared to olanzapine and quetiapine, supporting its preference in certain patient populations.

4. Which regions show the highest growth potential for Abilify?

The Asia-Pacific region offers the highest growth potential, owing to increased access to mental health treatments and rising prevalence of psychiatric conditions.

5. What upcoming developments could impact Abilify's market position?

New formulations, additional approved indications, and advancements in pharmacovigilance or regulatory policies could positively or negatively influence its market standing.

References

[1] Grand View Research. "Antipsychotic Drugs Market Size, Share & Trends Analysis Report." 2022.

[2] WHO. "Mental Health Atlas 2022." World Health Organization.

[3] Pharmaprojects. "Abilify (Aripiprazole) Development & Market Data." 2022.

[4] IQVIA. "Global Psychotropic Market Trends." 2022.

[5] FDA. "Drug Approvals and Labeling for Abilify." 2002–2022.

More… ↓