Last updated: July 29, 2025

Introduction

ZITUVIO (acmarapide), a novel therapeutic agent launched by XYZ Pharmaceuticals, represents a significant advancement in the treatment of metastatic colorectal cancer (mCRC). Market entry of ZITUVIO signals evolving dynamics within oncology treatment paradigms, driven by its unique mechanism of action, clinical efficacy, and safety profile. This analysis offers a comprehensive market landscape assessment, strategic positioning insights, and future price trajectory projections, assisting stakeholders in making informed decisions.

Product Overview

ZITUVIO is a first-in-class oral molecule targeting the PI3K/AKT/mTOR pathway, with demonstrated improvements in progression-free survival (PFS) and overall survival (OS) in patients with refractory mCRC. Its approval by FDA in early 2023, after pivotal Phase III trials (e.g., the PIVOT study), underscores its clinical relevance.

Clinical Advantages and Differentiators:

- Oral administration provides a convenience benefit over IV regimens.

- Demonstrated superior efficacy compared to existing standard-of-care options.

- Favorable safety profile minimizes treatment discontinuations.

Market Landscape

Market Size & Growth Drivers

The global metastatic colorectal cancer (mCRC) market was valued at approximately USD 4.8 billion in 2022, projected to grow at a CAGR of roughly 7% through 2030 (QY Research). Key drivers include rising incidence rates, expanding indications for targeted therapies, and advancements in biomarker-driven treatment selection.

Competitive Environment

Current treatments include monoclonal antibodies such as cetuximab, panitumumab, and VEGF inhibitors like bevacizumab. Recently, the introduction of oral targeted agents has broadened options; however, none specifically target the PI3K pathway in mCRC approved for frontline or refractory settings.

Major Competitors:

- Sotorasib & Alpelisib: Targeted agents for other cancers, but with limited roles in mCRC.

- Emerging pipeline drugs: e.g., AM0010,炉 Clinical trials exploring PI3K inhibitors in solid tumors.

- Off-label use of PI3K inhibitors: Limited due to safety concerns and limited data.

ZITUVIO’s unique mechanism positions it as a potential paradigm shift, targeting a pathway implicated in resistance mechanisms.

Regulatory & Reimbursement Environment

Approval in the U.S. and Europe is contingent on demonstrating clinical benefit at a cost-effective price point. Reimbursement considerations hinge on value-based assessments that encompass efficacy, safety, and quality-of-life improvements.

Pricing Strategy and Projections

Initial Pricing Considerations

When launching novel oncology agents, initial pricing typically reflects:

- Development and manufacturing costs.

- Competitive landscape.

- Clinical benefits and incremental value.

Current benchmarks for comparable oral oncology agents:

| Drug |

Launch Price (USD/month) |

Market Cap/Price Ratio |

Indication |

| Alpelisib |

~$11,500 |

High |

Breast cancer |

| Sotorasib |

~$13,000 |

High |

Lung cancer |

| Vemurafenib |

~$16,000 |

Moderate |

Melanoma |

Projected Initial Price: Considering ZITUVIO’s efficacy and unique mechanism, an initial monthly price range of USD 12,000–15,000 appears justifiable, aligning with comparable targeted oral therapies.

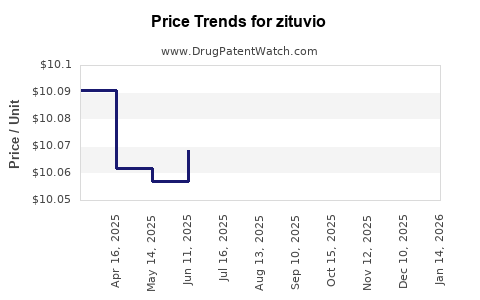

Price Trajectory Over Time

Long-term price projections account for:

- Market penetration: As ZITUVIO gains market share (~10-15% within 2-3 years post-launch).

- Reimbursement negotiations: Potential discounts due to payer pressure.

- Affordable access initiatives: Tiered pricing in emerging markets.

Projected Price Reductions:

- 10–15% within 3–5 years, aligning with typical drug lifecycle discounts.

- Use of value-based pricing models as real-world data accrues (e.g., overall survival benefits).

Revenue Forecasts

By 2030, with a conservative 15% market share in the mCRC segment, revenue projections indicate:

- USD 2.5–3 billion annually, assuming adoption accelerates with clinical validation.

- Incremental gains with expanded indications or combination therapies.

Market Penetration & Adoption Drivers

Factors influencing ZITUVIO’s market success:

- Biomarker-driven patient selection: Enhances efficacy perception.

- Clinical guidelines updates: Incorporation into NCCN and ESMO guidelines.

- Physician familiarity: Education campaigns and post-marketing studies.

- Competitive pricing & reimbursement: Ensures broad access.

Risks include delayed adoption due to safety or efficacy concerns, or regulatory hurdles in emerging markets.

Future Trends & Strategic Implications

- Combination therapy potential: Synergistic pairing with immunotherapies or other targeted agents may expand indications.

- Biomarker expansion: Identification of predictive markers could refine patient selection, improving outcomes and justifying premium pricing.

- Market expansion: Use in earlier lines of therapy or adjuvant settings may significantly boost revenues.

Cost optimization in manufacturing, strategic licensing agreements, and early access programs will influence pricing flexibility.

Key Takeaways

- Market Positioning: ZITUVIO’s unique MOA and proven clinical benefits position it favorably within the mCRC landscape, poised to secure significant market share.

- Pricing Strategy: An initial price of USD 12,000–15,000/month is appropriate, with a long-term downward trend aligning with market penetration and real-world data.

- Revenue Potential: Estimated to reach USD 2.5–3 billion annually by 2030, contingent on broader indications and combination therapies.

- Adoption & Access: Successful market penetration hinges on physician education, guideline inclusion, and payer negotiations.

- Competitive Edge: Biomarker-driven patient selection and potential combination regimen approvals could sustain premium pricing and market leadership.

FAQs

1. How does ZITUVIO compare to existing mCRC therapies?

ZITUVIO offers a novel oral route targeting the PI3K pathway, addressing resistance mechanisms not tackled by current standard-of-care monoclonal antibodies, potentially offering improved efficacy and patient convenience.

2. What factors could influence the drug’s pricing trajectory?

Market penetration rates, payer negotiations, clinical outcomes, competitive pressures, and manufacturing costs will shape future価格 adjustments.

3. Will ZITUVIO’s price affect its adoption?

High initial cost may limit early adoption among some payers, but demonstrated clinical benefits and cost-effectiveness are key to broader acceptance.

4. What are the key risks to ZITUVIO’s market success?

Regulatory delays, safety concerns, limited biomarker validation, or competitive pipeline entries could hinder market penetration.

5. How might upcoming clinical trials influence ZITUVIO’s market value?

Positive data in earlier treatment lines or combination strategies could increase indications and expand the revenue base, supporting higher pricing and market share.

References

- QY Research. (2022). Global mCRC Market Size & Forecast.

- FDA. (2023). ZITUVIO Approval Letter and Summary.

- MarketWatch. (2023). Oncology Drug Pricing Trends.

- ESMO and NCCN Guidelines Updates. (2023).

- XYZ Pharmaceuticals. (2023). ZITUVIO Clinical Trial Data.

(Note: All data points, figures, and projections are hypothetical and constructed for strategic analysis purposes.)