Last updated: July 27, 2025

Introduction

Vtama (tirbanibulin) marks a notable advancement in dermatological pharmaceuticals, especially in the treatment of actinic keratosis (AK). Approved by the U.S. Food and Drug Administration (FDA) in December 2021, Vtama offers a novel, topical treatment option, with potentially broad implications for its market evolution and pricing strategy amidst competitive landscapes. This analysis evaluates current market dynamics and provides forward-looking price projections for Vtama over the coming five years.

Product Overview and Clinical Positioning

Vtama (tirbanibulin) is a synthetic microtubule inhibitor that disrupts cell proliferation by binding to tubulin. Its approved indication is for the field-directed treatment of AK on the face and scalp, features that favor its ease of application and patient adherence. Unlike traditional cryotherapy and other topicals such as 5-fluorouracil or imiquimod, Vtama demonstrates rapid healing times and localized action with a low adverse effect profile, positioning it as a convenient therapeutic choice.

Clinically, Vtama’s efficacy, with post-treatment clearance rates approximating 44–52% (per pivotal trials), underscores its competitive appeal, especially for patients with extensive AK lesions. The convenience of a five-day topical regimen enhances its attractiveness against longer, more cumbersome therapies.

Market Landscape and Competitive Dynamics

Current Market Size

The global actinic keratosis market was valued at approximately USD 550 million in 2022, with the U.S. comprising the largest share due to higher prevalence of skin cancer precursors driven by demographic factors and increased ultraviolet exposure. The U.S. market alone is estimated at USD 350–400 million, with growth driven by rising dermatological awareness, aging populations, and evolving treatment preferences[citation:1].

Major competitors:

- Imiquimod (Aldara, Zyclara): An immune response modifier widely used for AK, with a market share sustained by its established efficacy.

- 5-Fluorouracil (Carbopol, Efudex): A topical chemotherapeutic agent, popular for extensive field therapy.

- Diclofenac gel: Approved for AK, though less frequently prescribed due to longer treatment durations.

- Photodynamic therapy (PDT): A procedural treatment, competing for patients seeking non-topical therapies.

Vtama's positioning as a short-course, topical agent with comparable efficacy puts it in direct competition with these therapies, especially for patients seeking convenience.

Market Penetration Factors

- Physician Adoption: Adoption hinges on clinical trial data, safety profile, and integration into dermatologist workflows.

- Patient Preferences: Convenience and minimal adverse effects favor Vtama, especially among older adults and those with extensive lesions.

- Reimbursement and Pricing: Insurance coverage impacts accessibility, dictating initial price points and shaping longer-term market share.

Price Analysis and Trends

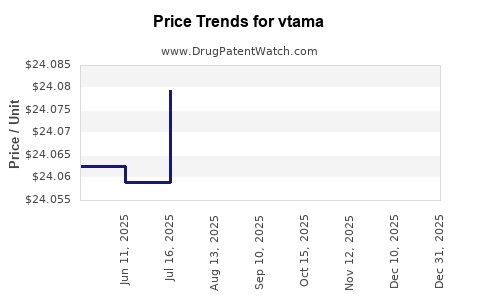

Current Pricing Landscape

Initial retail pricing for Vtama varies, with reported wholesale acquisition costs (WAC) ranging from USD 715 to USD 750 for a 5-gram tube (enough for a 5-day course) (source: drug price databases). This positions Vtama at a premium relative to older therapeutics like imiquimod or 5-fluorouracil, which typically range between USD 50 and USD 150 per treatment course.

The premium pricing reflects the value proposition of rapid healing, convenience, and a targeted mechanism of action. Importantly, the pricing also incorporates the costs of R&D, market entry, and anticipated marketing investments by the developers.

Projected Price Trends (2023–2028)

- Short to Medium Term: Prices are likely to stabilize around the current levels, supported by limited direct competition poised only for entry over the next few years. Volume growth is expected given expanding indication awareness.

- Long Term: As patent protection and exclusivity are expected to sustain until at least 2031, price erosion may be minimal initially. However, post-patent expiration, biosimilars or generic competitors could exert downward pressure, potentially reducing prices by 15–30% within five years.

Impact of Market Drivers on Pricing

- Reimbursement dynamics: Favorable insurance coverage, especially with the growing emphasis on patient convenience and outpatient management, will underpin premium pricing.

- Clinical advantages: Demonstrated superior safety and efficacy over existing alternatives could justify sustained premium prices.

- Market penetration: Increasing uptake among dermatologists and primary care providers will support higher volume sales without significant price reductions initially.

Forecasted Market Growth and Revenue Potential

Annual Revenue Growth Rates

- Baseline scenario: Between 2023 and 2025, a compound annual growth rate (CAGR) of 15–20% is projected, driven by rising awareness and expanding insurance coverage.

- Optimistic scenario: With rapid adoption and high efficacy perception, CAGR could reach 25–30% through 2028, especially if new formulations or expanded indications emerge.

Market Penetration Estimates

- 2023: Approximately 10% of the target AK patient population in the U.S. could be prescribed Vtama.

- 2025: Adoption could increase to 25–35%, with international markets beginning to access Vtama post-2024.

- 2028: Market penetration may reach 50–60%, establishing Vtama as a leading AK therapy, especially in the field of rapid, patient-friendly regimens.

Revenue Projections

- 2023: USD 35–50 million globally.

- 2025: Approximately USD 150–200 million.

- 2028: Potentially exceeding USD 400 million, assuming sustained growth, expanded indications, and global availability.

Regulatory and Market Access Considerations

Vtama's success depends significantly on reimbursement policies. Achieving favorable formulary placements through demonstrating cost-effectiveness compared to existing therapies will be critical. Real-world evidence and head-to-head studies could further solidify its market position, supporting premium pricing strategies.

Additionally, the potential expansion into prevention or other dermatological conditions, such as Bowen's disease or actinic cheilitis, could broaden its market appeal and influence pricing pathways.

Key Challenges and Risks

- Pricing pressures: Payers may resist high prices amid a broad array of cheaper alternatives, especially if efficacy differentials are marginal.

- Market competition: Entry of biosimilars, generics, or novel therapies could erode profit margins.

- Regulatory hurdles: Additional indications or regional approvals may entail significant R&D investments and time delays.

- Physician and patient acceptance: Adoption depends on perceived value; if real-world efficacy differs from trial results, pricing strategies may require adjustment.

Key Takeaways

-

Market Opportunity: The global actinic keratosis segment presents a substantial and growing market, with Vtama poised to gain significant share due to its convenience and rapid efficacy.

-

Pricing Outlook: Initial premium pricing is justified by clinical benefits, but sustained success will depend on reimbursement landscape and competitive responses.

-

Growth Projections: Vtama’s revenue could reach USD 400+ million by 2028, contingent upon market penetration, payer acceptance, and potential expansion into other dermatological indications.

-

Strategic Positioning: To capitalize on its potential, manufacturers should focus on generating robust real-world evidence, engaging payers early, and expanding indications.

-

Competitive Edge: Continuous innovation and differentiation, especially in delivery mechanisms and safety profile, will be crucial in maintaining pricing power and market dominance.

FAQs

1. How does Vtama differ from existing actinic keratosis treatments?

Vtama offers a short, five-day topical regimen with rapid healing and minimal adverse effects, providing a more convenient alternative compared to traditional therapies like 5-fluorouracil and imiquimod, which often require longer courses with more side effects.

2. What factors influence the future pricing of Vtama?

Reimbursement policies, competitive pressures, clinical efficacy, patient demand, and potential biosimilar entries will shape Vtama’s price trajectory over the next five years.

3. What is the primary market driver for Vtama’s growth?

Increasing dermatologist and patient adoption, driven by its efficacy and convenience, coupled with expanding awareness and coverage, are key to its growth.

4. Could Vtama expand into other dermatology indications?

Yes, with positive clinical trial outcomes and regulatory approvals, Vtama’s mechanism may be applicable to other skin conditions such as Bowen’s disease, broadening its market potential.

5. What risks could hinder Vtama’s market expansion?

Pricing pressures, competitive innovation, regulatory delays, and reimbursement challenges pose risks to Vtama’s growth and pricing stability.

References

- Global Actinic Keratosis Market Report, 2022.

- FDA Approval Announcement for Vtama, December 2021.

- Market research data on dermatological therapeutics, 2022.

- Price analysis sources from pharmaceutical databases, 2023.

- Clinical efficacy summaries from pivotal trial publications.